Self Employment Tax Explained for Freelancers and Small Business Owners

If you work for yourself, you must handle your own taxes. This includes paying self employment tax. Many freelancers and small business owners are surprised by this rule when they first start.

What is self employment tax? It covers your share of Social Security and Medicare taxes. When you work for someone else, your employer pays half of these taxes. But when you’re self-employed, you must pay both parts.

In this blog, you’ll learn how it works, who must pay, how to calculate it, and how to stay prepared.

What Is Self Employment Tax?

Self employment tax is a federal tax. It covers Social Security and Medicare payments. These programs give you future benefits like retirement income and health care when you turn 65.

If you work as an employee, your employer splits this tax with you. Each pays about 7.65 percent. But if you’re self employed, you must pay the full 15.3 percent.

This tax applies even if you do not owe income tax. If your net earnings are 400 dollars or more, you must pay self employment tax.

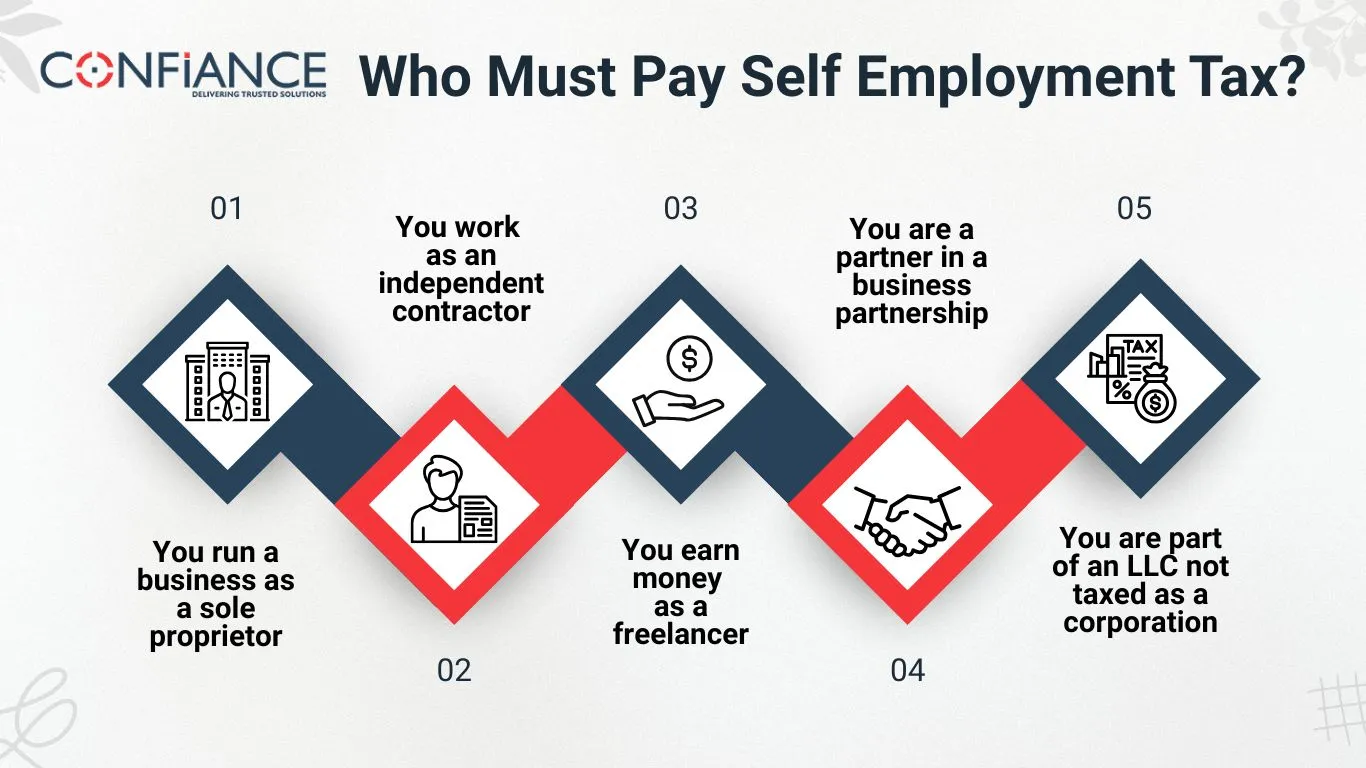

Who Must Pay Self Employment Tax?

You must pay self employment tax if:

- You run a business as a sole proprietor

- You work as an independent contractor

- You earn money as a freelancer

- You are a partner in a business partnership

- You are part of an LLC not taxed as a corporation

You must pay even if it is a side gig. If you sell goods online or do gig work, you are likely self employed.

Farmers and landlords may also have to pay self employment tax if their work includes regular services or labor.

How to Calculate Self Employment Tax

Start by finding your net earnings. Subtract your business expenses from your total income. This gives you your net income or profit.

Use this number to calculate your self-employment tax.

Here’s how it works:

- Only 92.35 percent of your net income is taxed

- Then apply the 15.3 percent rate:

- 12.4 percent for Social Security (on income up to 168,600 dollars in 2024)

- 2.9 percent for Medicare (no income limit)

If you earn over 200,000 dollars as a single filer, you may pay an extra 0.9 percent Medicare tax.

Example:

You earn 60,000 dollars net income from freelancing.

92.35 percent of 60,000 dollars = 55,410 dollars

Self employment tax = 15.3 percent of 55,410 dollars = 8,477.73 dollars

How to Report Self Employment Tax

You report self employment tax using IRS Schedule SE. This form goes with your yearly tax return.

Use Schedule C to report your income and expenses. Then use the net income from Schedule C to complete Schedule SE.

Even if you owe no income tax, you must file these forms if your net income is 400 dollars or more.

How to Pay Self Employment Tax

You must pay taxes throughout the year. This means making estimated payments every quarter.

Deadlines are:

– April 15

– June 15

– September 15

– January 15 (of the next year)

Use Form 1040 ES to estimate your tax. It includes a worksheet to help you figure out your payment.

If you do not pay enough on time, you may face a penalty.

You can pay online through IRS Direct Pay or EFTPS.

How Self Employment Tax Differs from Income Tax

Self employment tax and income tax are different. They are two separate taxes.

Income tax is based on your total income after deductions. You may reduce it with business costs, tax credits, or the standard deduction.

Self employment tax is based on your net business income. The rate is fixed and does not depend on tax brackets.

You must pay both. Filing one does not cancel the other.

Can You Deduct Self Employment Tax?

You can deduct half of your self employment tax when calculating adjusted gross income.

This helps reduce your income tax. But it does not reduce the amount you owe in self employment tax.

This deduction is automatic. You do not need to itemize to claim it.

How to Lower Self Employment Tax

You cannot avoid self employment tax, but you can reduce the amount owed. Here are legal ways to lower it:

Track All Business Costs

Deducting valid expenses lowers your net income, which lowers your tax.

Consider an S Corporation

Forming an S corporation may reduce your tax. You can pay yourself a salary and take extra income as a distribution. Only your salary is taxed for Social Security and Medicare.

Open a Retirement Plan

Use a Solo 401k or SEP IRA. Contributions reduce your taxable income.

Use the Qualified Business Income Deduction

You may be able to deduct up to 20 percent of business income. This helps with income tax, not self employment tax.

Always ask a tax expert before changing how your business is set up.

What Records Should You Keep?

Keep proof of all income and expenses. This includes:

– Invoices and payment receipts

– Credit card and bank statements

– Logs for business mileage

– Equipment and supply costs

– Office rent and home use records

Good records help you file your return and avoid mistakes. They also protect you if you get audited.

You can use software or apps to track business data all year.

What Income Triggers Self Employment Tax?

If your net income is 400 dollars or more, you must pay self employment tax.

This rule applies even if you are under the standard deduction for income tax.

If you work for a church and make at least 108.28 dollars, you may also owe self employment tax.

Even small freelance jobs can push you over this amount. So track all earnings.

Common Self Employment Tax Mistakes

Avoid these errors:

– Skipping quarterly payments

– Not saving for taxes

– Mixing business and personal funds

– Missing the extra Medicare tax

– Underreporting earnings

Why Self Employment Tax Matters

Self employment tax gives you Social Security and Medicare coverage. You must earn enough credits to qualify for benefits.

Each 1,730 dollars of income in 2024 earns one credit. You can earn up to four credits a year.

Missing payments now could mean no retirement or Medicare help later.

Paying self employment tax helps you qualify for future benefits when you stop working.

Self Employment Tax and State Taxes

Self employment tax is federal. But many states also charge income tax.

Some states may also charge business or gross income tax.

Check your state’s rules. Some require extra forms or quarterly payments for small businesses.

Self Employment and Other Taxes

In addition to self employment tax, you may owe:

– Sales tax

– Excise tax

– Local business taxes

These taxes are separate and do not replace self employment tax.

Can Self Employed People Get Tax Credits?

Yes. Self employed workers may qualify for:

– Earned Income Tax Credit

– Child Tax Credit

– Education Credits

These credits help with income tax, but do not reduce self employment tax.

Self Employment Tax and Health Insurance

You may deduct health insurance premiums. This includes:

– Medical

– Dental

– Vision

You can also deduct costs for your spouse and dependents.

This helps lower your adjusted gross income. But it does not reduce your self employment tax.

When to Get Help

Ask for help if:

– Your income changes often

– You earn income in multiple states

– You want to change your business type

– You make over 100,000 dollars

– You get a letter from the IRS

A tax expert or CPA can help you make the right choices and avoid mistakes.

Self employment tax is not optional. It funds Social Security and Medicare. If your net income is 400 dollars or more, you must pay it. Make quarterly payments during the year. Keep clear records. Use Schedule C and Schedule SE to report your income and tax.

What is self employment tax? It is your full share of payroll taxes when you work for yourself. You must pay it even if you have no employer. Handling self employment tax the right way helps you avoid penalties and prepare for the future. Plan well, track everything, and file on time. If you can’t keep up with it, you can outsource it to Confiance anyday.

We help individuals, freelancers, and small businesses with filing their self-employment tax. Forget about any penalties or legal troubles when you outsource it to Confiance. Contact us now and secure yourself with correct tax planning and filing.

FAQs

- What is self employment tax and why is it required?

It is a federal tax that covers Social Security and Medicare. You must pay it if you work for yourself. - Who has to pay self employment tax?

Freelancers, sole proprietors, independent contractors, and partners in a business must pay it. Even side gigs count. - What income amount triggers self employment tax?

If your net income is 400 dollars or more, you must pay. This applies even if you owe no income tax. - How is self employment tax calculated?

Tax applies to 92.35 percent of your net income. You pay 15.3 percent on that amount. - What forms are needed to report self employment tax?

Use Schedule C for income and expenses. Then use Schedule SE to report the tax. - When are estimated tax payments due?

Quarterly deadlines are April 15, June 15, September 15, and January 15 of the next year. - Can you deduct part of your self employment tax?

Yes. You can deduct half when figuring your adjusted gross income. This helps with income tax only. - What records should self employed people keep?

Keep all receipts, bank records, invoices, mileage logs, and home office costs. They help support your return.