Accounting Difference Between Credit and Debit with Examples

Accounting is the method of recording financial actions. It works through a system that tracks every transaction. The core of this system is built on two terms: debit and credit.

Every entry in business has these two parts. When you earn, spend, borrow, or buy, one account gets debited and another gets credited. This rule keeps your books balanced. It helps you see what comes in, what goes out, what you own, and what you owe.

This article explains the accounting difference between credit and debit using simple logic and useful examples. You will see how they work and how they affect each type of account.

What is a Debit?

A debit is the entry made on the left side of an account. It shows an increase in value that the business receives or uses. In daily records, debit is used for things the business owns or uses. If a business adds cash, buys tools, or pays rent, a debit is recorded.

Debits increase:

- Assets (cash, furniture, buildings, vehicles)

- Expenses (rent, salary, bills, repairs)

- Withdrawals (owner drawings)

Debits decrease:

- Liabilities

- Equity

- Income

Practical View of Debits:

- Buy a computer: asset grows. Debit.

- Pay rent: expense goes up. Debit.

- Withdraw cash for personal use: debit to drawings.

- Pay for office supplies: increase in expense. Debit.

- Buy prepaid insurance: debit to prepaid account.

Debits are the default side for what the business gains or pays for. It’s used across basic and advanced transactions.

What is a Credit?

A credit is the entry made on the right side of an account. It records value that leaves the business or shows a duty the business must meet. It is often used to track income, loans, or capital added by the owner.

Credits increase:

- Liabilities (loans, bills payable)

- Equity (owner’s capital)

- Income (sales, interest, fees)

Credits decrease:

- Assets

- Expenses

Practical View of Credits:

- Take a loan: cash increases, but so does liability. Credit to liabilities.

- Make a sale: income increases. Credit to revenue.

- Owner adds funds: capital increases. Credit to equity.

- Record unearned income: credit to unearned revenue.

- Pay off accounts payable: credit to cash.

Credits reflect the sources of funds, obligations, or ownership. Most entries linked to income or liabilities fall under this side.

Why Debits and Credits Always Work Together

The double-entry system rules all accounting. Every action needs a debit and a credit. The values must be equal. This rule applies to all sizes of businesses and all types of accounts.

You cannot just add money to an account. You must show its source. For example, if cash increases, you must also show if the money came from a sale, loan, or capital investment.

This rule gives a clear view of activity. If totals do not match, an error exists. This check helps prevent wrong records and shows when something is missing.

How Debit and Credit Affect Account Balances

Each account has a normal balance. Assets and expenses normally carry a debit balance. Liabilities, income, and equity carry a credit balance. When an entry is made, it either increases or decreases the balance, based on this normal side.

Examples:

- Cash is an asset. It increases with debit and decreases with credit.

- Accounts Payable is a liability. It increases with credit and decreases with debit.

- Rent Expense is an expense. It increases with debit and decreases with credit.

Knowing this pattern helps post entries correctly. Errors in this part lead to confusion in final accounts.

Debit and Credit in Different Accounts

Different account types react differently to debit and credit. Here is how they work:

| Account Type | Debit Effect | Credit Effect |

| Assets | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Equity | Decrease | Increase |

| Expenses | Increase | Decrease |

| Income | Decrease | Increase |

This table shows the basic accounting debit vs credit difference.

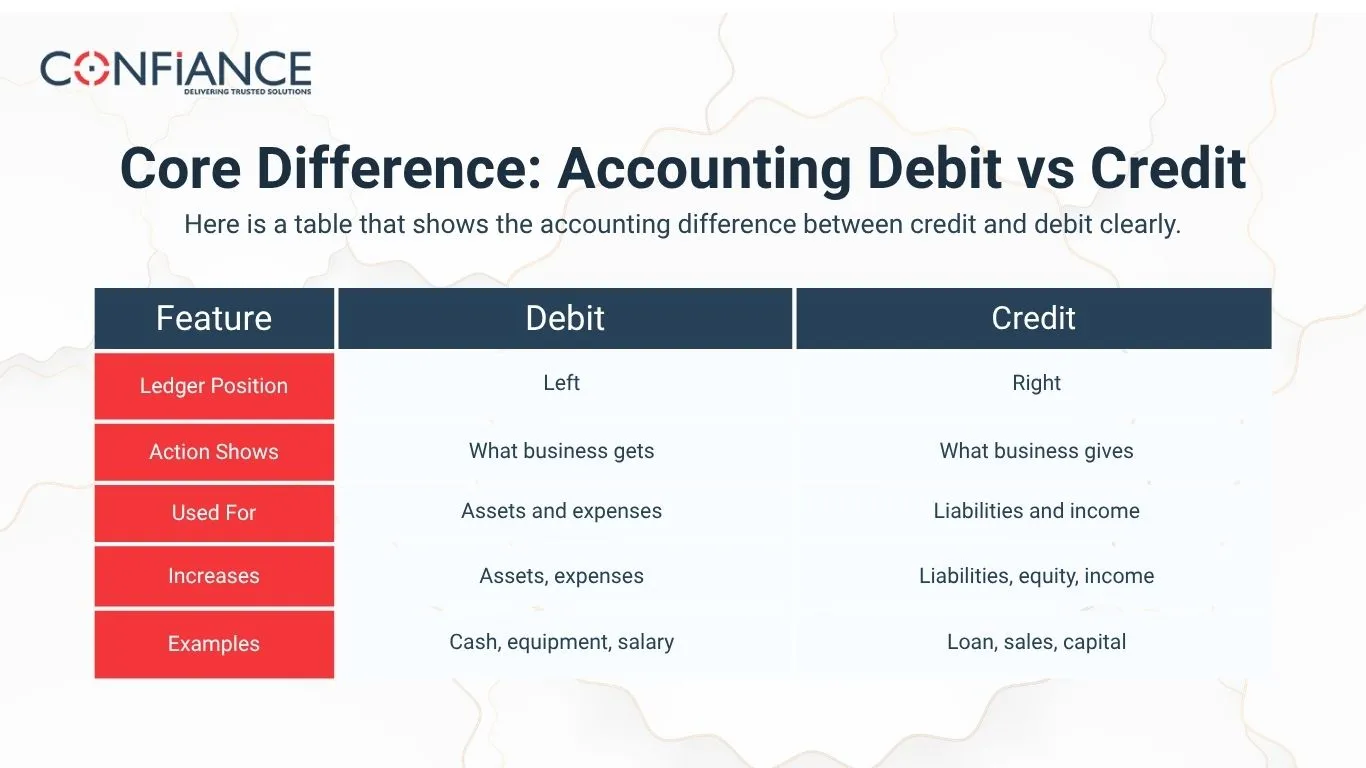

Core Difference: Accounting Debit vs Credit

Here is a table that shows the accounting difference between credit and debit clearly:

| Feature | Debit | Credit |

| Ledger Position | Left | Right |

| Action Shows | What business gets | What business gives |

| Used For | Assets and expenses | Liabilities and income |

| Increases | Assets, expenses | Liabilities, equity, income |

| Examples | Cash, equipment, salary | Loan, sales, capital |

Both sides are always part of every entry.

Detailed Examples of Debit and Credit

- Buy furniture with cash

- Debit: Furniture

- Credit: Cash

- Take a loan from a bank

- Debit: Bank

- Credit: Loan Payable

- Pay office rent

- Debit: Rent Expense

- Credit: Bank

- Earn income from service

- Debit: Bank

- Credit: Service Income

- Buy inventory on credit

- Debit: Inventory

- Credit: Accounts Payable

- Owner adds capital

- Debit: Bank

- Credit: Capital

- Pay utility bills

- Debit: Utilities Expense

- Credit: Bank

- Receive interest from savings

- Debit: Bank

- Credit: Interest Income

- Receive customer payment for previous sale

- Debit: Bank

- Credit: Accounts Receivable

- Record depreciation

- Debit: Depreciation Expense

- Credit: Accumulated Depreciation

- Pay business loan interest

- Debit: Interest Expense

- Credit: Bank

- Record service earned but not billed

- Debit: Accounts Receivable

- Credit: Revenue

Practical Use of Debits and Credits in Day-to-Day Business

Debits and credits are not just accounting terms. They shape how daily business runs. From a small vendor recording daily cash sales to a large firm tracking inventory, every financial move uses these concepts.

Daily Use Cases:

- A cafe receives payment from a customer: Debit cash, credit revenue.

- A freelancer pays for a design tool: Debit software expense, credit bank.

- A trader buys stock for resale: Debit inventory, credit supplier account.

Even actions like paying monthly rent, collecting fees from clients, or recording loan interest depend on correct debit and credit use.

Understanding these roles ensures businesses stay clear with their records and avoid costly errors.

DEALER Rule for Quick Memory

Use DEALER to remember account types:

Increase with Debits

- D: Dividends

- E: Expenses

- A: Assets

Increase with Credits

- L: Liabilities

- E: Equity

- R: Revenue

This memory trick is used in accounting classes and helps simplify concepts.

Journal Entries and Posting Process

All records begin with a journal entry. It shows the debit and credit. Every transaction has a date, brief note, and debit-credit pair.

Example: Sell goods for $1,000

- Debit: Bank $1,000

- Credit: Sales $1,000

Entries are moved to ledgers. Then totals form the trial balance. This process continues monthly and yearly in all businesses.

Posting involves moving each journal entry to the respective account ledger. It helps summarize balances by type.

Trial Balance: A Check on Totals

Trial balance lists all accounts with their balances. Debits and credits must match. This report is used before preparing final reports.

If not, you must check your work. This step confirms your records are right. If it still does not match, there may be a missing entry. Often, a simple data input error is the cause.

Impact on Reports

Debits and credits affect your reports. Each report gives a full picture of the financial state.

Income Statement:

- Debits: expenses

- Credits: revenue

- Result: profit or loss

Balance Sheet:

- Debits: assets

- Credits: liabilities and equity

- Result: must balance

Statement of Owner’s Equity:

- Debits: drawings

- Credits: new capital and profits

Cash Flow Statement:

- Operating, investing, and financing flows are tracked.

- These link back to changes caused by debit and credit entries.

Together, these reports form the base of financial decisions.

Common Business Transactions Summary

| Transaction | Debit | Credit |

| Sell goods for cash | Cash | Sales |

| Buy stock on credit | Inventory | Accounts Payable |

| Pay wages | Salary Expense | Bank |

| Take a loan | Bank | Loan Payable |

| Repay part of a loan | Loan Payable | Bank |

| Owner adds more money | Bank | Capital |

| Client pays for service | Bank | Accounts Receivable |

| Pay for insurance | Insurance Expense | Bank |

| Pay income tax | Tax Expense | Bank |

| Withdraw cash | Drawings | Bank |

| Sell equipment | Bank | Equipment |

| Record bad debt | Bad Debt Expense | Accounts Receivable |

| Earn commission | Bank | Commission Income |

Why You Must Understand Debit and Credit

Knowing the accounting difference between credit and debit helps you:

- Keep records clean

- Post correct entries

- Prepare good reports

- Spot errors early

- Make sound choices

This is useful even if you use software. Tools rely on correct input. You still need to know what debit and credit to apply.

In simple words:

- Debit adds to what you receive or spend

- Credit adds to what you owe or earn

Each entry needs both. Totals must always match. Once you practice, it gets easier. The system works when rules are followed every day.

FAQs

- Can one entry have more than one debit or credit?

Yes. You can split amounts across accounts if the totals match. - Is accounting debit vs credit logic fixed across industries?

Yes. The rule stays the same, though account names may change. - Do credits always mean income?

No. A credit can also show liability or equity. - What if debit and credit totals match, but details are wrong?

Trial balance may still match. But your records are not correct. Always check both sides. - Does software prevent all entry errors?

No. It helps. But understanding debit and credit keeps you in control. - How do I test my debit and credit skills?

Make sample entries. Prepare a trial balance. Check totals. Adjust errors. Repeat.