How to Outsource Accounts Payable Services Without Losing Control

Outsourcing accounts payable helps small and growing firms save time, lower costs, cut down on errors, and handle vendor bills with more ease. But passing this task to an outside team does not mean you lose control. With a smart plan, you can outsource accounts payable services and still track each part of the process.

This guide shows how to outsource accounts payable services while keeping full control of your books. It walks you through the steps, shows the benefits, lists the tools you may need, and points out common errors to avoid.

What Are Accounts Payable Outsourcing Services?

Accounts payable outsourcing means you hire an outside team to handle your bill tasks. This includes checking invoices, setting payment dates, talking to vendors, and keeping clear records. These teams use tools made for tracking money and staying on top of rules.

They often help with:

- Getting and checking bills

- Matching bills to orders

- Sending bills to the right staff for sign-off

- Planning and sending payments

- Talking to vendors

- Fixing errors or missing info

- Following your company’s rules and tax laws

- Sharing reports you can check anytime

Outsourcing these tasks gives your team more time for planning and growth. It also cuts down on late payments and simple errors.

Why Companies Outsource Accounts Payable

Many companies outsource accounts payable to save money, work faster, and avoid errors. Here are the top reasons:

Lower costs

You save on wages, skip buying pricey software, and avoid late fees.

Fewer errors

Outsourced teams follow clear steps that cut down on missed bills, double payments, and bad data entry.

Better tools

Most providers use cloud systems, smart software, and automation to move faster and stay accurate.

Stronger compliance

They keep up with tax laws, record rules, and reports so you stay in line.

Easy to scale

As your business grows, the team can handle more work without needing to hire more staff.

Ready for audits

Their systems track each step and give you full access to reports, helping with reviews and audits.

Outsourcing also helps keep steps the same, reduces delays in approval, and gives you more control over what you spend. It builds a system that can grow with your business.

Risks of Outsourcing Without a Plan

Outsourcing without a solid plan can cause big problems. Here are the main risks:

Missed payments

Without a clear process, invoices may get lost or paid late.

Unhappy vendors

Late or wrong payments can hurt your vendor ties and slow down service.

Bad data

Weak controls can lead to wrong entries or repeated records.

Fraud

If the provider ignores your rules, it could lead to fake payments or money loss.

Rule violations

Not tracking tax forms or saving records the right way can lead to fines or audit trouble.

To stay safe, set up your process before handing off tasks. Make sure your team knows the plan and has tools to check the work.

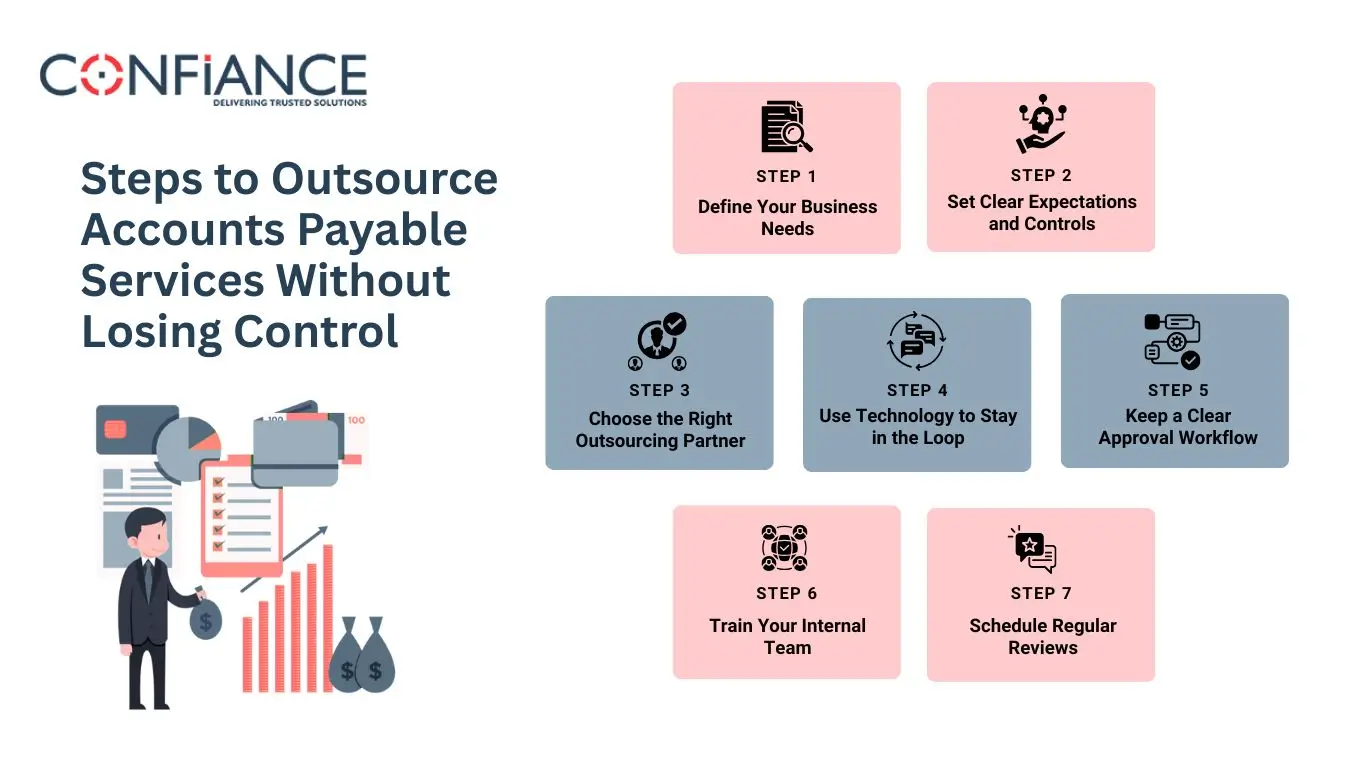

Steps to Outsource Accounts Payable Services Without Losing Control

1. Define Your Business Needs

Look closely at how your current accounts payable process works. Find the pain points that slow things down or cause errors. These may include:

- Disputes over invoices

- Delays in getting approvals

- Too many changes or exceptions

- Constant follow ups with vendors

- Poor tracking of unpaid bills

Once you spot the issues, decide which parts to outsource. Some companies outsource the full process from invoice to payment. Others choose to keep key steps like approvals and adding vendors within their team.

2. Set Clear Expectations and Controls

Create clear service rules in writing. These should cover:

- How long it should take to process invoices

- What documents are needed at each step

- Who can approve payments and when to raise issues

- How the provider should talk to your team and vendors

Make sure the provider follows your internal controls. Set rules for adding vendors, approving invoices, and planning payments. This helps you keep full oversight of the process.

3. Choose the Right Outsourcing Partner

Look for providers with a proven track record in accounts payable outsourcing services. Ask questions such as:

- Do you support businesses in our industry?

- What software platforms do you use?

- How do you manage compliance with financial regulations?

- What experience do you have with audit support?

Choose a partner that uses secure, cloud-based systems and offers real-time reporting. They should have strong client reviews and a clear onboarding process.

4. Use Technology to Stay in the Loop

Technology makes it easy to track outsourced work without extra effort. Use cloud accounts payable tools that offer:

- Live dashboards

- Alerts for key actions

- Custom approval steps

- Logs of vendor messages

- Access controls by user role

Ask the provider to share weekly or monthly reports. These should show:

- Total invoices processed

- Any delays or problems with approvals

- Payments made

- Unpaid balances

- Cases flagged for review

With this level of detail, you can step in fast if something needs attention.

5. Keep a Clear Approval Workflow

Stay in control by setting clear rules for approvals. For example:

- Bills over $1,000 need a manager’s OK

- Payment changes must be checked by finance

- New vendors must meet your paper rules

Teach your outsourcing partner to follow these rules. This stops wrong payments and keeps your team responsible.

6. Train Your Internal Team

Make sure your finance and operations staff know the new process. Training should cover:

- How to review and approve invoices online

- How to check payment status

- How to contact the provider if there are issues

- How to run reports and check vendor balances

Good training avoids confusion and helps your team work well with the outside provider.

7. Schedule Regular Reviews

Hold regular review meetings to evaluate performance. In each session, review:

- Metrics such as processing speed and error rates

- Current invoice status

- Unresolved exceptions

- Budget variance

- Vendor feedback

Regular communication keeps the provider accountable and helps you adjust the process if needed.

Key Features to Look for in Accounts Payable Outsourcing

To get the most value, select a provider that offers:

- Automated invoice capture: Speeds up data entry and reduces errors

- Approval workflows: Ensures proper routing and control

- Real-time dashboards: Provides visibility into processing and payment status

- Audit trails: Supports compliance and transparency

- Vendor portals: Makes it easy for vendors to check status or submit questions

- Secure payment systems: Protects your financial data

- Custom reporting: Helps track KPIs that matter to your business

These features allow your team to monitor accounts payable activity without micromanaging the provider.

Benefits of Accounts Payable Outsourcing Services

Outsourcing your accounts payable brings clear financial and work benefits:

Lower Costs

You save on staff wages, training, software, and office expenses. You also avoid late fees and duplicate payments that waste money.

Better Accuracy

Outsourcing teams use trusted systems and trained staff. This cuts errors and keeps your records correct.

Improved Cash Flow

Fast invoice processing and clear reports help you know when payments are due. This makes it easier to manage your cash and see what you owe.

Easy to Grow

You can handle more invoices as your business grows without hiring more staff. This keeps your work simple and efficient.

Less Risk of Fraud

Most providers use two-step approvals, limited access, and audit logs to prevent fraud. This adds safety to your payments.

More Time to Plan

Your team can focus on forecasting, managing vendors, and planning money instead of daily invoice tasks.

Common Mistakes to Avoid

- Starting without a plan: Leads to disorganized workflows

- Skipping internal training: Causes errors and delays

- No performance tracking: Makes it hard to judge provider quality

- Weak controls: Increases fraud or payment risks

- Poor communication: Breaks down trust with vendors

Avoid these by creating a well-defined process and reviewing it often.

Staying Compliant With Outsourced AP

Your provider must follow key tax and legal rules, such as:

- 1099 filing

- Collecting W-9 forms

- Tracking sales tax

- Keeping records as required

- Helping with tax audits

They should also work with your CPA to keep your business in line with all rules at the state, federal, and industry level.

Best Practices to Stay in Control

- Use two-person approval for large invoices

- Check AP reports each week or month

- Limit who can add or approve vendors

- Track how long it takes to process or fix issues

- Review your process every quarter

- Set monthly budget checks for each team

These steps help keep your payables clear and in check.

Sample Workflow for Outsourced AP

- Vendor sends invoice to your designated inbox

- System captures and reads the invoice

- Automated matching with purchase order

- Invoice routed for approval based on rules

- Approved invoice sent for payment

- Payment made based on payment terms

- System updates reports and sends alerts

Every step is logged and visible to your team through your dashboard.

Questions to Ask an Outsourcing Provider

- How do you verify invoice accuracy?

- What software do you use to manage accounts payable?

- How quickly do you process invoices?

- Can I access reports at any time?

- How do you handle exceptions and urgent issues?

- What data security standards do you follow?

- Can you support international vendors?

These questions help ensure your provider is reliable and aligned with your goals.

Use Cases for Outsourcing Accounts Payable

- Growing companies needing to control costs

- Multi-location businesses wanting centralized processes

- Remote teams needing cloud access and shared tools

- Seasonal operations requiring flexible staffing

- Regulated industries with strict documentation needs

Outsourcing adapts well to changing business conditions.

The Long-Term Value of Outsourcing Accounts Payable

Outsourcing accounts payable is more than a quick fix. It brings long-term value by cutting costs, improving accuracy, and freeing up your team. With Confiance, you get clear insight into payments, better vendor relations, and smarter money choices.

When done well, you keep full control of your accounts payable while enjoying the ease and flexibility of outsourcing. The key is to pick a trusted provider, set clear steps, and use the right tools.

FAQs

- Can I monitor outsourced accounts payable in real time?

Yes. Most providers offer dashboards, alerts, and access logs so you can check status anytime.

- What documents should I collect before outsourcing accounts payable?

Gather your vendor list, approval rules, invoice samples, payment terms, and compliance needs.

- Will outsourcing slow down invoice approvals?

No. With the right setup, outsourced teams can speed up approvals by following your custom rules.

- What happens if the outsourcing provider makes an error?

Top providers fix issues quickly and use audit logs so you can trace every action and correct mistakes fast.

- How can I prevent duplicate payments with an outsourced team?

Use systems that flag repeated invoices, enforce approval steps, and restrict vendor edits to avoid this.

- Do I need accounting software before I outsource accounts payable?

Not always. Many providers offer their own platforms, or they can work with your existing system.