Bookkeeping Software for Real Estate Agents: A 2025 Guide

Real estate agents work with unpredictable income and steady costs. To stay on track, they need clear records. Manual bookkeeping takes time and often leads to errors. There are many bookkeeping software for real estate agents that can fix this problem.

In 2025, bookkeeping software does more than store data. It helps agents manage money, track commissions, and plan for taxes. This blog explains why it matters, what to look for, and which tools to use.

Why Real Estate Agents Need Bookkeeping Software

Real estate agents often get paid after a deal closes. Between deals, they still pay for ads, gas, meals, and tools. If they skip tracking, they lose money.

Accounting software for real estate agents helps keep all records in one place. It reduces mistakes. It shows where money goes and what can be claimed for tax. It helps agents stay ready if they get audited.

Here are common tasks that software can help with:

- Recording commissions

- Sorting expenses

- Uploading and storing receipts

- Tracking business miles

- Creating reports

- Linking bank and card accounts

- Managing client payments

- Generating tax-ready summaries

- Automating invoice reminders

Without software, agents often use spreadsheets or paper. These get lost or contain wrong numbers. Good software stops that.

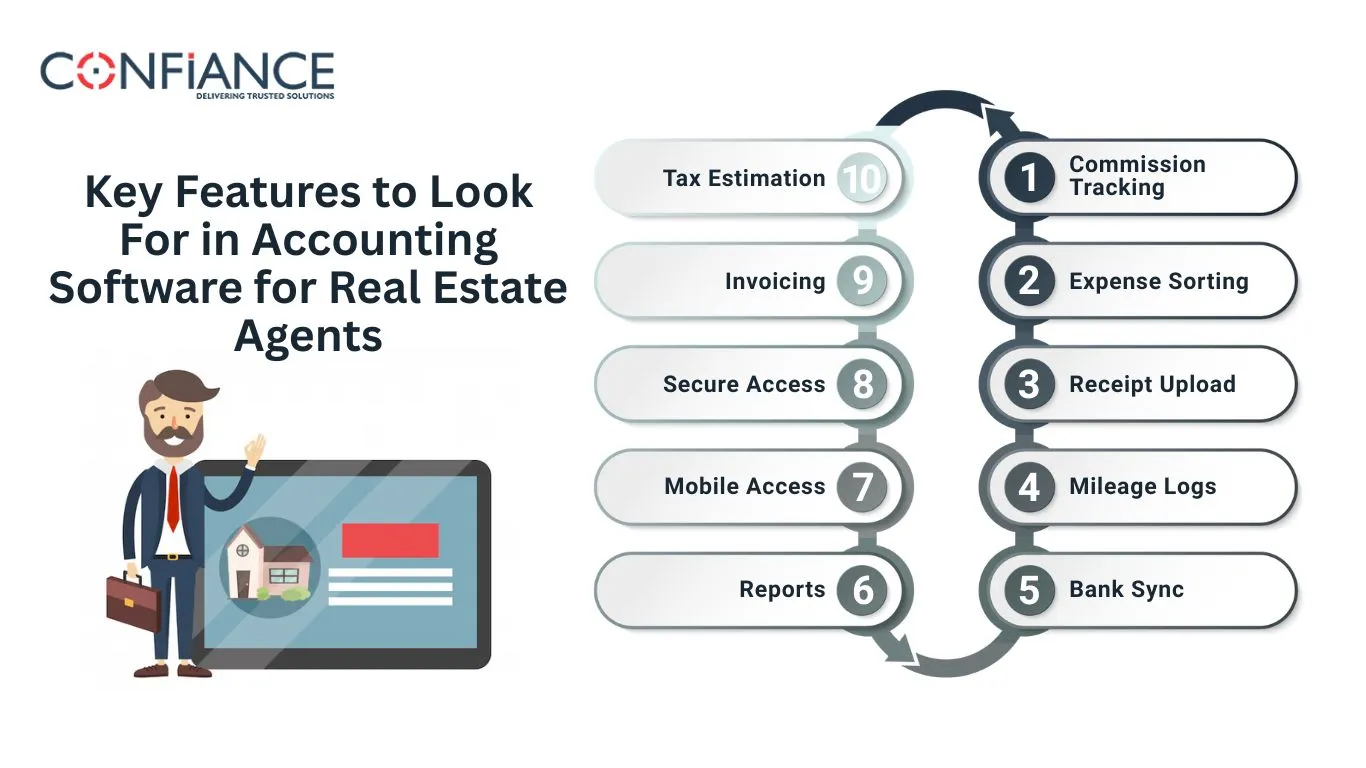

Key Features to Look For in Accounting Software for Real Estate Agents

Not all tools fit every agent. The best bookkeeping software for real estate agents includes these features:

- Commission Tracking

You need to track income from each sale. Some deals include splits. A good tool shows who paid you and how much. - Expense Sorting

Agents pay for staging, ads, meals, and travel. Software should let you create and label each type of cost. - Receipt Upload

Keeping paper receipts is messy. A tool that lets you take a photo and store it saves time. You stay ready for tax season. - Mileage Logs

You drive to showings and client meetings. Tools with GPS help track miles. This adds up for tax savings. - Bank Sync

When the tool links to your bank, it pulls in each charge. You do not need to enter every line. This keeps records clean. - Reports

You need reports for taxes, planning, or checking business health. Good tools create these with a click. - Mobile Access

Agents work from phones. The tool must work well on mobile so you can log items anywhere. - Secure Access

If you work in a team, you may need others to view records. Choose software with safe access options. - Invoicing

Some agents bill for extra services. Choose a tool that sends and tracks invoices. - Tax Estimation

Good tools help you set aside the right amount for taxes. This avoids surprises.

Best Bookkeeping Software for Real Estate Agents

These tools are top-rated in 2025. Each one fits real estate needs in different ways.

QuickBooks Online

Many agents use QuickBooks. It handles both simple and complex records. It works well on mobile.

Features:

- Syncs with banks

- Tracks income and spending

- Offers detailed reports

- Works with tax tools

- Logs mileage

- Sends invoices

- Tags by client or job

Best For: Agents who want full control and plan to grow

Cost: Starts near $30 each month

Realtyzam

This tool is made for real estate agents only. It is simple and clean. It tracks deals, expenses, and splits.

Features:

- Designed for agents

- Tracks commissions

- Adds receipts fast

- Makes tax reports

- Tracks miles

- Works on mobile

Best For: Solo agents who want a tool built just for them

Cost: Around $12 each month after a free trial

Xero

Xero is a strong tool with clean design. It works well for agents who handle more than just sales.

Features:

- Syncs with banks and cards

- Tags costs by job or client

- Connects with other tools

- Makes useful reports

- Sends invoices

- Tracks time

- Offers mobile app

Best For: Agents who manage many properties or teams

Cost: Starts near $15 each month

FreshBooks

FreshBooks is made for service work. Some agents use it to track time or send bills.

Features:

- Sends invoices

- Stores receipts

- Tracks time and miles

- Has mobile access

- Offers client portals

- Supports project tagging

Best For: Agents who offer extra services

Cost: Starts at $17 each month

Zoho Books

Zoho offers tools for small firms. Its books app is full of features and costs less than most.

Features:

- Syncs with banks

- Makes reports fast

- Offers full mobile access

- Links to client tools

- Sends invoice reminders

- Supports tax calculation

Best For: Agents who want more for less

Cost: Starts around $15 each month

How to Choose the Right Accounting Software for Real Estate Agents

Each agent works in a different way. Pick software that fits your habits. Ask these questions:

- Do you want to track each sale by client?

- Do you need to track miles?

- Do you work from your phone?

- Do you send invoices?

- Do you need to plan for taxes?

- Do you need team access?

- Will you grow your business soon?

Try a free version. Log real entries. See if the tool saves time. If it feels easy, it is likely the right one.

Benefits of Using Software

Using accounting software for real estate agents saves time and cuts stress. It keeps your records clean and helps you grow.

Time Saved

You enter less. You search less. You file less. This gives you more time to sell.

Fewer Errors

Software checks for mistakes. It flags odd items and missing data.

Clearer Cash Flow

You know what you earn and spend. You spot waste. You make smarter plans.

Tax Ready

When tax time comes, you do not dig for receipts. Reports are ready.

More Deductions

Good records mean you can claim more. This cuts what you owe.

Audit Proof

If the IRS checks your books, you have proof. Every receipt, mile, and charge is stored.

Client Trust

Better records mean faster service. Clients see you as more professional.

Faster Payments

With tools that send invoices and reminders, you get paid quicker.

Tips for Daily Use

Once you choose a tool, make it a habit. These tips help you stay on track:

- Check your records each week

- Use mobile tools to log costs right away

- Keep notes with each entry

- Split costs by client or deal

- Scan every receipt the day you spend

- Review reports each month

- Set tax money aside every quarter

Doing a little each day makes tax time easier.

Common Mistakes to Avoid

Some agents buy tools but never use them. Others mix personal and business money. Avoid these errors:

Waiting Too Long

Start now. Waiting means missed costs and more stress later.

Mixing Accounts

Use a separate card and account for your work. This keeps things clean.

Not Backing Up

Use software with cloud storage. Your records stay safe even if your phone breaks.

Skipping Reviews

Check reports often. They show what is working and what is not.

Using Too Many Tools

Stick to one main tool. Use others only if they add real value.

Ignoring Updates

Update the app often. This fixes bugs and adds features.

Not Learning the Tool

Spend time with tutorials. A little learning saves hours later.

Bookkeeping software for real estate agents is not just for saving time. It is about staying in control. In 2025, there are more software than ever. Each one offers ways to track income, cut costs, and stay tax ready.

Pick one that fits your work. Use it often. Keep it simple. With clean records, you can plan better, grow faster, and avoid tax pain.

Whether you close two deals or twenty, the right software helps you maintain your records. At Confiance, we use industry-leading bookkeeping software for real estate agents for our property management bookkeeping services.

FAQs

- Can real estate agents use bookkeeping software for rental income?

Yes. Many tools let agents track rental payments, costs, and reports for each unit. - Is cloud storage safe for storing real estate financial data?

Yes. Most tools use encryption and backups to keep your data secure. - Does bookkeeping software work for both residential and commercial deals?

Yes. You can tag and sort deals by type to track them better. - Can software help with year-end real estate tax prep?

Yes. Most tools make reports you can send to a tax pro or file yourself. - Are there bookkeeping apps that work offline for agents?

Some apps offer limited offline features and sync once online. - Is it smart to switch tools during the year?

Yes, but transfer your old data and check reports for accuracy after the move.