What Is a 409A Valuation and How Does It Affect Your Startup

Startups often need to offer stock options to attract talent. But issuing those options needs a clear value. That is where a 409A valuation comes in. It helps set the fair market value of your company's common stock. This is important when you offer stock options to employees, advisors, or contractors.

A 409A valuation for startup companies is not just a good practice. It is required by law. It protects your team from tax penalties. It also shows investors that your company values compliance and structure.

What Is a 409A Valuation?

A 409A valuation is an independent appraisal of your company’s common stock. It comes from Section 409A of the Internal Revenue Code. The IRS created this rule to make sure companies do not undervalue stock options.

Before this rule, companies would assign low values to stock options. That allowed employees to buy them at cheap prices and then sell them at a profit. The IRS viewed this as deferred income. To stop it, they created the 409A rule.

So, what is a 409A valuation? It is a formal way to decide the current fair market value of your startup’s common shares. You usually need it when you give stock options. The value you assign must be fair and backed by a professional report.

Why Startups Need a 409A Valuation

If your startup offers stock options, you need a 409A valuation. That’s because stock options must be priced at or above the fair market value. If not, the IRS can impose penalties on your team.

Let’s say you issue stock options at a lower price than the fair market value. Your employees could owe extra taxes and interest. That risk can affect trust and morale. It can also cause legal and tax trouble.

Startups often think they are too small or early to worry about this. That is a mistake. If you plan to raise money, hire staff, or sell equity, you should get a 409A valuation. It shows you follow rules and care about your team.

When to Get a 409A Valuation

You should get a 409A valuation for startup stock if:

- You plan to issue new stock options

- You just raised a funding round

- You made a major change in your business model

- You have had a merger or buyout offer

- It has been 12 months since your last valuation

Each of these events can change your company’s value. The IRS expects you to update the valuation when something big happens. Most startups get a new 409A every year or after each funding round.

Who Performs a 409A Valuation

An independent third party should perform your 409A valuation. This could be a firm that specializes in valuation services. Some companies try to do it in-house, but that is risky. The IRS may reject a report if it seems biased or incomplete.

A qualified firm uses financial models, industry data, and market trends. They may use methods like the income approach, market approach, or cost approach. They review your business plan, financials, capital structure, and past transactions.

The result is a report that sets the fair market value of your common stock. That becomes your strike price for new options. If done properly, it gives your team a safe tax position.

409A Valuation vs. Preferred Stock Price

Your 409A valuation is usually lower than your preferred stock price. That is normal and expected.

Investors who buy preferred shares get special rights. These may include liquidation preferences, dividends, or voting powers. Common stock does not have these rights. So, its value is lower.

If you raise $2 million at $10 per preferred share, your common stock may still be valued at $2 or $3. That reflects the different levels of risk and reward. The IRS allows this difference as long as it is based on a fair valuation.

How Long a 409A Valuation Lasts

A 409A valuation is valid for 12 months or until your company has a material event. A material event is something that changes your value. That could be new funding, new products, major contracts, or leadership changes.

If nothing major changes, your existing report can last a full year. But if you raise a new round, you need a new valuation. Investors and auditors may also ask for an updated report.

What Happens If You Skip a 409A Valuation

Skipping a 409A valuation can lead to tax problems. If you issue options below fair market value, the IRS may treat them as deferred income.

Your team could owe income tax, penalties, and interest. Worse, this risk stays with them even if they leave the company. It creates fear and confusion. That can hurt morale and lead to legal claims.

Without a valid 409A, your financial statements may also be inaccurate. That can slow down funding rounds, M&A talks, or IPO prep. It also weakens trust with investors and employees.

Cost of a 409A Valuation

A 409A valuation for startup firms can cost between $1,000 and $5,000. The price depends on your size, complexity, and growth stage. Early-stage firms with few assets pay less. High-growth startups with several rounds of funding may pay more.

Many valuation firms offer flat-rate services. Others give custom quotes. Some cap table software platforms also bundle 409A services. You should choose a provider that understands startups and has a strong track record.

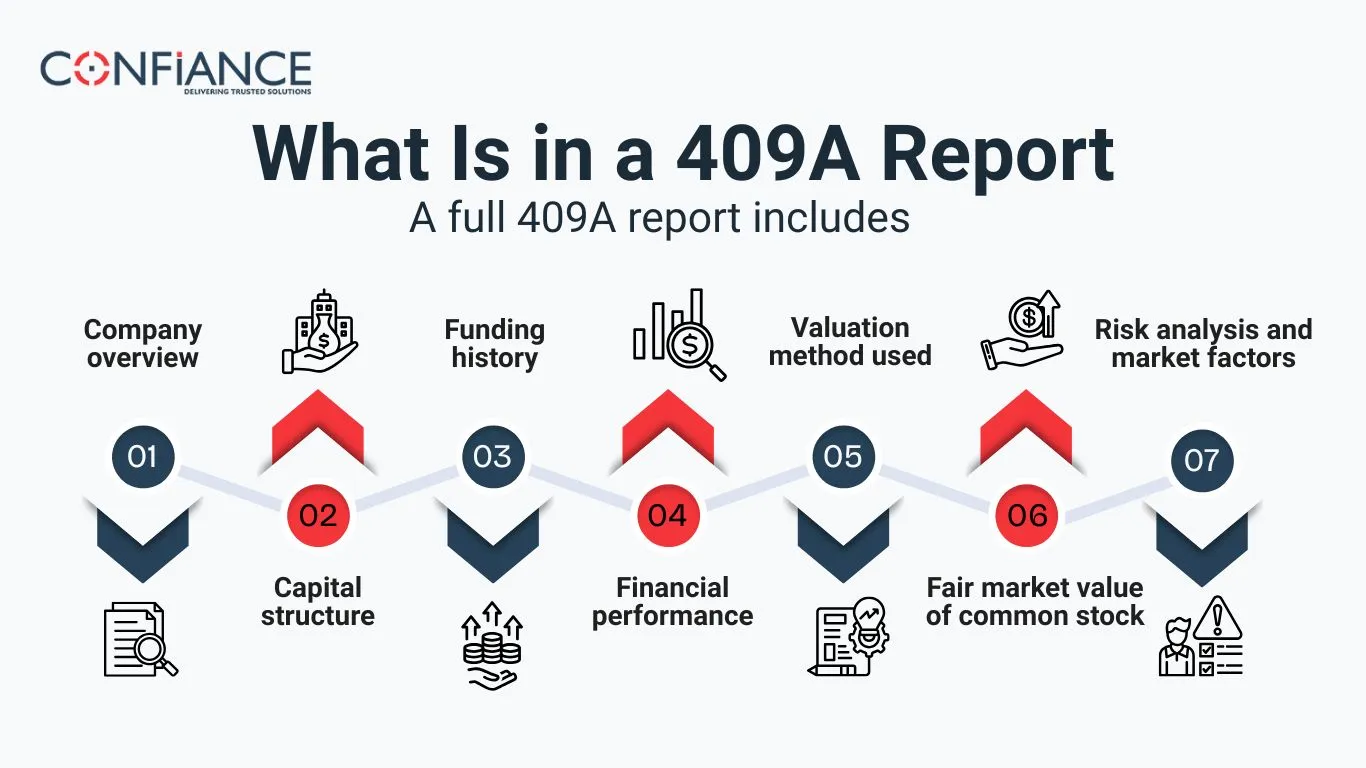

What Is in a 409A Report

A full 409A report includes:

- Company overview

- Capital structure

- Funding history

- Financial performance

- Valuation method used

- Fair market value of common stock

- Risk analysis and market factors

It ends with a conclusion of value and a signature from the analyst. If the IRS audits your company, this report serves as proof.

How Often Should You Update It

You should update your 409A valuation:

- Every 12 months

- After each new funding round

- When you change your business model

- After mergers, acquisitions, or buyout offers

- When a key executive joins or leaves

Timely updates keep your tax position safe. They also help you issue stock options without delay.

How to Prepare for a 409A Valuation

To get ready for a 409A, gather these items:

- Updated cap table

- Financial statements

- Business plan

- Market comps or pitch decks

- Details of recent funding rounds

Share these with the valuation firm. Be clear about your goals and growth plans. That helps them build a solid report.

Common Myths About 409A Valuation

- Myth: Only big companies need it

- Truth: Even seed-stage startups need it if they issue options

- Myth: It is only needed for fundraising

- Truth: It is required for option pricing and tax safety

- Myth: It is a one-time task

- Truth: You must update it often, especially after material events

- Myth: You can do it yourself

- Truth: That’s risky and may not hold up under IRS review

A 409A valuation for startup firms is not optional. It is a legal step that protects your employees, builds trust, and supports growth. It sets the fair market value of your common stock and ensures safe stock option grants.

What is a 409A valuation? It is your proof of fair pricing. It gives your team confidence in their options. It shows investors that your company follows rules and prepares for success.

If you plan to grow, raise funds, or issue equity, get a 409A valuation. Keep it updated. Use it to strengthen your company’s foundation. Confiance can help your emerging startup with its valuation. Get in touch with us to stay updated with your 409A valuation.

FAQs

- What is a 409A valuation used for in a startup?

It sets the fair market value of common stock when a startup offers stock options to employees or advisors. - When does a startup need to get a 409A valuation?

You need it before granting stock options, after funding rounds, or when your business model changes. - Who should carry out a 409A valuation?

A third-party firm with valuation experience should do it. The IRS may reject in-house reports. - How long is a 409A valuation valid?

It stays valid for 12 months unless your company has a major event that changes its value. - Why is common stock priced lower than preferred stock in a 409A valuation?

Common stock lacks the rights of preferred stock, like dividends or liquidation claims, so its value is lower. - What happens if a startup skips the 409A valuation?

You risk IRS penalties, added taxes for employees, and problems during audits or funding. - What does a 409A valuation report include?

It includes your company overview, funding history, capital structure, and a value based on market and financial data. - What does a 409A valuation cost for early startups?

Most startups pay between $1,000 and $5,000 depending on growth stage, structure, and business activity.