What is the QBI Deduction and How it Can Lower Your Tax Bill

If you own a small business or work for yourself, your taxes can take a big part of your income. But there's one rule that could help you keep more. It's called the Qualified Business Income deduction, often shortened to QBI deduction.

This tax rule was made to help owners of small and mid-sized businesses. You do not need to itemize to use it. You may claim it even if you take the standard deduction. For many, it leads to big savings.

What is Qualified Business Income?

Qualified Business Income is the net income your business earns. It is your revenue after subtracting your costs, including rent, supplies, and other usual business expenses.

But not all types of income count. QBI does not include:

- Wages paid to you as an employee

- Capital gains from selling property

- Dividend income from investments

- Interest income not tied to business

- Income earned outside the country

- Payments made to partners that are fixed

The income must come from a real business or trade that operates in the U.S. It should involve regular and active business activity, not just passive investment.

What is the QBI Deduction?

The QBI deduction lets eligible business owners deduct up to 20 percent of their qualified business income from their total taxable income.

This deduction does not lower your business income directly. It does not affect your self-employment tax. It only lowers the part of your income that gets taxed. You still file your return in the usual way, but you add this special deduction.

The goal of the QBI deduction is to help business owners keep more of what they earn.

Who Can Use the QBI Deduction?

You can claim the deduction if your business income passes through to your personal tax return. That includes:

- Sole proprietors

- Partners in a partnership

- Shareholders in an S corporation

- Certain trusts and estates

C corporations do not qualify. Wages from regular employment also do not qualify. If you work for someone else and get a W-2, you cannot use this deduction.

Income Limits That Apply

The QBI deduction is subject to income limits. For the 2025 tax year, the rules say:

- If you file as single, your income must be under $191,950

- If you file jointly with your spouse, it must be under $383,900

If your income is under the limit, you can take the full 20 percent deduction. If your income is over the limit, your deduction may be reduced or phased out.

For those over the limit, more steps are required. You must factor in wages paid by the business or property owned by the business.

What is a Specified Service Trade or Business?

Some types of work have more limits. These are called Specified Service Trades or Businesses, or SSTBs.

SSTBs include fields like:

- Law

- Medicine

- Accounting

- Consulting

- Performing arts

- Athletics

- Financial planning

- Investment advice

If you work in one of these fields and your income is over the limit, your deduction could be reduced. If your income is under the limit, you can still take the full deduction like any other business owner.

How the QBI Deduction Is Calculated

Basic Calculation

- Start with your net business income (QBI)

- Subtract allowed deductions like self-employment tax or health insurance

- Multiply the QBI by 20 percent

- Check if income limits affect your case

- Apply wage and asset limits if your income is too high

Let’s say your QBI is $80,000. You multiply that by 20 percent. That gives you a possible deduction of $16,000.

If your income is below the phase-out limit, you take the full amount. If you’re above it, more limits apply based on what your business pays in wages or owns in property.

Wage and Asset Limits for Higher Income

If your income is above the phase-out level, the deduction depends on:

- 50 percent of wages paid by your business, or

- 25 percent of wages plus 2.5 percent of the cost of qualified business property

You can pick the method that gives you a higher deduction.

Here’s an example. If your business pays $40,000 in wages:

- First option: 50 percent of $40,000 is $20,000

- Second option: 25 percent of $40,000 is $10,000. If you also own $100,000 of equipment, 2.5 percent of that is $2,500. Total is $12,500

In this case, the first option gives a higher deduction, so you use that.

What is Form 8995 and Why It Matters

To claim the deduction, you must complete a special form. It is called Form 8995. This form is where you do the math and show the IRS how you got your final deduction.

Form 8995 is short and works for simple cases. Use it if:

- Your income is under the phase-out limit

- Your business is not complex

- You are not part of a specified service trade or business

If your income is high or your case is more complex, you use Form 8995-A instead.

When to Use Form 8995-A

Form 8995-A is for more advanced tax situations. You must use it if:

- Your income is over the limit

- Your business is an SSTB

- You have multiple sources of QBI

- You need to show detailed wage and asset data

This form has extra sections and takes longer to complete. It asks for deeper detail, including how your QBI was divided across businesses.

How to Fill Out Form 8995

- List all businesses that generate QBI

- Write the QBI earned from each

- Multiply each by 20 percent

- Apply limits if your income is too high

- Add the total deduction

- Transfer the final amount to your main tax form

Make sure all figures are based on good records. Errors on this form can lead to IRS questions or rejected returns.

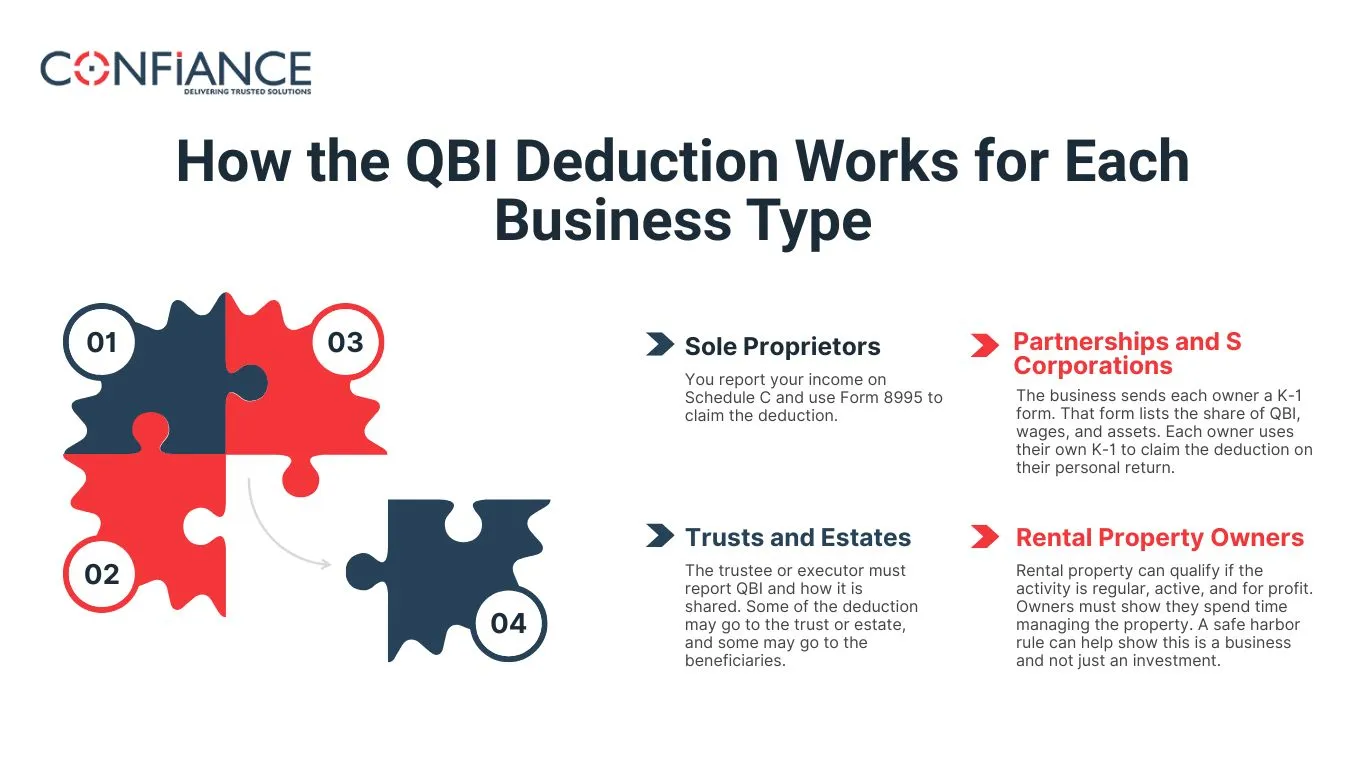

How the QBI Deduction Works for Each Business Type

Sole Proprietors

You report your income on Schedule C and use Form 8995 to claim the deduction.

Partnerships and S Corporations

The business sends each owner a K-1 form. That form lists the share of QBI, wages, and assets. Each owner uses their own K-1 to claim the deduction on their personal return.

Trusts and Estates

The trustee or executor must report QBI and how it is shared. Some of the deduction may go to the trust or estate, and some may go to the beneficiaries.

Rental Property Owners

Rental property can qualify if the activity is regular, active, and for profit. Owners must show they spend time managing the property. A safe harbor rule can help show this is a business and not just an investment.

Keeping Records for the QBI Deduction

You must keep clear and full records. That includes:

- Income statements

- Business expenses

- Payroll records

- Property purchase details

- Retirement plan and health insurance deductions

- K-1s if you are part of a partnership or S corporation

Accurate records support your deduction and reduce the risk of IRS problems.

Errors to Avoid

Some common mistakes people make include:

- Using gross income instead of net QBI

- Forgetting to subtract health or retirement deductions

- Including capital gains, dividends, or foreign income

- Reporting W-2 wages as QBI

- Filing the wrong form

Using a tax advisor or trusted software helps avoid these errors.

The QBI deduction is one of the best tax rules for business owners. If your income qualifies, it allows you to keep more of what you earn. It supports those who work for themselves or run a small company.

Know your limits. Use the correct forms. Keep your books clean. Track the rules as they change each year. Be honest with your filing. The benefits can be large if you follow the steps properly.

Contact Confiance to know if you qualify for it and we will help you claim it. With the use of Form 8995, we check your Qualified Business Income, and make sure you get the most out of QBI deduction. It's one of the easiest ways to cut your taxes without changing your business.

FAQs

Can Employees Use the QBI Deduction?

No. If you are a regular employee, you cannot use this deduction. It does not apply to wages.

Even if you receive a 1099 form, the IRS may still treat you as an employee if you don’t meet the rules of being a real business.

Can You Change Your Setup to Qualify?

Some people try to lower their income or split a business into parts to stay under the limit. Others try to shift business types to avoid SSTB rules.

The IRS looks for these moves. If they find you only changed your setup to avoid limits, they may reject your claim.

Talk to a tax expert before making changes. Honest planning is allowed, but you must follow the law.

Does the QBI Deduction Change Each Year?

Yes. The IRS adjusts the income limits for inflation every year. Make sure you use the latest forms. Check the new limits before filing.

Also check if new tax laws affect the QBI deduction. Congress could change or end this rule at any time.

What Happens After 2025?

The QBI deduction was created under a law that ends after 2025. If Congress does not extend it, this deduction may no longer be allowed after that year.

Watch the news and IRS updates. Future planning should include the chance that this deduction could go away.

Why the QBI Deduction Is Worth Your Time

If you run a business, the QBI deduction is a tool you should not ignore. You don’t need special status. You don’t need to itemize. You don’t need extra paperwork beyond what you already filed.

You just need to know your income, your business type, and the forms to use. Form 8995 makes it simple for most people. Qualified Business Income rules are clear. The answer to What is the QBI Deduction could save you real money.