What is Accounts Payable, along with Accounts Payable Process and Practical Examples

Strong money management is the heart of every smart business. Running a company means tracking cash that comes in and goes out each day. Accounts Payable shows what a business owes for goods or services it has received. Proper management keeps cash safe and avoids fees. In this article, we explain the Accounts Payable process step by step and share simple examples to make it easy to follow.

What is Accounts Payable?

Accounts Payable (AP) is the money a company owes for goods or services bought on credit. In simple words, it is the unpaid bills that the company must pay soon.

Managing AP is important because it helps a business:

- Pay suppliers on time

- Avoid penalties

- Keep accurate financial records

- Plan cash flow and budgets

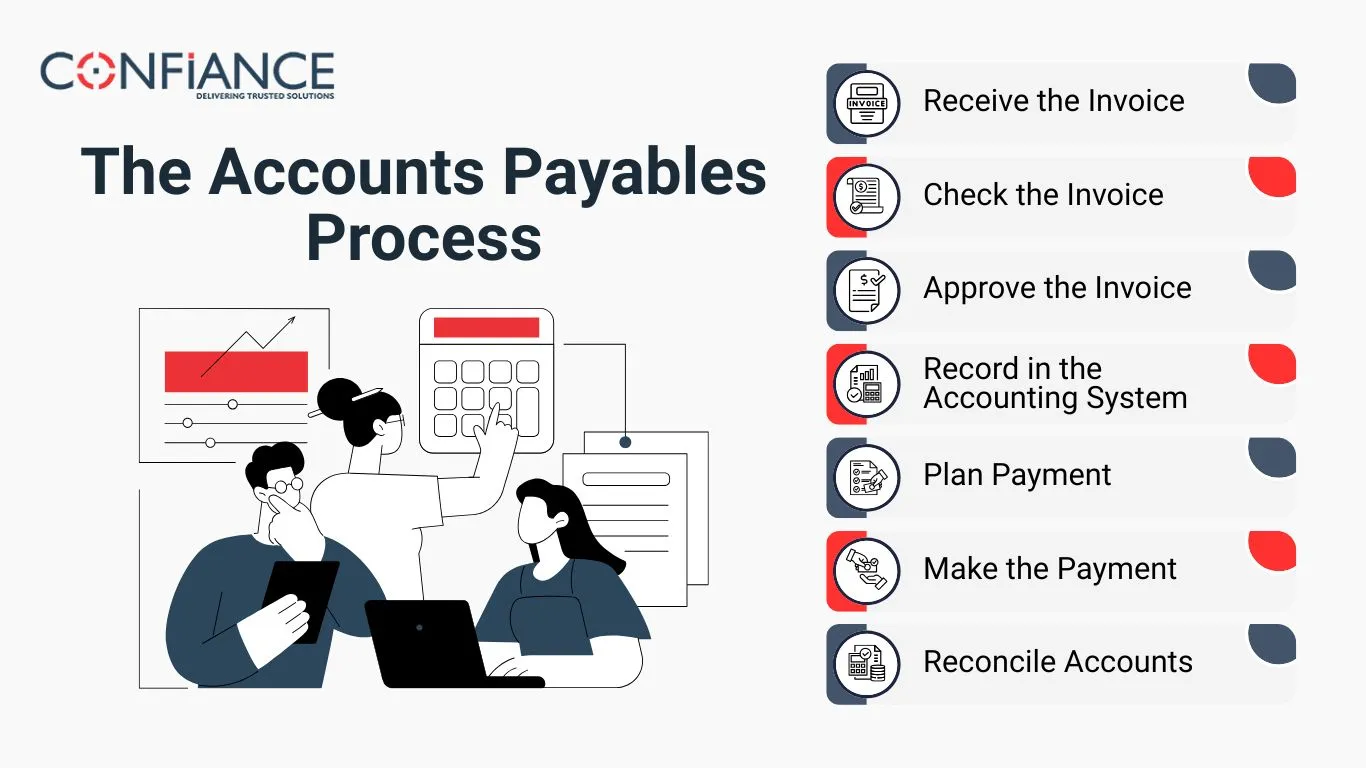

The Accounts Payables Process

The Accounts Payables Process is how a business handles its bills from receipt to payment. A clear process stops mistakes, saves time, and makes sure payments are made on time.

Step 1: Receive the Invoice

The first step is to get a bill from the supplier. Bills may come by email, mail, or online.

Example:

A company buys office supplies for $500. The supplier sends a bill by email. This bill is the first record in the AP system.

Step 2: Check the Invoice

Next, the AP team checks the bill for errors. They look at:

- Supplier name

- Bill date

- Amount due

- Match with the purchase order

- Goods or services received

Example:

The bill says $500, but the order was $480. The team fixes the difference before paying.

Step 3: Approve the Invoice

After checking, the bill goes to the manager for approval.

Example:

The manager approves the $500 office supply bill. After approval, it moves to the next step.

Step 4: Record in the Accounting System

Once approved, the bill is entered into the system under AP. This keeps records right.

Example:

The $500 bill is entered in the AP system. The company now owes $500 to the supplier.

Step 5: Plan Payment

The AP team sets the payment date. They check due dates, cash on hand, and early payment deals.

Example:

The supplier allows 30 days to pay. The team schedules payment on day 28 to pay on time and keep a good relationship.

Step 6: Make the Payment

Payments are made by bank transfer, check, or online. Once paid, the bill is marked as cleared in the system.

Example:

The company pays $500 by bank transfer. The AP system updates the record and marks the bill as paid.

Step 7: Reconcile Accounts

The last step is to check that payments match bank records and supplier bills.

Example:

The AP team checks the bank statement against the records to confirm the $500 payment is correct.

Key Components of AP

Knowing the main parts of AP helps a firm pay bills on time. Each part keeps records clear and makes sure money is tracked and paid correctly.

Invoices

Invoices are bills from vendors for goods or work. They show the amount due, the date to pay, and what was bought. Checking bills keeps accounts right and stops wrong payments.

Purchase Orders

A purchase order is a note to buy goods or work. It lists items, count, and price. Matching bills to orders makes sure the firm pays only for what it got.

Payment Terms

Payment terms are the rules for when and how to pay. They may set due dates, early payment deals, or late fees. Clear terms help the business plan’s cash flow and avoid missed payments.

Approvals

Approvals are checks to make sure invoices are right. Managers or team leads confirm that amounts and items match orders. Good approvals prevent mistakes and keep vendors happy and trustful.

Accounting Records

Accounting records track what the firm owes. They list bills, payments, and totals. Clear records help check accounts, make reports, and track money in and out.

These parts work together to make the accounts payable process clear, fast, and easy for any firm.

AP Metrics and KPIs

Measuring accounts payable helps a firm work fast and avoid mistakes. Key numbers show how bills are handled, help save money, and keep cash flow smooth.

Days Payable Outstanding (DPO)

DPO shows how many days a firm takes to pay bills. Watching DPO helps plan cash, avoid late fees, and keep good ties with vendors.

Invoice Processing Time

This shows the time from getting a bill to paying it. Short time means staff work fast, records stay right, and errors are found and fixed early.

Cost per Invoice

Cost per invoice shows the money spent to handle each bill. Low cost means staff work well, save cash, and keep records correct without extra waste.

Payment Accuracy

Payment accuracy shows the share of bills paid with no mistakes. High accuracy avoids extra fees, keeps vendors happy, and keeps books right and clear.

Discount Capture Rate

The discount capture rate shows how many early pay discounts a firm uses. Using discounts saves money, rewards prompt payment, and helps plan cash smartly.

Tracking these key numbers helps a firm pay bills fast, cut mistakes, save money, and keep records clear for smart choices.

Tips for Streamlining the Accounts Payables Process

Use AP Tools

Use tools to record and approve bills. All invoices stay in one place. Staff work fast, avoid errors, and record correctly. This keeps payments clear and simple.

Set Clear Rules

Set short rules for paying bills. Say who approves them, when to pay, and how to fix errors. Clear rules help staff act fast and avoid wrong payments.

Train Staff

Teach staff to check bills, match orders, write amounts, and pay on time. Staff who know the steps make fewer mistakes, work faster, and keep all records right.

Check Accounts Often

Check accounts and bank records each month. Compare paid and unpaid bills to find mistakes early. This keeps books right and shows what the firm owes at any time.

Use Early Pay Deals

Pay early if vendors offer a discount. This saves money and keeps cash flow smooth. Plan payments well to get the best deals and lower overall costs.

These tips make paying bills simple, save time, reduce mistakes, and help the business manage cash flow well.

Examples of Accounts Payable

Example 1: Office Supplies

A company orders $1,000 of stationery. The invoice is verified, approved, and entered into the AP system. Payment is made after 15 days to manage cash flow.

Example 2: Software Subscription

A company pays $300 monthly for software. The AP team sets up recurring payments to avoid delays and errors.

Example 3: Equipment Purchase

A factory buys machinery for $20,000. The invoice is checked against the purchase order and delivery note. Payment is scheduled in parts to manage cash flow.

Challenges in the AP Process

Even with a clear process, businesses can face problems:

- Paying the same invoice twice

- Missing due dates and paying penalties

- Errors in invoice amounts

- Slow manual approval and data entry

These issues can be avoided by using automation, checking records regularly, and training staff.

Best Practices for AP

- Use software to automate invoices

- Keep supplier records up to date

- Reconcile accounts regularly

- Track cash flow for timely payments

- Take early payment discounts to save money

A strong Accounts Payables Process ensures that bills are paid on time, records remain accurate, and suppliers stay satisfied. By following best practices, using automation, and learning from practical examples, businesses can keep cash flowing, reduce errors, and grow steadily. Managing ap well is not just about paying bills; it helps a business plan better, save money, and build strong supplier relationships.

At Confiance, we offer solutions to make managing accounts payable easy and stress-free. Our team handles invoice entry, payment scheduling, vendor follow-ups, and monthly reconciliations. We use secure tools to process payments on time and give clear reports so you always know your payables status. With us, you get accurate records and smooth cash flow without the daily AP workload.

FAQs

- What is Accounts Payable?

It is the money a firm must pay to vendors for goods or work it has received but not yet paid for. These unpaid bills are short-term debts that need to be cleared soon.

- How is it different from Accounts Receivable?

AP is cash that the firm must give out to vendors or service teams. Accounts Receivable is cash the firm will get from its buyers or clients.

- Why is the Accounts Payables Process important?

It makes sure bills get paid on time and cash stays steady. It also helps the firm avoid late fees and maintain trust with vendors.

- What key papers are used in AP?

The main ones are bills, buy orders, notes of goods, and proof of pay. These papers track what was bought, what was obtained, and what is due.

- How can a company make the process faster?

Use simple AP tools to scan and log bills with less work. Set clear steps and roles so each bill moves fast and with no errors.

- What mistakes happen most often?

Paying the same bill two times is one of the top errors. Firms also miss due dates or type the wrong sums in records.

- Can AP work be outsourced?

Yes. Many firms hire groups to do AP for them. This cuts costs, saves time, and keeps pay work clean and on track.