Guide to Recording Sales Journal Entry with Examples

A sales journal entry is an important part of accounting. It shows every sale made on credit and keeps track of customer payments. A correct record of each sale is vital for clean books and smooth audits. In this guide, we explain what a sales journal entry is, why it matters, and how to record it with clear examples that any business owner or team member can follow.

What is a Sales Journal Entry?

A Sales Journal Entry is a record of all credit sales a business makes. These entries help accountants keep track of what customers owe. It is part of the accounting system that ensures accuracy in financial records.

Why Sales Journal Entries Matter

Recording sales properly is important because it:

- Shows how much revenue a business earns

- Helps track accounts receivable

- Makes financial reporting accurate and simple

- Avoid mistakes that lead to wrong tax filings

A proper Journal Entry is not just good practice. It is a key step to measure growth and manage cash flow.

Role of Sales Journal in Financial Planning

A sales journal is more than a simple log. It is a key report for business planning.

- Cash Flow: Shows when payments are due so you can plan expenses.

- Budgeting: Past data helps predict future sales and set realistic goals.

- Tax Filing: Accurate entries reduce stress during tax season.

- Credit Tracking: Shows which customers owe money and when.

- Sales Check: Reveals which products or services sell best.

- Audit Check: Gives clear records for fast audits.

- Help with Choices: Supplies simple data for pricing or growth plans.

Managers can use the data to find trends, check which products sell best, and plan marketing efforts.

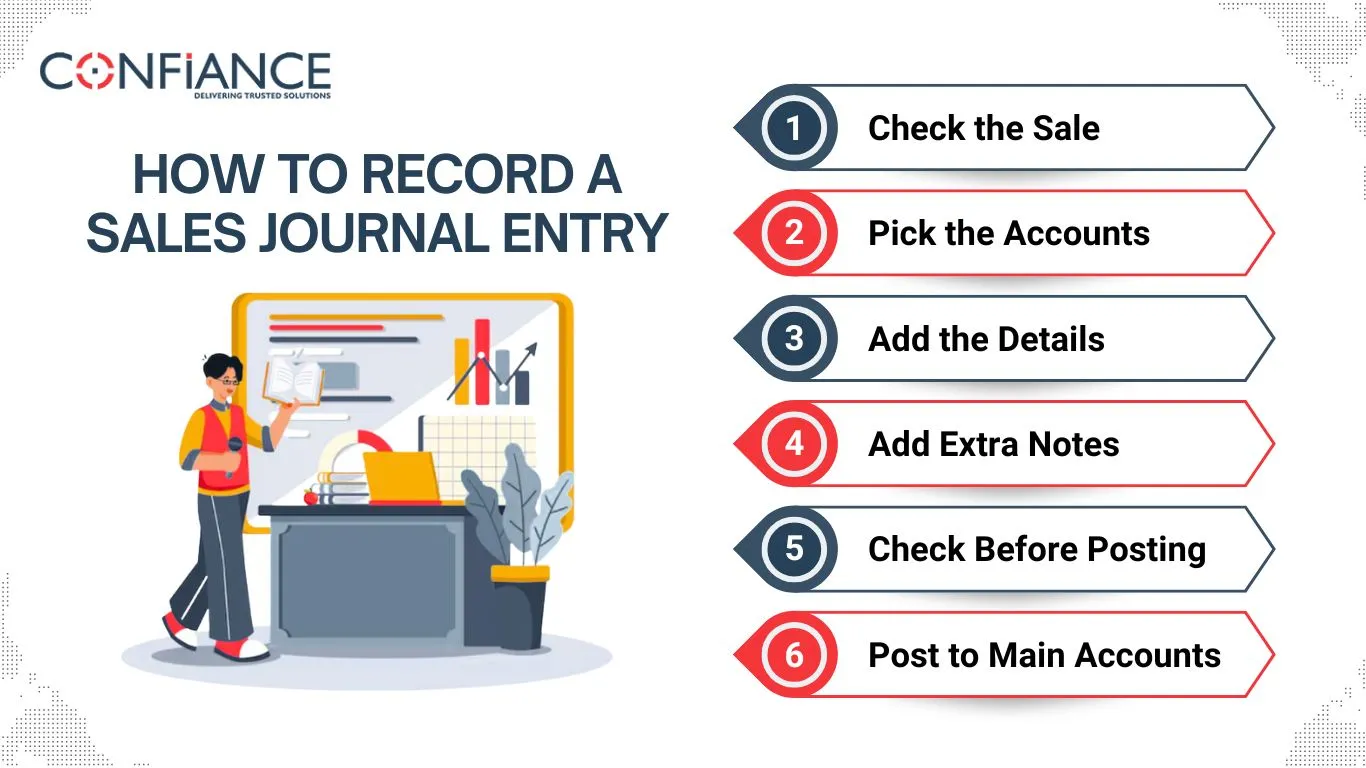

How to Record a Sales Journal Entry

Recording a sales journal entry is easy if you follow a simple plan. Doing it right keeps your books correct and easy to read. Here is a step-by-step guide with examples and tips.

Step 1: Check the Sale

First, see if the sale is on credit. Only credit sales go in the sales journal. Cash sales go in the cash journal.

Tip: Mark “credit” or “cash” on the invoice. This avoids mistakes and keeps your records clear.

Step 2: Pick the Accounts

Every credit sale affects two accounts:

- Debit Accounts Receivable: Shows the money the customer owes.

- Credit Sales Revenue: Shows the money you earned.

Tip: Check the amount before posting. Even a small error can unbalance your books.

Step 3: Add the Details

Write down the date, customer name, invoice number, and amounts.

Tip: Use the same format for all entries. This makes it easy to read and review.

Step 4: Add Extra Notes

You can also add:

- Product or service sold

- Payment terms (e.g., 30 days)

- Any discount

Notes make it easy to track returns or discounts later.

Step 5: Check Before Posting

Check that dates, invoice numbers, and amounts match your sales slips. Make sure accounts are correct.

Tip: Small checks save hours of work later.

Step 6: Post to Main Accounts

At the end of the day or week, total all sales and update your main accounts. This keeps books balanced and ready for reports.

Case Study: Recording a Sales Journal Entry

This case shows how a sales journal entry works in a small business.

Example 1: Multiple Sales in a Day

ABC Traders made three credit sales on the same day:

| Date | Customer | Invoice | Accounts Receivable | Sales Revenue | Notes |

| 23-Sep-25 | John Doe | 101 | $500 | $500 | 30-day credit |

| 23-Sep-25 | Jane Smith | 102 | $1,200 | $1,200 | 30-day credit |

| 23-Sep-25 | Mike Brown | 103 | $800 | $800 | 10% discount early |

Each sale lists the customer, invoice, and amount.

Example 2: Sales Return

Jane Smith returned goods worth $200. ABC Traders added this as a sales return:

| Date | Customer | Invoice | Accounts Receivable | Sales Revenue | Notes |

| 25-Sep-25 | Jane Smith | 102R | -$200 | -$200 | Returned items |

Extra lines like this keep totals correct and clear.

Example 3: Early Payment Discount

Mike Brown paid early and got a 10% discount ($80). ABC Traders added this in the sales journal:

| Date | Customer | Invoice | Accounts Receivable | Sales Revenue | Notes |

| 28-Sep-25 | Mike Brown | 103D | -$80 | -$80 | Early payment discount |

Discounts are shown as extra lines so books stay correct.

Example 4: Full Week View

A combined view of sales, returns, and discounts:

| Date | Customer | Invoice | Accounts Receivable | Sales Revenue | Notes |

| 23-Sep-25 | John Doe | 101 | $500 | $500 | 30-day credit |

| 23-Sep-25 | Jane Smith | 102 | $1,200 | $1,200 | 30-day credit |

| 25-Sep-25 | Jane Smith | 102R | -$200 | -$200 | Returned items |

| 23-Sep-25 | Mike Brown | 103 | $800 | $800 | 10% discount early |

| 28-Sep-25 | Mike Brown | 103D | -$80 | -$80 | Early payment discount |

This shows how a business keeps sales, returns, and discounts clear and easy to track.

Types of Sales Journal Entries

Not all sales are the same. Knowing the type of sale helps you make the right entry. Different entries help keep the books correct and easy to read.

Regular Credit Sales

This is the most common type. A product or service is sold on credit with no changes after the sale. These entries show how much each customer owes and help track revenue every day.

Sales Returns

If a customer returns goods, you record a reverse entry to reduce the sales total. These entries help show any money refunded and keep the accounts accurate for reports.

Sales Discounts

Some firms give a discount if the customer pays early. The discount is recorded as a separate line. This lets the business track offers, keep totals correct, and see who paid early.

Adjustments

Occasional price changes or small write-offs may also need a special entry to keep the journal accurate. Adjustments help fix errors or reflect changes in sales amounts clearly and quickly.

Common Mistakes in Recording Sales Journal Entries

Even small mistakes can cause big problems. Here are some errors to avoid:

Wrong Account

Using cash instead of accounts receivable for a credit sale is a common error. Always check the type of sale first.

Missing Details

Always include the customer name, invoice number, and date. Missing information makes tracking hard.

Incorrect Amounts

A single wrong digit can throw off the balance. Always double-check.

Late Entries

Delaying records can cause confusion during month-end closing.

Tips for Accurate Sales Journal Entries

To make your Sales Journal Entry correct and easy to follow:

Stay Organized

Keep a separate journal for sales. Update it daily or weekly. A tidy journal helps spot errors fast and keeps records clear for review.

Double-Check Numbers

Ensure the amounts are correct before posting to the main accounts. Check each line carefully to avoid mistakes that could affect totals later.

Use Accounting Software

Software can reduce human errors and save time while recording sales. It also helps generate reports and makes checking entries easier.

Train the Team

Ensure all staff know how to handle a Sales Journal Entry. Training guides them to post correctly, avoid mistakes, and save time during audits.

Best Practices for Small and Mid-Size Firms

Smaller firms may not have a full finance team. These tips help them stay on track:

- Use cloud-based tools for easy access

- Keep copies of invoices and receipts

- Reconcile journals with the general ledger each week

- Create a simple approval process for large sales

These habits help even a small firm keep accurate books.

A proper Sales Journal Entry is essential for smooth accounting. It helps track credit sales, maintain accurate records, and simplify financial reporting. By following the steps, avoiding mistakes, and using clear examples, businesses can record sales confidently and efficiently.

At Confiance, we offer services to keep your sales records clear and correct. We handle setup for new firms, review and clean existing records, and provide ongoing support with updates and staff training. Our team has certified experts to make your sales data easy to track and ready for reports. For smooth and reliable accounting, partner with us for complete financial support.

FAQs

1. What is the main purpose of a sales journal?

A sales journal records all credit sales. It shows how much money customers owe and how much the business earns. It also keeps books clear and helps with reports.

2. How often should I update a sales journal?

It is best to update it daily. This keeps books correct and avoids problems at month-end. Daily updates also help find mistakes early.

3. Can I record cash sales in a sales journal?

No. Cash sales go in a cash journal, not a sales journal. Keeping credit and cash sales separate shows clearly who owes money and what is received.

4. What details must be added in a sales journal entry?

Add the date, customer name, invoice number, accounts receivable, and sales revenue. Extra notes like product sold, terms, or discounts help make the entry clear.

5. Do small businesses need a sales journal?

Yes. Small firms need a sales journal to track credit sales and customer payments. It helps keep books correct and avoids confusion about who owes money.

6. How do discounts affect a sales journal entry?

Discounts are added as extra lines. They reduce the total owed and total revenue. This keeps accounts correct and makes it easy to see how much was paid.

7. Why check a sales journal with main accounts?

Checking makes sure all sales entries match the main accounts. It also helps spot missing entries, mistakes, or duplicate amounts early. This keeps books correct.