What to Expect When You Hire Offshore CPA for Your Business

Many businesses today want to save money but keep their accounts correct. One way to do this is to hire offshore CPAs. This means working with certified accountants who live in other countries. They help with your accounting and taxes at a lower price than local accountants. If you plan to hire offshore CPAs, it is good to know what to expect. This blog will explain the process, benefits, challenges, and tips for working well with offshore accountants.

Why Do Businesses Choose to Hire Offshore CPA?

The main reason companies hire offshore CPA is to save money. Accounting services can be costly in many places. Offshore CPAs offer the same work for less money. This helps businesses spend less without losing quality.

Besides saving money, offshore CPAs often have strong skills. Many hold certificates like CPA or ACCA. These show they are trained and able to handle accounting and tax work.

Hiring offshore CPA also frees your local team. Offshore CPAs handle daily tasks like bookkeeping, payroll, and tax filing. This lets your staff focus on other work like sales and customer care.

Many small and medium firms find it hard to pay for full-time local accountants. Hiring offshore CPA offers expert help when you need it, often for less money.

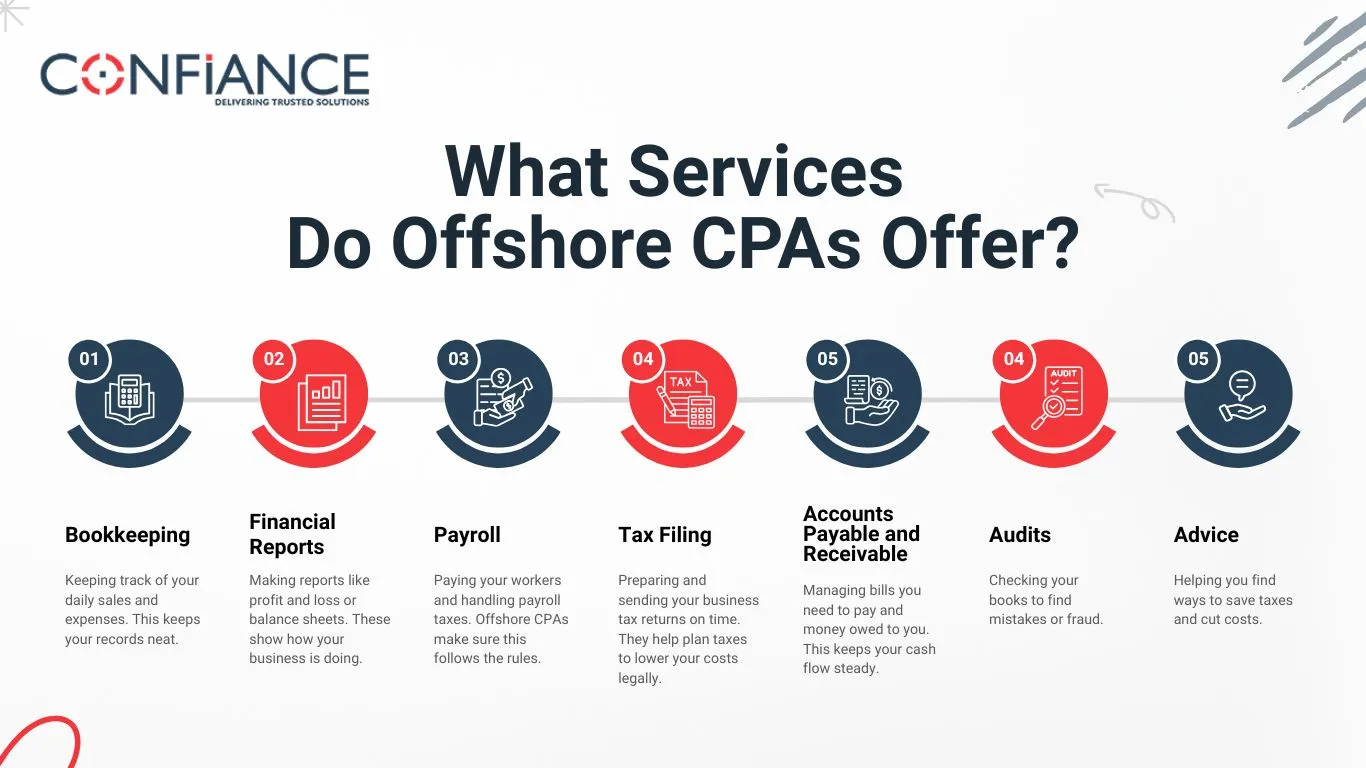

What Services Do Offshore CPAs Offer?

When you hire an offshore CPA, you get many kinds of assistance. Common services include:

- Bookkeeping: Keeping track of your daily sales and expenses. This keeps your records neat.

- Financial Reports: Making reports like profit and loss or balance sheets. These show how your business is doing.

- Payroll: Paying your workers and handling payroll taxes. Offshore CPAs make sure this follows the rules.

- Tax Filing: Preparing and sending your business tax returns on time. They help plan taxes to lower your costs legally.

- Accounts Payable and Receivable: Managing bills you need to pay and money owed to you. This keeps your cash flow steady.

- Audits: Checking your books to find mistakes or fraud.

- Advice: Helping you find ways to save taxes and cut costs.

By hiring offshore CPA, you get these services without paying for full-time local staff.

How Will You Communicate?

A common question is how you will talk with an offshore CPA. They may be in a different time zone or speak another language.

Most offshore CPAs use email, phone, and video calls to stay in touch. They also use online tools to share files and updates. It is good to agree on times for calls or reports.

Clear and regular talk helps keep your work on track. It builds trust and cuts down delays.

How Safe Is Your Data?

Giving your financial data to someone far away may feel risky. But good offshore firms keep data safe.

They use:

- Secure Servers: Strong protection to stop hackers.

- Encryption: Scrambling data so only the right people can see it.

- Access Controls: Only certain people can open your files.

- Backups: Saving copies often to avoid loss.

Before hiring, ask about their security. Make sure they follow laws on data safety. Signing a privacy agreement is smart.

Good data safety stops theft and fraud.

How Is Quality Assured?

You want your accounts to be right and on time. Most offshore CPAs follow common rules for accounting.

Many have certificates to show they know their work. Good firms check their work for errors before sending it to you.

You should also check reports and ask questions. This helps keep your books clean and correct.

What Will It Cost?

Offshore CPAs usually cost less than local ones. But costs depend on the work you want and the firm you choose.

Some charge by the hour. Others offer fixed monthly fees.

When you hire offshore CPA, ask for all costs. Check if there are extra fees for special work.

Knowing costs early helps you plan your budget and avoid surprises.

What Problems Could Happen?

While hiring offshore CPA has many good points, some issues may come up.

- Time Zones: You may wait longer for answers if they work when you sleep.

- Language: Even if they speak English, some words or ideas may be unclear.

- Culture: Work styles may differ.

- Tech: You need good internet and software to share files and talk.

Clear instructions and patience help solve these. Over time, you and your offshore CPA will work well together.

How to Pick the Right Offshore CPA?

Choosing the right CPA is key. Tips include:

- Look for firms with good reviews and experience.

- Check their certificates and licenses.

- Make sure they speak your language well.

- Ask about their data safety.

- Understand prices and contracts.

Compare two or three firms before you decide.

How to Onboard Your Offshore CPA?

A good start helps your CPA work better.

- Share your business goals and info.

- Give access to your software and files.

- Introduce your team if needed.

- Set times for meetings and reports.

- Agree on tasks and deadlines.

Good onboarding avoids confusion and delays.

What Are the Long-Term Benefits?

Hiring offshore CPA has many long-term gains:

- You save money and get expert help.

- Your team can focus on other work.

- You get timely, correct reports to make smart choices.

- Your CPA learns your business and works faster.

- You stay legal with tax rules and avoid fines.

The partnership grows stronger over time.

Common Myths About Offshore CPAs

Here are some myths and truths:

- Myth: Offshore means bad quality.

Truth: Many offshore CPAs are skilled and certified. - Myth: Communication will fail.

Truth: Clear plans and tools keep contact smooth. - Myth: Data is unsafe offshore.

Truth: Good firms protect data well. - Myth: Offshore costs more later.

Truth: Offshore often costs less and keeps quality.

Knowing this helps you choose right.

How Does Technology Help?

Tech makes it easy to work with offshore CPAs.

- Cloud software lets you share data safely.

- Automation speeds up payroll and billing.

- Online tools make meetings and sharing fast.

These cut errors and keep your finances clear.

How to Track Your Offshore CPA’s Work?

Check your CPA’s work often:

- Make sure reports are correct and on time.

- Compare costs now with before.

- Ask your team for feedback.

- Change your process if needed.

Regular checks keep your money matters smooth.

Can You Change Services When Needed?

Flexibility is a big plus.

- You can get more help in busy times like tax season.

- You can cut back when business is slow.

This saves money and fits your needs.

Hiring offshore CPA helps you save money and get expert help. If you hire CPA from Confiance, you can expect clear talk, strong data safety, and accuracy. Also, we will help you overcome any challenges you face with your accounts. Choose your CPA well! Contact Confiance now to stay organized and grow your business.

FAQs

- What are the main services provided by offshore CPAs?

Offshore CPAs handle bookkeeping, payroll, tax filing, financial reports, accounts payable and receivable, audits, and offer tax advice. They cover daily accounting tasks to keep your business organized. - How do offshore CPAs keep my financial data safe?

They use secure servers, encryption, access controls, and regular backups. These steps protect your data from theft or loss and follow legal rules on data safety. - What communication methods work best with offshore CPAs?

Email, phone calls, and video meetings are common. Many also use online tools to share files and updates. Setting clear times for communication helps avoid delays. - How can I ensure the quality of work from an offshore CPA?

Check their certificates and licenses. Review reports regularly and ask questions. Good firms also double-check their work before sending it to you. - What factors should I consider when choosing an offshore CPA?

Look at their experience, client reviews, language skills, data security, pricing, and contract terms. Comparing a few firms helps you pick the best fit. - How do time zones and language differences affect working with offshore CPAs?

Time zones can cause delays in replies. Language differences might cause misunderstandings. Clear instructions and patience help solve these problems. - Can I adjust the level of services from my offshore CPA as my business needs change?

Yes, you can increase help during busy times or reduce it when things slow down. This flexibility helps control costs and fits your current needs.