What’s New in the 1040 Form 2025? Key Changes You Should Know

The 1040 form 2025 comes with a list of updates. These changes affect how taxpayers report income, claim credits, and file returns. Knowing what’s new can save time and prevent errors. This blog covers every change that matters in the 1040 form 2025, using simple words and clear lines.

What Is the 1040 Form?

The 1040 tax form is the standard document people use to file federal income taxes with the IRS. It shows income, deductions, credits, and the tax owed or refunded. Almost every individual taxpayer uses this form.

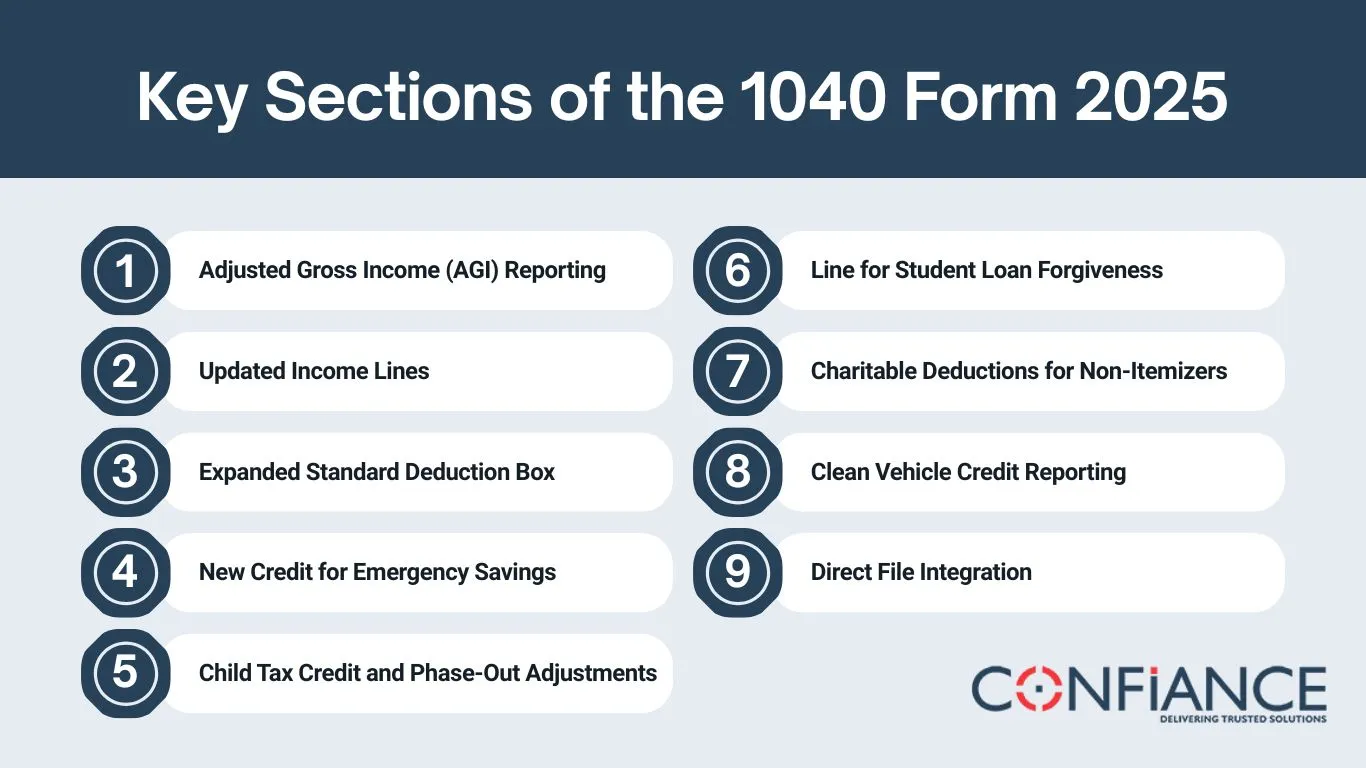

Key Sections of the 1040 Form 2025

The IRS has made some changes to the form's layout and sections. Let’s look at the parts where updates are now in place.

1. Adjusted Gross Income (AGI) Reporting

The line for 1040 tax form agi is now easier to locate. AGI is used to figure out your income after certain adjustments. It decides what deductions or credits you may claim. In 2025, AGI reporting includes added clarity. The line number may have changed again, so check the instructions carefully.

New point: There is now a footnote under the AGI line explaining how new student loan exclusions affect the AGI figure.

2. Updated Income Lines

Wages, salaries, tips, and other income types now appear with clearer labels. Some old income lines have been merged. Here’s what’s changed:

- Gig work income now includes a reminder to file Schedule C

- Cryptocurrency gains or losses now appear on a separate line

- State tax refunds have a small box that links with itemized deductions

3. Expanded Standard Deduction Box

The standard deduction is a set amount that reduces your taxable income. In the 1040 form 2025, the IRS has added a box that explains how the figure applies if you or your spouse are over 65 or blind. This helps avoid errors when filing jointly or as a qualifying widow(er).

For single filers, this amount is now displayed next to your filing status instead of several lines below.

4. New Credit for Emergency Savings

Congress passed a new emergency savings tax credit in late 2024. It shows up in the credits section of the 1040 form. This new credit helps low-income filers who contributed to emergency savings accounts. It’s non-refundable, meaning it only lowers tax owed.

To claim it, you need to attach a statement from your financial provider. The IRS will not process the return if this is missing.

5. Child Tax Credit and Phase-Out Adjustments

The child tax credit now includes a sharper phase-out chart. It helps people know if their income is too high to get the full amount. In past years, many filers claimed it by mistake and faced corrections.

1040 form 2025 includes a tooltip next to the credit line when filing online. It guides users to check income levels before adding the amount.

Also, filers with children under 6 get a bump in the refundable portion of the credit.

6. Line for Student Loan Forgiveness

Some student loan amounts forgiven in 2025 are tax-free. There is now a new line to report this if it applies to you.

This applies to:

- Public service loan forgiveness

- Disability discharge

- Specific COVID-related loans forgiven after January 1, 2025

Make sure to attach Form 1099-C or the IRS may reject the entry.

7. Charitable Deductions for Non-Itemizers

A temporary update lets non-itemizers claim up to $600 in charitable giving. This change was reintroduced for 2025.

The 1040 tax form now includes a separate space under "Other Adjustments" for this deduction. Only donations made by December 31 count. You must keep receipts, even for small gifts.

8. Clean Vehicle Credit Reporting

The IRS updated clean vehicle credit rules. Buyers of electric vehicles must now include:

- Vehicle ID number

- Purchase date

- Manufacturer's certification

These are entered directly on the 1040 form 2025 instead of on a separate worksheet. If any detail is missing, the IRS may deny the credit.

A QR code links to a list of certified vehicles.

9. Direct File Integration

The 1040 form 2025 now supports integration with the IRS Direct File system. This pilot program rolled out for more states. You can now file returns straight with the IRS without software.

Key points:

- Secure login via IRS credentials

- Pulls W-2 data from employers that opt in

- Connects directly to IRS refund trackers

The system fills most fields automatically and prompts users if AGI from the prior year is missing.

Other Notable Additions in the 1040 Form 2025

Besides the headline changes, the IRS added a few small features:

- Error prompts for common mistakes like skipped Social Security numbers

- Filing status helper in the form instructions

- Foreign asset declaration reminder moved to the main page

- Health insurance checkbox added for those under ACA marketplaces

Changes to Schedules Tied to 1040 Form

The main form links to extra documents called schedules. In 2025, some of these have also changed:

Schedule 1: Additional Income and Adjustments

- Expanded to include royalties from digital content

- Clearer layout for HSA contributions

- Added section for 1099-K reporting from third-party apps

Schedule 2: Tax

- Child support enforcement collections removed

- More room for calculating the Net Investment Income Tax

Schedule 3: Nonrefundable Credits

- Includes the emergency savings credit mentioned above

- Line added for long-term care insurance credit in qualifying states

Where to Find AGI on 1040 Form 2025

The 1040 tax form agi is located on Line 11, same as last year. But the form now explains how to calculate it if you have new types of income like:

- Gig work

- Crypto trades

- Refundable state-level credits

This helps match IRS records and speeds up refund checks.

Tips to Avoid Common Errors in 2025

Filing errors slow down processing and can trigger audits. Avoid these mistakes with the 1040 form 2025:

- Use last year’s AGI to sign your return

- Don’t skip the checkbox for ACA health coverage

- Enter child names exactly as on Social Security cards

- Include all supporting schedules if you claim credits

- Double-check bank details for direct deposit

How to File the 1040 Form 2025

There are three main ways to file:

- IRS Direct File System

- Tax software

- Paper return by mail

E-filing is fastest and safest. The IRS gives a filing status bar to track refund progress. For paper filers, always use certified mail with tracking.

You’ll need the following to complete your form:

- W-2s and 1099s

- Social Security numbers

- Prior year AGI

- Bank account info

- Any IRS letters or notices received

IRS Deadlines for 2025

The standard deadline for filing is April 15, 2025. If you need more time, request an automatic extension by that date. But remember, extensions give you more time to file, not to pay.

Use Form 4868 for extensions. The IRS also accepts online payments through its website or linked apps.

Should You Use a Tax Professional?

If you own a small business, have rental income, or moved across states, consider getting help. A tax pro can:

- Confirm AGI is accurate

- Maximize credits

- Avoid IRS letters

But if your return is simple, the 1040 form 2025 now makes self-filing easier than before.

Summary of 1040 Form 2025 Changes

| Section | What Changed |

| AGI Line | Clearer wording, footnotes added |

| Income Reporting | Gig work and crypto split lines |

| Standard Deduction | Inline explanation for age/blind claims |

| New Credit | Emergency savings credit added |

| Child Tax Credit | More income guidance and expanded refund |

| Student Loan Forgiveness | Line added for tax-free forgiveness |

| Charitable Deductions | Non-itemizers can claim $600 |

| Vehicle Credit | More details needed on main form |

| Direct File | Wider rollout, connects to IRS tools |

The 1040 form 2025 reflects shifts in tax policy, digital filing, and how people work today. Changes like the 1040 tax form agi update or emergency savings credit show how tax forms adapt to real needs. If you understand these changes now, filing becomes smoother when the season begins. Check instructions, keep records, and file early to avoid stress. The IRS offers free tools and phone support for most basic questions. Keep this guide handy to avoid surprises.

FAQs

1. What documents should I gather before filling the 1040 form 2025?

You should have your W-2, 1099s, bank interest details, mortgage interest form, and Social Security numbers. Keep proof of deductions or credits claimed.

2. Can I file the 1040 form 2025 without a tax preparer?

Yes. If your return is simple, you can use IRS Direct File or free tax software to complete and send the form on your own.

3. Do I need to report income from part-time work on the 1040 form 2025?

Yes. All income, including part-time or side jobs, must be listed. This includes income paid in cash or through apps.

4. Is it required to enter my bank details on the 1040 form 2025?

No, but if you want your refund by direct deposit, you should add your bank name, routing number, and account number.

5. Can I still use the 1040 form if I am self-employed?

Yes. Self-employed individuals also use the 1040 form. You’ll likely need to attach Schedule C and pay self-employment tax.

6. What happens if I submit the 1040 form 2025 after the deadline?

Late filing can lead to penalties. Interest also builds on unpaid tax. File for an extension if you can’t finish on time.

7. Where can I check my 1040 form 2025 refund status?

Use the “Where’s My Refund?” tool on the IRS site. You’ll need your Social Security number, filing status, and refund amount.

8. Can I fix a mistake after submitting the 1040 form 2025?

Yes. You can file an amended return using Form 1040-X. It lets you correct errors or add missed income or credits.