Automotive Accounting: What Dealerships & Auto Shops Must Know

Automotive Accounting - 2025

Ever wondered how new and emerging technologies impact demands of the automotive industry? In this blog, we will explain how the new technologies will impact the automotive industry in the year 2025. With correct financial practices, any industry can survive this transformation easily. For the automotive industry, there is a specific accounting term called “automotive accounting”. Automotive accounting means accounting operations done for car dealerships and auto repair shops. It is mainly for managing cash flow, inventory management, and maximizing profits of the automotive business.

We know that there’s a lot of competition in the automotive industry. Businesses that implement good accounting practices can outshine the competition. To be precise, good accounting practices mean recording, analyzing, and reporting financial transactions of the business. In the automotive sector, such practices help them track expenses, manage revenue, and comply with taxes. Additionally, it also covers aspects like car dealership finance, inventory management, sales tracking, and service revenue monitoring.

What is Automotive Finance?

Definition of Automotive Finance:

Automotive finance includes all the financial services and products that help individuals and businesses purchase, lease, or manage vehicles. It includes loans, leases, dealership financing, and other insurance options.

Types of Automotive Finance

- Retail Financing: Customers get auto loans from banks, credit unions, or dealership financing programs to purchase a vehicle.

- Lease Financing: Instead of buying, customers can lease a vehicle for a specific period through lease financing by making monthly payments

- Dealer Floor Plan Financing: Dealerships can secure financing to maintain their vehicle inventory before selling to customers.

- Commercial Auto Loans: It is for businesses who want to purchase multiple vehicles for operational purposes. Through commercial auto loans, they can make fleet purchases or lease multiple vehicles.

Role of Financial Institutions in Automotive Finance

- Banks, credit unions, and specialized auto finance companies provide financing options to dealerships and customers.

- These institutions test creditworthiness, set interest rates, and manage repayment terms of loan repayment terms.

Key Factors Affecting Automotive Finance

- Credit Score: Determines eligibility for loans and influences interest rates.

- Loan Terms: Includes duration, interest rates, and repayment structures.

- Down Payments: Larger down payments reduce loan amounts and monthly installments.

- Vehicle Depreciation: It impacts vehicle resale value and financing options.

Main Components of Automotive Accounting

In the automotive industry, accounting accurately has become increasingly important. With financial management, tracking revenue, expenses, and measuring dealership profitability becomes easy. Here are some main components of automotive accounting:

Inventory Management:

- Monitoring stock of new and used vehicles.

- Calculating depreciation and making adjustments in valuations.

Revenue Recognition:

- Recording income from vehicle sales, service, and financing to calculate gross profit accurately.

- Following accounting standards for accurate financial reports.

Expense Tracking:

- Cost management for expenses like rent, utilities, and salaries.

- Allocating marketing and advertising expenses.

Tax Compliance:

- Filing income taxes, sales taxes, and payroll taxes accurately.

- Keeping track of deductible expenses to reduce tax liability.

Cash Flow Management:

- Ensuring sufficient liquidity to cover operating expenses and maintain long term financial stability.

- Monitoring loan and lease repayments.

Profit Margin in Car Dealership: Factors Impacting Earnings

Car dealership profits and profit margins depend on various factors. Understanding these can help dealerships optimize their business strategies. Key factors include:

Vehicle Pricing and Cost Control:

- Profit margins are influenced by how well a dealership negotiates purchase costs with manufacturers.

- Proper pricing strategies for new and used cars ensure maximum profitability.

Financing and Interest Rates:

- Offering attractive automotive finance options increases sales volume.

- Proper pricing strategies for new and used cars, along with strong car sales performance, ensure maximum profitability.

Service and Repair Revenue:

- Dealerships that offer maintenance and sale services generate additional revenue streams.

- Providing extended warranties and service contracts through the service department boosts profitability.

Operational Efficiency:

- Efficient automotive accounting helps in reducing overhead costs.

- Automating financial processes ensures smooth and precise operations within the business.

How Confiance Can Streamline Your Automotive Accounting Needs

Comprehensive Automotive Accounting Solutions

- Confiance offers specialized automotive accounting services for car dealerships and auto repair shops.

- We take care of accurate financial record keeping, revenue tracking, and tax compliance.

Expert Management of Car Dealership Finance

- Our team manages car dealership finance. It includes loan processing, inventory financing, and lease accounting.

- We help in boosting profit margins in car dealerships by improving cash flow, minimizing unnecessary expenses, and enhancing customer relationships through transparent financial practices.

Accurate Tax Compliance and Reporting

- Confiance stays updated with the latest tax regulations to ensure dealerships comply with evolving laws.

- We manage sales tax, vehicle excise tax, and depreciation calculations so that you experience smooth tax filing.

Profitability Analysis and Financial Insights

- We analyze dealership financials to identify areas of cost savings and improve profit margins.

- Our detailed reports help businesses make correct decisions about their pricing, inventory purchases, and service offerings to strengthen their bottom line.

Inventory and Expense Management

- Confiance assists dealerships in maintaining accurate inventory valuation and expense tracking.

- We provide live insights about services and parts, accessories, and vehicle sales to improve financial efficiency.

Integration of Digital Accounting Tools

- We implement advanced accounting software and automation tools to simplify financial management.

- Our digital solutions reduce errors, automate bookkeeping, and improve efficiency in automotive finance.

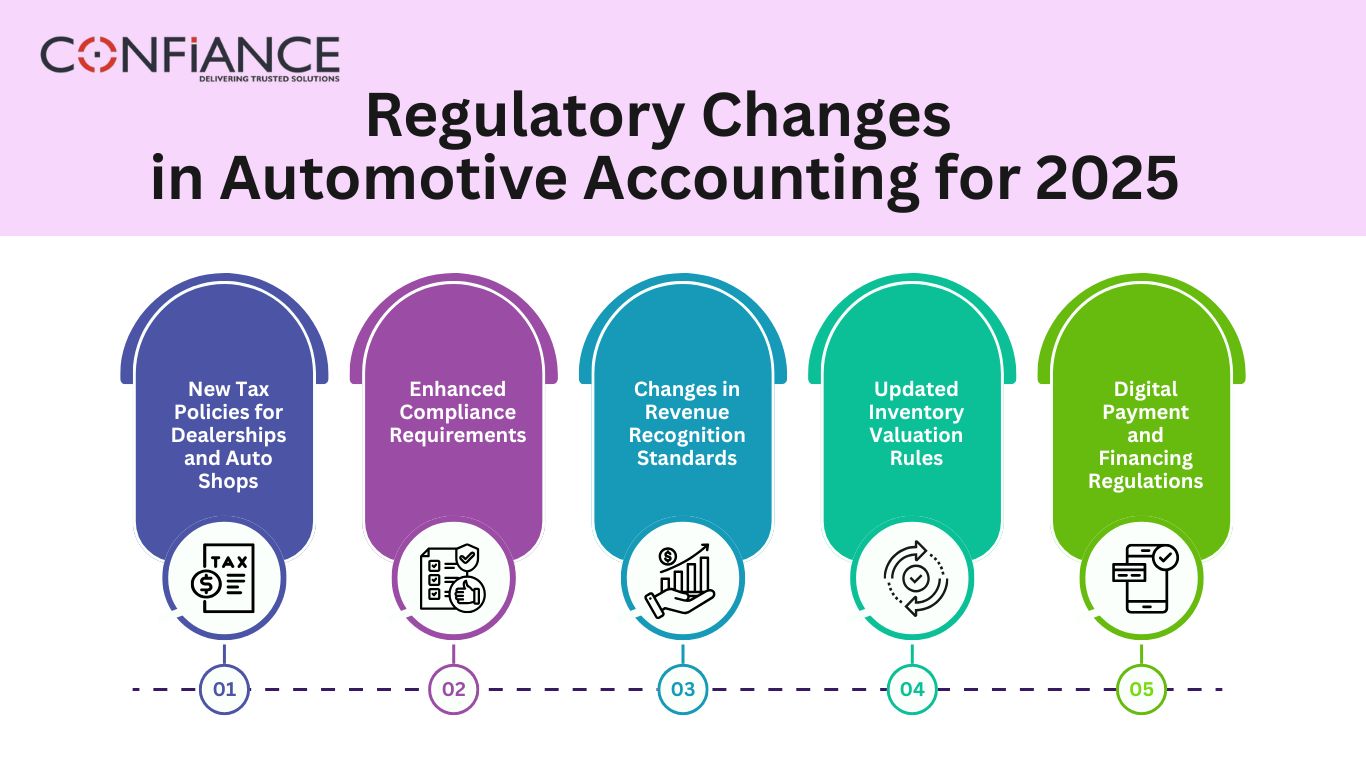

Future Trends in Automotive Accounting

Automotive accounting is a must to ensure financial compliance, profitability, and efficiency, as these factors can significantly impact the future of dealership operations. Car dealership finance needs modern strategies to stay profitable. In the same way, profit margins in car dealerships can be boosted to a certain level. Implementing digital tools and staying updated with automotive financial regulations is essential for every business.

- AI & Automation: Automated invoicing, tax calculations, and financial reporting will improve efficiency.

- Blockchain Security: Secure financial transactions and reduce fraud in car dealership finance.

- Cloud-Based Accounting: Real-time financial data access for better decision-making.

- Data Analytics: Predictive insights will optimize pricing and inventory management.

- ESG Compliance: Tracking sustainability metrics for tax benefits and regulatory compliance.

- Stricter Regulations: Enhanced tax laws and digital reporting requirements.

FAQs

- What is automotive finance, and why is it important?

- Automotive finance means supporting the financial aspects of the auto industry. It includes loans, leases, dealership funding, and credit policies. It is crucial for maintaining cash flow in the business and also gives purchasing power to customers.

- How does automotive accounting help car dealerships?

- Automotive accounting helps in tracking business finances. It also helps in managing expenses, complying with tax laws, and boosting profits.

- What factors affect the profit margin in car dealership businesses?

- Some factors affecting the pricing of vehicles are financing options, operational efficiency, and additional service revenue from repairs and warranties.

- How can Confiance help my dealership with accounting?

- Confiance provides expert car dealership finance solutions, tax compliance assistance, and automated accounting tools to streamline financial management.

- What are the latest trends in automotive finance for 2025?

- The industry is moving toward AI-driven financial automation, digital invoicing, and enhanced financial transparency to improve operational efficiency.

By understanding the latest advancements in automotive accounting, dealerships, and auto shops can stay ahead in the competitive market. Optimize your car dealership's finances with Confiance. We help businesses maximize profit margins in their operations.