Accounting Services in California for Small and Medium Businesses

Running a small or mid-size business in California can be hard. One of the main challenges is handling money. Accounting services in California help firms keep track of cash, pay bills, handle taxes, and plan for growth.

Using these services saves time, reduces mistakes, and keeps the business on the right track. With expert help, owners can focus on work that grows the business, instead of spending hours on numbers. In this blog, we will look at why accounting is important, the types of services available, and how to choose the best accounting partner for your business.

Why Accounting Services Matter

Good accounting is more than just keeping records. It helps businesses make smart choices. Small and medium businesses often have limited staff. Handling money on top of daily operations can be hard. Using professional accounting services makes it easier for California businesses to handle money and avoid errors.

Track Your Money

Bookkeeping and accounting help you see exactly where your money goes. All sales, bills, and payments are recorded. This gives a clear picture of your business's health.

Stay Legal and Pay Taxes on Time

California has rules for taxes and reports. Accountants help you follow these rules. They make sure your taxes are filed correctly and on time. This avoids fines and legal problems.

Benefits of Accounting Services in California

Hiring accounting services gives small and mid-size businesses in California real advantages. They help track income and expenses, handle taxes on time, and create clear reports.

Save Time

Handling accounting internally can take hours every week. By outsourcing accounting, business owners can focus on growth, customer service, and operations. Professionals handle bookkeeping, tax filing, payroll, and more efficiently.

Save Money

Hiring a full-time accountant can be costly. Outsourcing is cheaper. It also lets you spend money on marketing, staff, or new products.

Make Better Decisions

Accountants do more than record transactions. They check your numbers, make reports, and give advice. This helps you plan budgets, forecast profits, and make smart decisions.

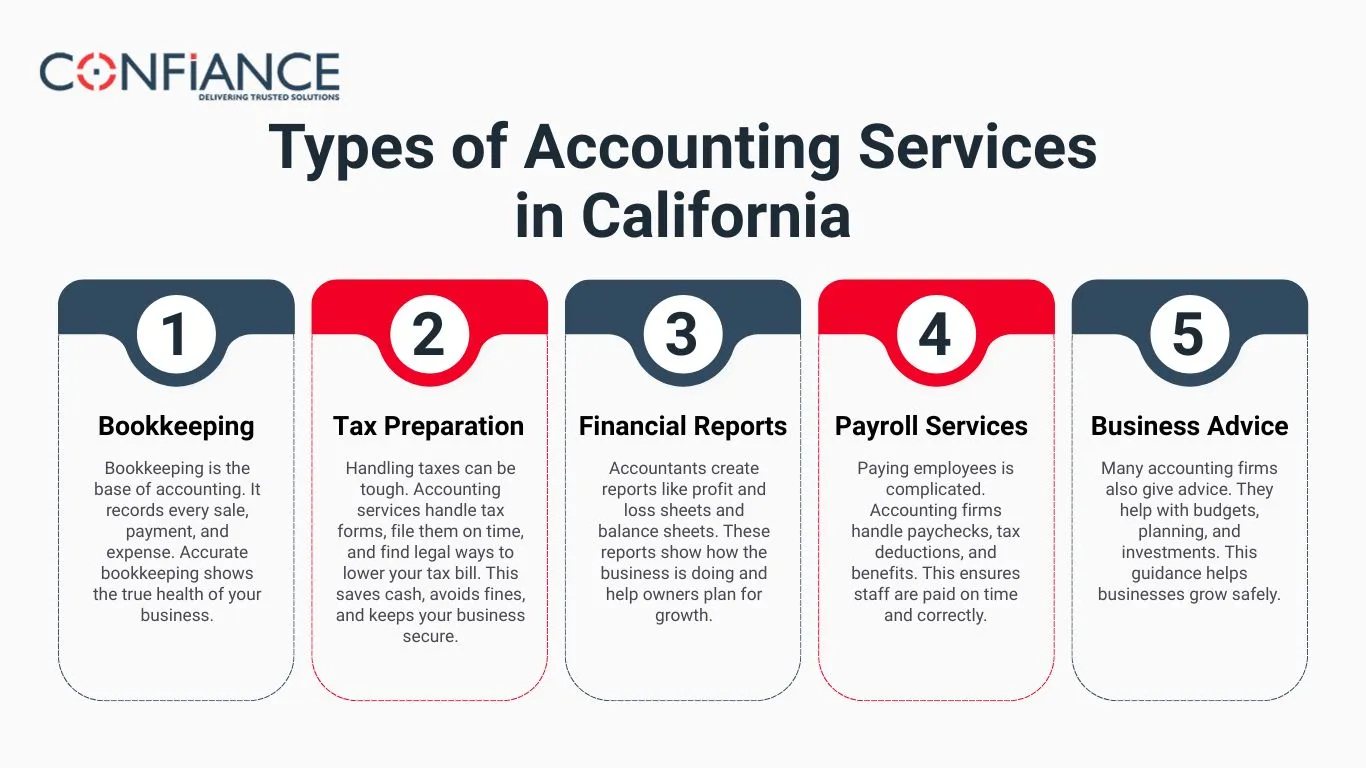

Types of Accounting Services in California

Small and mid-size firms often struggle with taxes, payroll, and cash flow. Accounting Services in California solve these issues by offering clear books, on-time filings, and smart advice. These services not only keep money matters in order but also help firms plan and expand.

Bookkeeping

Bookkeeping is the base of accounting. It records every sale, payment, and expense. Accurate bookkeeping shows the true health of your business.

Tax Preparation

Handling taxes can be tough. Accounting services handle tax forms, file them on time, and find legal ways to lower your tax bill. This saves cash, avoids fines, and keeps your business secure.

Financial Reports

Accountants create reports like profit and loss sheets and balance sheets. These reports show how the business is doing and help owners plan for growth. With clear and simple reports, owners can make smart choices and stay in full control of their money.

Payroll Services

Paying employees is complicated. Accounting firms handle paychecks, tax deductions, and benefits. This ensures staff are paid on time and correctly.

Business Advice

Many accounting firms also give advice. They help with budgets, planning, and investments. This guidance helps businesses grow safely.

How to Choose the Right Accounting Services

Not all accounting services are the same. Choosing the right one is important for your business.

Check Experience

Look for firms with experience in small and medium businesses. Industry knowledge makes a big difference.

Check Services Offered

Make sure the firm can handle bookkeeping, payroll, taxes, and advice if needed.

CommunicatiCheck Services Offered

Make sure the firm can do bookkeeping, payroll, taxes, and advice. Pick a firm that can cover all your key accounting needs in one place.

Communication and Transparency

A good firm uses clear words and shares reports on time. Prices should be simple and easy to read, with no hidden fees.

Reviews and Recommendations

Check online reviews or ask other owners. Good feedback shows the firm is trusted and does a solid job.

Use of Technology

Modern accounting uses software. Firms that use updated tools work faster and give real-time updates.

Common Challenges Small and Medium Businesses Face Without Accounting Services

Ignoring professional accounting can cause many problems. Knowing these issues shows why hiring experts is important.

Ignoring skilled accounting can cause big problems. Knowing these issues shows why hiring experts matters.

Cash Flow Problems

Without sound accounting, firms can face cash flow gaps. Bills and payments pile up, making it hard to cover daily costs and slowing the business.

Risk of Fines

California has strict tax laws. Firms without trained accountants may pay fines or face audits when reports are late or wrong.

Bad Choices

With no clear money records, owners may make poor calls. They may spend too much, invest too little, or miss good chances to grow.

Lost Time

Doing books in-house takes time from key tasks. Owners and staff may spend hours on work that experts can do faster and with fewer errors.

Time Drain

Doing accounting in-house takes time from other key tasks. This lowers productivity and slows growth. Owners and staff may spend hours on work that experts can handle faster.

How Accounting Services Can Boost Business Growth

Accounting services do more than track money. They also help firms grow and plan for the future.

Strategic Financial Planning

Accountants study data and give tips on growth, spending, and saving. They help firms plan smartly so they can expand without risk.

Improved Profitability

By spotting waste, cutting extra costs, and finding tax breaks, accountants help firms earn more and keep cash safe.

Stress Reduction for Business Owners

When experts handle finances, owners can focus on goals and growth. This lowers stress and helps them make better decisions.

Access to Expert Advice

Many accounting services give advisory support. Firms can get help with deals, investments, and risk management, which can be key for long-term success.

Common Misconceptions About Accounting Services in California

Many business owners have wrong ideas about accounting. Clearing these misconceptions helps make smart choices.

Accounting is Only for Big Companies

Some believe accounting is only for large firms. In reality, small and medium businesses benefit greatly from professional accounting services in California.

It’s Too Expensive

People think accounting services are costly. Outsourcing is often cheaper than hiring a full-time employee and saves money in the long run.

DIY Accounting Works Fine

Handling finances alone seems simple. But mistakes in bookkeeping or taxes can cost more than professional services.

Accountants Only Handle Taxes

Accounting is not just taxes. It includes bookkeeping, payroll, reports, and financial advice to grow your business.

Technology Replaces Accountants

Software helps, but it cannot replace professional expertise. Accountants provide insights, strategy, and error-free compliance.

The Future of Accounting Services in California

Accounting is changing fast. Small and medium businesses must adapt to benefit from new trends.

Cloud Accounting

Cloud systems make real-time tracking easier. Businesses can see finances anytime, anywhere.

Automation of Tasks

Routine tasks like payroll and invoicing are automated. This reduces errors and saves time.

Data-Driven Decisions

Accountants use analytics to offer advice. This helps businesses plan budgets and investments wisely.

Virtual Accounting Services

Remote accounting is growing. Businesses can work with top firms without location limits.

Focus on Strategic Growth

Accounting is shifting from record-keeping to helping businesses grow with better planning and advice.

Client Success Stories: Real Results from Accounting Services in California

Real firms see strong results with expert accounting. These stories show how small and mid-size companies save time, cut costs, and grow with help from pro accountants.

Increased Profit Margins

A small retail shop raised profits by 20% after using accounting services. Experts tracked costs, cut waste, and filed taxes the right way. The owner then focused on sales and growth.

Time Saved for Growth

A mid-size IT company saved hours each week by outsourcing bookkeeping and payroll. Staff had more time for clients, marketing, and expansion, while accountants handled money tasks with care.

Avoided Penalties

A restaurant avoided fines with help from accounting pros. The team filed taxes, tracked payments, and met California rules. This kept the business safe and let the owners focus on daily work.

Strategic Planning

A small consulting firm gained clear advice on budgets and investments. Accountants helped plan cash flow, control costs, and guide growth. The firm opened a second office while keeping money matters on track.

Better Cash Flow Management

A small factory improved its cash flow by tracking income and spending closely. Accounting services helped plan payments, reduce errors, and support smart choices for growth and stability.

Effective Accounting helps small and mid-size businesses in California stay on track. It keeps money, taxes, and payroll in order. By using experts like Confiance, owners save time and avoid mistakes. They get clear reports and advice to help the business grow.

With the right partner, firms can pay bills on time, plan for the future, and avoid fines. At Confiance, we make sure all accounts are correct, easy to read, and ready for smart decisions. This gives owners peace of mind and helps the business succeed.

FAQs

- What are Accounting Services in California?

Accounting services help firms keep track of cash. They include bookwork, payroll, taxes, and advice. These services save time and make small and mid-size firms run smoothly. - Why do small firms need accounting services?

Small firms have little staff or time to handle cash. Accounting services track income and costs, pay taxes on time, and give clear tips. This keeps the firm safe and helps it grow. - How much do accounting services cost in California?

Cost changes with firm size and work needed. Outsourcing is often less than hiring a full-time accountant. Many firms give set rates for bookwork, payroll, and taxes. This helps small firms plan. - Can accounting services help with taxes?

Yes. Accountants file taxes right, find legal breaks, and follow rules. This cuts fines and keeps cash safe and neat, giving owners peace of mind. - Are accounting services just for big firms?

No. Small and mid-size firms gain much from accounting services. They help track cash, plan budgets, and grow safely, just like big firms. - How do I pick the right accounting service?

Pick firms that work with small firms, have clear rates, and have good reviews. Make sure they give all the services you need and use new tools to show fresh cash information. - Can accounting services help my firm grow?

Yes. Accountants do more than track cash. They give tips on budgets, profit, and plans. This helps firms save cash, avoid errors, and grow their business.