How to Read Income Statement Accounts for Smarter Financial Decisions

Reading an income statement is key for anyone who wants to make good money plans. This report shows how a business makes cash, spends it, and keeps gains for a set time. By checking it, you can see which parts of the firm bring cash and which cost too much. You can spot trends in sales and spend, plan your budget, and avoid waste. Learning to read an income statement helps you make smart picks, cut costs, and grow your firm. Even a small shop can use it to track results and plan.

What Is an Income Statement?

An income statement (also called a profit and loss report) shows income, costs, and profit for a set time, like a month, quarter, or year. Unlike a balance sheet, which shows what you own and owe, this report shows how well the firm does in daily work.

Why It Matters

- Shows if the business makes or loses money.

- Helps owners plan budgets and cut costs.

- Guides investors on how safe the firm is.

- Helps lenders see if the firm can pay its debts.

- Shows trends in sales and spend over time.

- Let's managers make smart moves to grow the business.

Key Parts of the Income Statement

To read this report, you need to know its main parts. Each line gives a clue to the firm’s money story.

Revenue

This is the first line, also called sales or top line. It shows how much money came in from goods or services.

Cost of Goods Sold (COGS)

These are the direct costs to make or sell a product. It may include raw goods, labor, and tools.

Gross Profit

Gross profit = Revenue – COGS. It shows how much the firm earns before other costs.

Operating Costs

This covers rent, pay, ads, and admin costs. These are needed to run the firm but are not tied to the product itself.

Operating Income

This is what’s left after gross profit minus operating costs. It shows the firm’s core money strength.

Other Income and Costs

This may include gains or losses from things not tied to the main work, like rent income, asset sales, or loan costs.

Net Income

Known as the “bottom line,” it is what’s left after all costs and taxes. Net income shows the true gain or loss in the period.

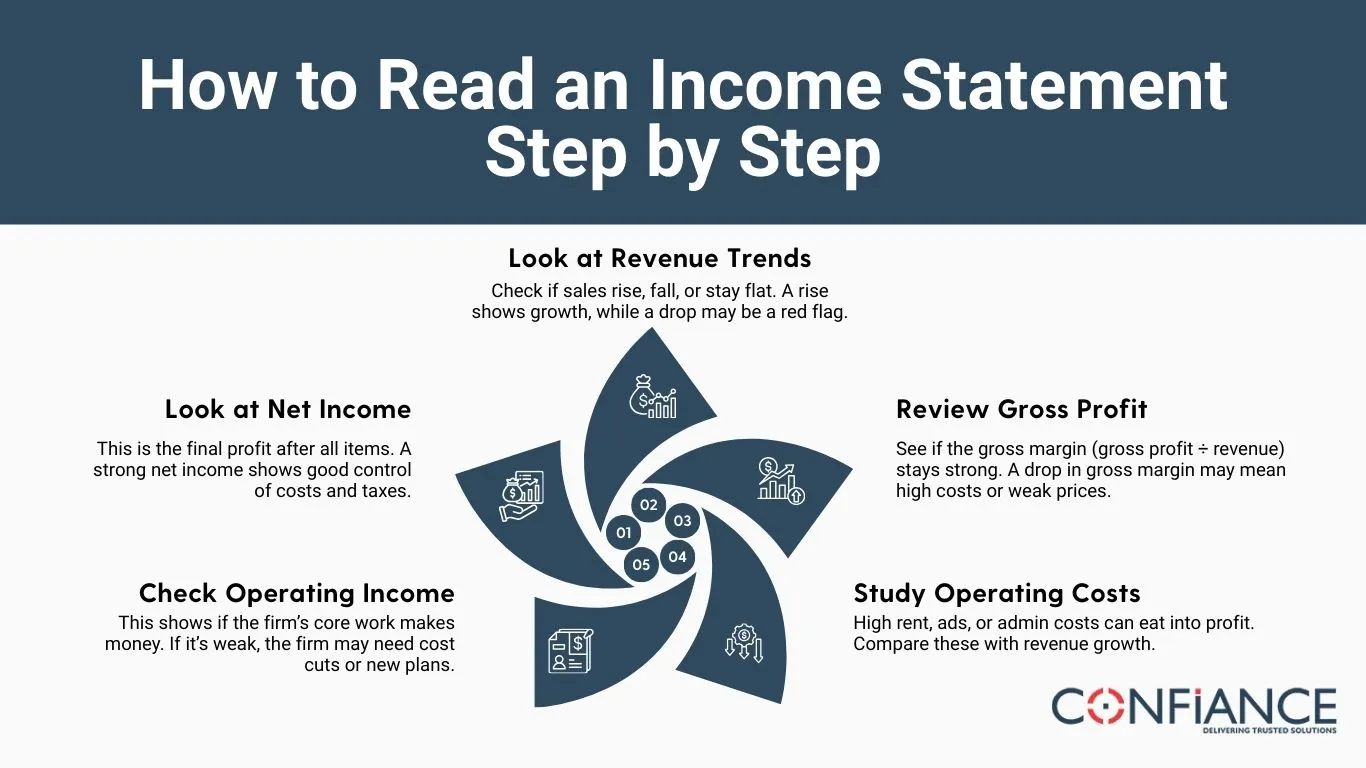

How to Read an Income Statement Step by Step

An income statement shows how much money a business earns and spends. Learning to read it step by step can help you make smarter financial choices.

Step 1: Look at Revenue Trends

Check if sales rise, fall, or stay flat. A rise shows growth, while a drop may be a red flag.

Step 2: Review Gross Profit

See if the gross margin (gross profit ÷ revenue) stays strong. A drop in gross margin may mean high costs or weak prices.

Step 3: Study Operating Costs

High rent, ads, or admin costs can eat into profit. Compare these with revenue growth.

Step 4: Check Operating Income

This shows if the firm’s core work makes money. If it’s weak, the firm may need cost cuts or new plans.

Step 5: Look at Net Income

This is the final profit after all items. A strong net income shows good control of costs and taxes.

Common Ratios in the Income Statement

Ratios help you read the report with ease and give clear signs of health.

Gross Margin

Gross Profit ÷ Revenue × 100

Shows how much profit is left after direct costs.

Operating Margin

Operating Income ÷ Revenue × 100

Shows how much the firm earns from its main work.

Net Profit Margin

Net Income ÷ Revenue × 100

Tells how much of the sales turn into profit.

Tips for Smarter Financial Choices

Track Year-to-Year Change

Don’t just look at one year. Compare income, costs, and profit over time. This helps you spot growth or decline early.

Watch Cost Growth

If costs grow faster than income, it may hurt profit. Keep an eye on both fixed and variable costs.

Compare with Rivals

Look at firms in the same field. This shows if margins are strong or weak and helps set realistic targets.

Use the Report to Plan

By spotting trends, owners can cut costs, boost sales, or find new growth opportunities.

Focus on Cash Flow

Even if profit is high, low cash can hurt a business. Compare income with actual cash to avoid surprises.

Set Profit Goals

Use the income statement to set clear goals for profit margins and track progress each period.

Watch Seasonal Changes

Some months may bring more sales or costs. Check patterns to plan staffing, inventory, and marketing.

Check Expense Ratios

Look at each cost as a share of revenue. High ratios may show where you can save without cutting sales.

Common Mistakes When Reading Earnings Statements

Ignoring Non-Cash Costs

Items like depreciation are not cash out, but they do lower net income. Know the difference to avoid wrong decisions.

Not Checking Notes

Notes in the report may explain odd gains, losses, or one-time events that affect profit.

Looking Only at Net Income

Don’t just check the bottom line. Look at margins, trends, and cost changes for a full view of health.

Overlooking Small Expenses

Minor costs can add up and shrink profit. Check small but regular items like subscriptions, fees, or utilities.

Failing to Compare Periods

Looking at one period alone may mislead. Compare months or years to spot real growth or decline.

Ignoring Revenue Mix

Revenue may come from different products or services. Some may be more profitable than others, so review carefully.

Forgetting Tax Effects

Taxes can change net income significantly. Always note how taxes impact overall profit.

Earning Statement for Small Firms vs. Big Firms

Small Firms

- Often simple with fewer lines.

- Focus more on daily cash and core costs.

Big Firms

- May have complex items like stock options or foreign gains.

- Need more review and more skills to read.

Why Learn to Read an Earnings Report

By learning to read an earnings report, you can:

Check Firm Health

Reading an earnings report shows if a firm makes good cash and keeps costs low. It helps you see if the business is strong or weak and gives a clear view of the money health over time.

Make Smart Picks

By spotting trends in sales and gains, you can pick firms or projects that may grow. This helps you invest well and avoid risky moves that could bring loss.

Plan with Real Facts

Do not guess. Use facts from the earnings report to guide business or personal money plans. It helps with budgets, forecasts, and setting clear goals based on real results.

Spot Risks Fast

An earnings report shows trouble early, such as high costs or weak sales. Seeing risks soon lets you act quickly to guard gains and stop big losses.

Cut Costs

Knowing where cash goes lets you trim waste and grow profit. A steady check of the earnings report helps keep costs down and the firm in good shape.

Set Goals and Track

Use the earnings report to set sales or profit goals. Track results to see if the firm meets those goals and adjust plans to stay on track.

Improve Decision Speed

With a clear view of money from the earnings report, you can act fast when opportunities arise or when problems start. Quick moves can boost profit and lower risk.

The Income Statement is more than just numbers. It tells the story of how a firm makes and spends money. By learning each part of revenue, costs, and profit, you can make smarter choices in business or in personal finance.

At Confiance, we provide clear reports that show income, costs, and profit. This makes it easier to see how a business is doing. We also help track spending, sales, and cash flow. With these reports, you can spot trends, find problems early, and plan for the future. By working with us, businesses can understand important numbers, watch costs in each department, and predict cash flow.

FAQs

- What Is an Income Sheet?

An income sheet shows how a firm makes cash, spends it, and keeps gains for a set time like a month, quarter, or year. - Why Is an Earnings Sheet Key?

It shows if a firm makes or loses cash, tracks costs, sets budgets, and guides smart money moves. - What Are the Main Parts?

The main parts are sales, cost of goods, gross gain, run costs, run gain, other cash, and net gain. - How Can I Use It?

By tracking sales, costs, and gains, you can cut waste, set aims, plan spending, and grow the firm. - Can Small Firms Use It?

Yes. A small shop can track cash, check flow, and plan well with an income sheet. - What Mistakes Should I Avoid?

Do not skip non-cash costs, small spend, tax hits, or sales mix. Always match time spans to spot real trends. - How Often Should I Check It?

Check each month or quarter. Steady checks help spot trends, trim costs, and plan growth. - How Does Reading Accounts Lead to Smarter Money Moves?

By reading each account on the income statement, you learn where cash comes in and where it goes out. This insight helps you plan, cut waste, and make sound money decisions.