How to Set Up Trust Accounting in California: Step-by-Step

Setting up trust accounting in California is very important for anyone who handles client money. Lawyers, real estate agents, and other professionals who hold client funds must keep them safe and organized. Correct trust accounting helps you follow California rules, protects your clients’ money, and keeps your business running smoothly.

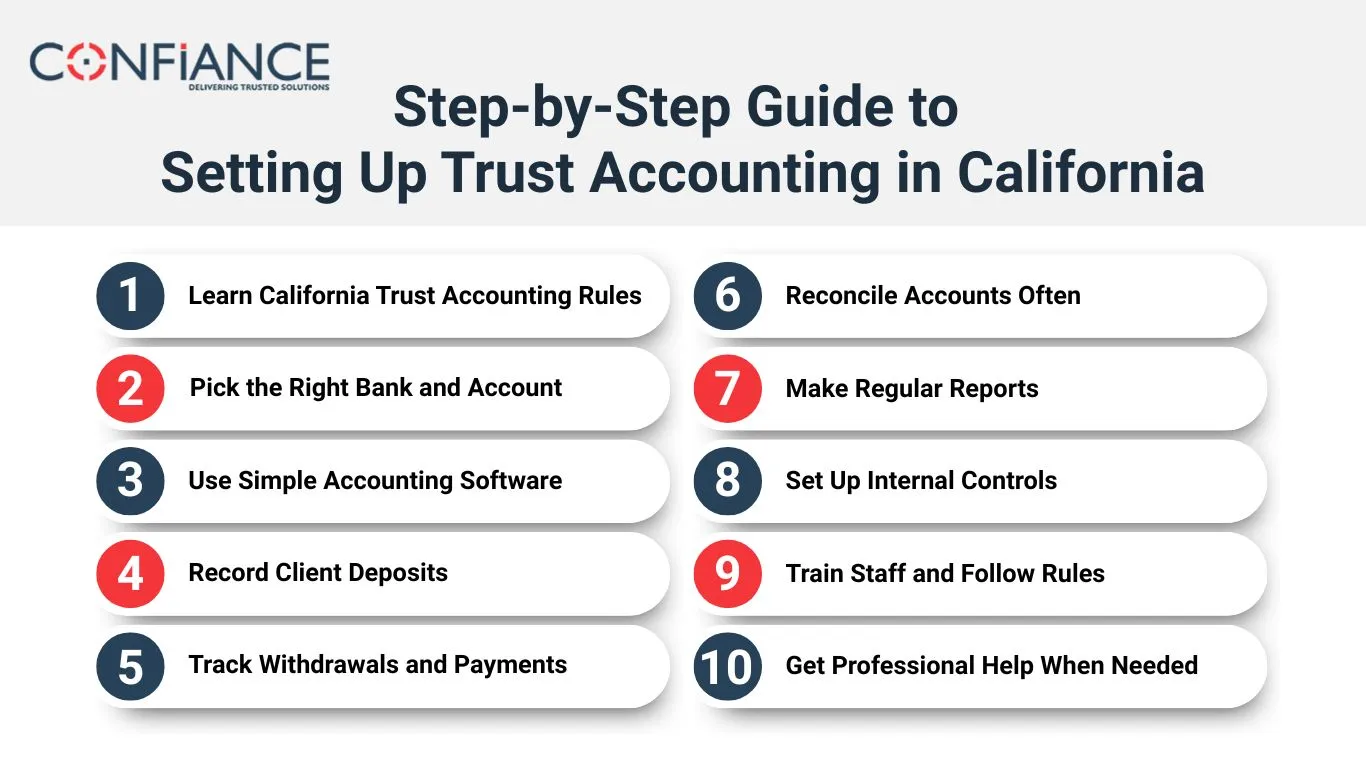

This guide will show you step by step how to set up trust accounting in California. You will learn how to track deposits, withdrawals, and balances. You will also see how to make records clear, check accounts, and stay fully legal. Doing these steps right makes your work easier and builds client trust.

What is Trust Accounting in California?

Trust accounting means keeping a careful track of money for clients in California. This can include deposits, escrow money, retainers, or other funds that belong to someone else.

The main goal is to keep client funds separate from your personal or business money. California law sets clear rules to make sure money is safe and handled correctly. If you fail to follow these rules, you may face legal problems or fines. Good trust accounting is not just the law but also shows clients that you are careful and reliable.

Why Trust Accounting is Important

Follow the Law

Trust accounting helps you stay within California rules. Mishandling money can cause fines, license loss, or other legal trouble.

Build Client Trust

Clients want to know their money is safe. Proper accounting shows transparency and builds confidence in your services.

Clear Finances

Accurate records make it easy to see balances, track deposits, and check payments. This reduces mistakes and makes accounting simple.

Smooth Operations

A good system keeps daily work organized and efficient. You can check funds quickly and prepare reports without stress.

Reduce Risk

Following rules and keeping clear records lowers the risk of mistakes, fraud, or lost funds. It protects both clients and your business.

Step-by-Step Guide to Setting Up Trust Accounting in California

1: Learn California Trust Accounting Rules

Before you start, you must know the rules. California law tells how to manage client money.

Key Rules to Know

- Separate accounts: Keep client money apart from your own.

- Keep records: Write down all deposits, payments, and balances.

- Check often: Make sure your books match the bank account.

Understanding these rules stops problems and keeps clients happy.

2: Pick the Right Bank and Account

Choosing the right bank is the first step to safe trust accounting. You need an account that meets the rules for holding client money.

How to Pick a Trust Account

- Check bank rules: Make sure the bank supports trust accounts.

- Avoid mixing funds: Client money must stay separate from your money.

- Easy access: Online access and statements help track funds.

Interest-bearing or non-interest accounts are common, depending on the type of funds.

3: Use Simple Accounting Software

Good software makes trust accounting easier. Manual tracking can cause mistakes.

What to Look for in Software

- Track money for each client.

- Record every deposit and payment.

- Reconcile accounts automatically.

- Make reports easily.

Popular options like QuickBooks, Clio, or Xero help with trust accounting.

4: Record Client Deposits

After opening the account, record all deposits. This is important for accurate trust accounting:

How to Record Deposits

- Make a ledger for each client.

- Write the deposit date and amount.

- Make sure the bank records match your ledger.

Accurate deposits prevent errors and help with reporting.

5: Track Withdrawals and Payments

Every payment or withdrawal needs careful tracking. This keeps your trust accounting in California accurate.

Steps to Track Withdrawals

- Get written approval for payments.

- Update the client’s ledger right away.

- Give receipts if needed.

This protects client money and keeps records clear.

6: Reconcile Accounts Often

Reconciliation is checking that your records match the bank. It is a key part of trust accounting.

How to Reconcile

- Compare ledgers with bank statements.

- Fix any mistakes quickly.

- Keep a record of reconciliations.

Most professionals do this every month; some check weekly for more safety.

7: Make Regular Reports

Reports give you a clear picture of client funds. They are needed in trust accounting.

Types of Reports

- Client statements: Show deposits, withdrawals, and balances.

- Internal reports: Track overall account health.

- Regulatory reports: Submit as required by law.

Good reports keep your business safe and transparent.

8: Set Up Internal Controls

Controls prevent mistakes and fraud in trust accounting in California.

Simple Controls to Use

- Divide duties: Different people handle deposits, withdrawals, and checks.

- Dual signatures: Two people approve big transactions.

- Track changes: Keep logs of all entries.

- Audits: Check accounts internally or with an expert yearly.

These rules protect client funds and your business.

9: Train Staff and Follow Rules

Staff should understand the trust accounting rules in California. Training reduces errors and keeps compliance strong.

Staff Training Tips

- Give clear manuals.

- Offer short training sessions regularly.

- Check that rules are followed.

- Make honesty and care a top value.

A trained team reduces mistakes and builds client trust.

10: Get Professional Help When Needed

Trust accounting can be tricky in California. Experts can help if needed.

When to Call an Expert

- Handling complex funds.

- Large volumes of client money.

- Legal questions about fiduciary duties.

- Preparing for audits or inspections.

Professional guidance keeps your trust accounting safe and legal.

Benefits of Proper Trust Accounting

Doing trust accounting in California correctly gives many advantages:

- Follow the law and avoid fines.

- Build client trust.

- Easy audits and smooth reporting.

- Clear and simple finances.

Good trust accounting saves time, prevents trouble, and builds confidence in your business.

Common Mistakes to Avoid in Trust Accounting in California

Even careful professionals make mistakes. Here are the top ones to watch for:

1. Mixing Funds

Combining client and personal money is illegal and risky. Always keep accounts separate to protect clients and your business from legal issues.

2. Late Recordkeeping

Delaying deposits, payments, or ledger updates causes errors and may trigger penalties under California law.

3. Skipping Reconciliations

Failing to reconcile accounts often can hide mistakes and lead to overdrafts or unbalanced accounts.

4. Weak Internal Controls

Lack of checks and dual approvals can make fraud or mistakes easier to happen.

5. Poor Staff Training

Staff who do not understand rules may make mistakes in deposits, withdrawals, or reporting.

6. Ignoring Reports

Not creating regular client or regulatory reports can lead to non-compliance and hurt your business reputation.

Technology and Tools to Simplify Trust Accounting

Modern tools make trust accounting easier and faster.

1. Accounting Software

QuickBooks, Xero, or Clio track deposits, payments, and balances automatically.

2. Online Banking

Banks offering online access and statements simplify reconciliations.

3. Automated Alerts

Software notifications help track deposits, withdrawals, and deadlines.

4. Ledger Templates

Digital templates reduce errors and speed up data entry.

5. Reporting Tools

Generate client and regulatory reports automatically to stay compliant.

6. Audit Logs

Track all changes and approvals to improve transparency and prevent fraud.

California Training and Resources for California Law Firms

Several resources help staff understand trust accounting rules in California.

1. State Bar Resources

California State Bar offers guides, tutorials, and webinars for law firms.

2. Online Courses

Many platforms provide courses on trust accounting and fiduciary duties.

3. Workshops

Local law associations hold in-person workshops and seminars.

4. Manuals and Guides

Downloadable PDFs and manuals provide step-by-step instructions.

5. Webinars

Live sessions offer updates on law changes and practical tips.

6. Professional Networks

Networking with other firms helps share best practices and solutions.

At Confinace, we provide trust accounting services tailored for law firms and fiduciaries in California. Our team offers software solutions, guidance on compliance, reconciliation services, and reporting support. We help firms stay fully compliant, reduce errors, and manage client funds safely. With Confinace, you can focus on your clients while they ensure your trust accounting is accurate, up to date, and in line with California law, giving you confidence in every transaction.

FAQs

- What is trust accounting in California?

Trust accounting is the method of managing money held for clients in California. It keeps client funds separate from business funds, tracks deposits and payments, and ensures compliance with California law.

- Who needs to follow trust accounting rules?

Lawyers, real estate agents, fiduciaries, and other professionals handling client funds must follow the trust accounting California rules to stay legal and protect client money.

- Can I mix client funds with my business funds?

No. You cannot mix client money with your own. Client funds must stay in a separate account. This keeps the money safe, stops mistakes, and meets California rules.

- How often should I check trust accounts?

Trust accounts should be checked at least once a month. If you handle many transactions, check them weekly. Regular checks help find mistakes and keep records correct.

- What tools help with trust accounting?

Simple tools make trust accounting easy. Programs like QuickBooks, Xero, or Clio help track money. Online banking, alerts, and reports also help keep accounts correct and follow California law.

- What happens if I make mistakes in trust accounting?

Mistakes can cause fines, client complaints, or legal trouble. Following rules, keeping good records, and using proper software help cut errors and keep client money safe.

- Can I get help with trust accounting in California?

Yes. You can get help from accountants or firms that know trust rules. They can assist with account setup, software use, tracking, and reports. This ensures accounts stay correct and follow California law.