The Best Medical Bookkeeping Software for Your Organization in 2025

Medical offices deal with more than just patient care. Billing, payments, and financial tracking are part of daily operations. As regulations grow and insurance claims become more complex, using the right tools matters. In 2025, medical bookkeeping software does more than manage books. It improves accuracy, saves time, and reduces risk.

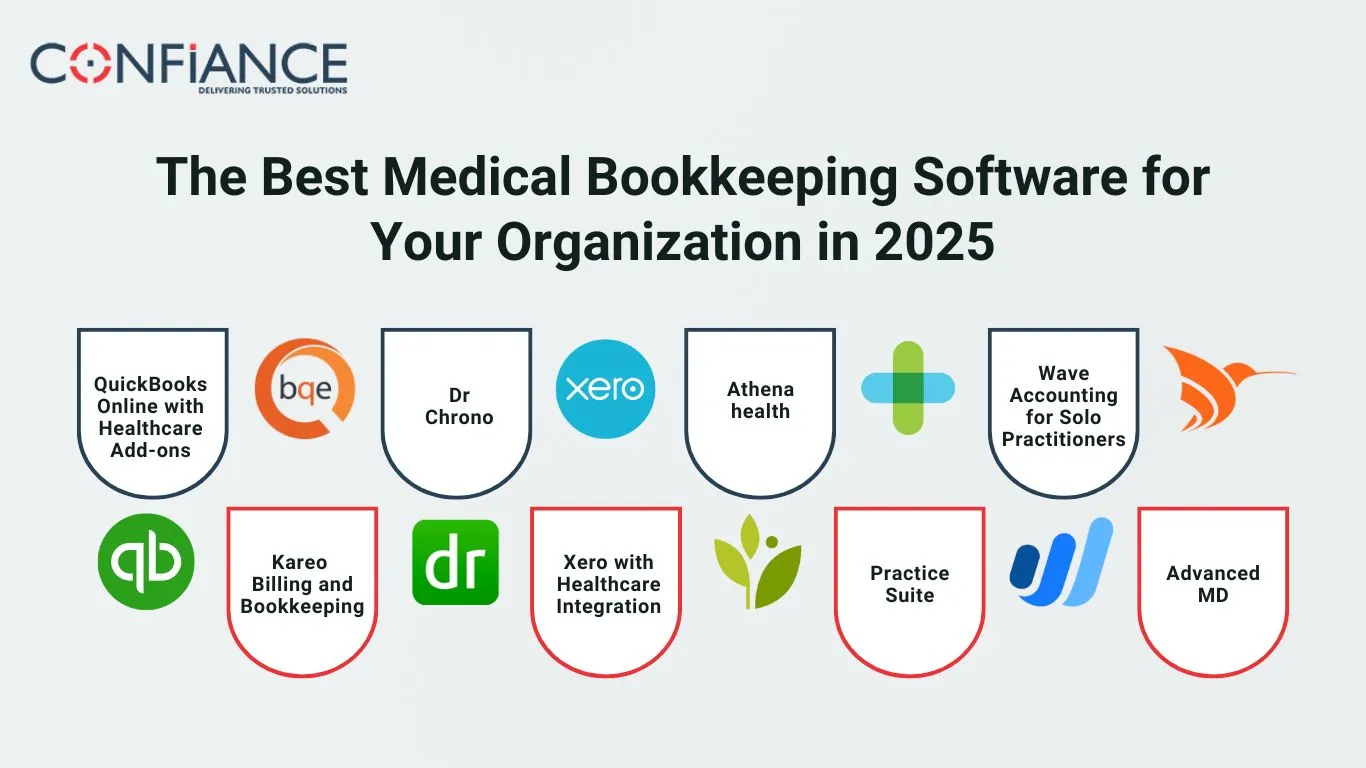

Below is a detailed look at the best medical bookkeeping software options in 2025. Each tool is built to support clinics, hospitals, and private practices with billing, invoicing, and financial reporting.

Why Use Medical Bookkeeping Software?

Manual bookkeeping is slow and error-prone. Spreadsheets can only do so much. Medical bookkeeping software automates many steps, including invoice creation, payment tracking, and expense reporting. It also keeps records organized and accessible.

Some software also works with electronic health records. This helps connect patient billing with treatment details. Medical invoicing software focus on features like coding for insurance claims and automatic payment reminders.

Choosing the right tool depends on your size, needs, and budget. Below are the best options to consider in 2025.

1. QuickBooks Online with Healthcare Add-ons

QuickBooks is a leading name in small business accounting. Though not built only for healthcare, it supports add-ons that make it work for clinics and practices.

Key Features:

- Tracks patient invoices and payments

- Connects with medical billing tools

- Manages payroll for office staff

- Offers clear financial reports

Pros:

- Easy to use

- Strong mobile access

- Works with many healthcare apps

Cons:

- Some features need third-party tools

- May require setup help for full medical use

QuickBooks works well for small to mid-size offices that want a known name with wide support. When paired with medical invoicing software, it covers most practice needs.

2. Kareo Billing and Bookkeeping

Kareo is made only for medical offices. It offers billing, scheduling, and bookkeeping in one platform. It suits small practices that want an all-in-one system.

Key Features:

- Tracks patient balances and payments

- Sends electronic claims to insurers

- Offers detailed reports

- Includes secure patient portals

Pros:

- Built for healthcare

- Easy claim tracking

- Strong support and training

Cons:

- Limited for large hospitals

- Some reports take time to load

Kareo is ideal for small clinics that want both billing and financial tools in one place. It helps reduce admin work and boosts cash flow.

3. DrChrono

DrChrono combines medical records, billing, and accounting features. It fits best with clinics using Apple devices. Its strong invoicing tools make it a solid option for billing-heavy offices.

Key Features:

- Built-in medical invoicing software

- Accepts online payments

- Syncs with EHR and scheduling

- Offers claim tracking

Pros:

- Full iPad and iPhone support

- Custom forms and billing codes

- Clear financial snapshots

Cons:

- Apple-focused design

- Setup may take time

DrChrono works best for mobile-friendly practices. It brings invoicing and records together in one view.

4. Xero with Healthcare Integration

Xero is known for its clean design and cloud access. It offers strong bookkeeping tools and supports healthcare add-ons. It fits private practices and small health groups.

Key Features:

- Tracks income and expenses

- Handles staff payroll

- Links with medical billing tools

- Produces real-time reports

Pros:

- Clear interface

- Strong mobile features

- Affordable plans

Cons:

- No direct patient billing tools

- Some functions need extra apps

Xero is good for practices that want solid financials but already use another billing tool. Its clear layout helps non-accountants stay on track.

5. Athenahealth

Athenahealth is more than just software. It offers a full service that includes billing, records, and revenue management. Its bookkeeping features are part of a larger support system.

Key Features:

- Manages patient invoices

- Collects payments and handles follow-ups

- Offers full reporting

- Includes payer contract tracking

Pros:

- Built for larger practices

- Handles complex billing rules

- Reduces claim errors

Cons:

- Expensive for smaller offices

- May require training

Athenahealth works best for larger clinics or groups that want hands-off billing. It takes care of both medical and financial workflows.

6. PracticeSuite

PracticeSuite offers cloud-based billing and accounting tools. It fits medical offices that need control over invoicing and records but not full EHR tools.

Key Features:

- Manages medical billing and payments

- Offers audit-friendly reports

- Includes automated claim follow-ups

- Works with accounting software

Pros:

- Modular pricing

- Built-in compliance features

- Detailed patient billing

Cons:

- Interface looks dated

- Limited mobile features

PracticeSuite is strong in financial tracking and billing. It helps reduce payment delays and supports proper recordkeeping.

7. Wave Accounting for Solo Practitioners

Wave is free accounting software with invoicing features. It suits solo doctors or small practices with tight budgets. While not built for healthcare, it covers basic needs well.

Key Features:

- Tracks income and expenses

- Sends professional invoices

- Accepts online payments

- Generates tax reports

Pros:

- Free for most features

- Easy to set up

- Good for low volume billing

Cons:

- Lacks advanced medical tools

- No insurance claim support

Wave is best for small or new practices. It works if you do simple invoicing or use a separate tool for medical billing.

8. AdvancedMD

AdvancedMD offers a wide set of tools for billing, records, and finance. It fits practices that want to grow or improve their payment cycle.

Key Features:

- Automates billing and invoicing

- Tracks patient payments

- Syncs with practice schedules

- Offers custom reports

Pros:

- Cloud access with strong security

- Good customer service

- Handles complex codes

Cons:

- High learning curve

- Price can add up

AdvancedMD is suited for mid-size to large practices. It helps improve payment speed and reduces billing errors.

What to Look For in Medical Bookkeeping Software

Before picking a tool, review what features matter most for your office. Here are the key ones:

1. Invoicing and Billing

Make sure the tool supports medical invoicing software features. This includes patient invoices, insurance claims, and co-pay tracking.

2. Expense Tracking

You should be able to see where money goes. Look for clear expense reports and account syncing.

3. Claim Management

Claim errors cause payment delays. Choose software that tracks claim status and flags issues.

4. Reporting Tools

Financial reports help you plan and track growth. A good tool gives snapshots of income, costs, and profit.

5. Integration Options

Pick software that works with your EHR, payroll, or appointment systems. Fewer logins and smoother workflows save time.

6. Compliance and Security

Patient and payment data must stay safe. Use software that meets HIPAA rules and offers strong access control.

Benefits of Using Medical Invoicing Software

A strong medical invoicing software does more than send bills. It helps your practice:

- Speed up payments

- Track unpaid invoices

- Reduce human error

- Improve cash flow

- Make tax time easier

It also helps staff spend less time on admin work and more time on patient care.

Cost Considerations

Prices vary widely. Some tools charge monthly fees, while others offer free base plans. Higher-end tools may include support or custom setup. Before buying, compare costs with expected savings in time and fewer errors.

Always try the demo or trial version before making a final choice. That way you can test features with your real workflow.

Choosing the right medical bookkeeping software in 2025 depends on your practice size, billing needs, and budget. Some tools focus on billing alone. Others combine invoicing, accounting, and reporting in one place.

QuickBooks and Xero offer strong financial features. Kareo and DrChrono give full medical billing support. AdvancedMD and Athenahealth suit larger offices that want more automation.

Make a list of your top needs. Match those to software features. Then test before you commit. The right tool can reduce stress, improve records, and help your practice run better. At Confiance, we use suitable software as per the need of medical practice. Our medical bookkeeping services are customized using all the top software in the market.

FAQs

- Can I use regular accounting software instead of medical bookkeeping software?

You can, but it may not cover key needs like handling insurance codes, tracking co-pays, or managing patient balances. Medical-specific tools reduce errors and save time by handling tasks unique to healthcare. - How does medical invoicing software help reduce billing mistakes?

It uses built-in code libraries, real-time checks, and reminders to catch missing info before claims go out. This lowers rejected claims and speeds up payments. - Is medical bookkeeping software only for large practices?

No. Solo providers, small clinics, and large groups can all use it. Some tools are made just for small offices with limited staff and simpler needs. - Will this software help during audits?

Yes. It keeps records organized and time-stamped, which helps you show clear payment trails and billing history if an audit happens. - Can I still work with my accountant or billing team?

Yes. Most software lets you give access to accountants, billing teams, or bookkeepers so everyone works with the same data in real time. - What happens if my internet goes down?

Most cloud tools store data safely and sync when you’re back online. Some desktop options offer offline access with later sync features.

Q. testing

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Explicabo, placeat, architecto rem dolorem dignissimos repellat veritatis in et eos doloribus magnam aliquam ipsa alias assumenda officiis quasi sapiente suscipit veniam odio voluptatum. Enim at asperiores quod velit minima officia accusamus cumque eligendi consequuntur fuga? Maiores, quasi, voluptates, exercitationem fuga voluptatibus a repudiandae expedita omnis molestiae alias repellat perferendis dolores dolor.