Understanding IRS Form 720: What It Is and How to File It

Filing taxes can be tricky. But when you run a business that deals with certain goods or services, there’s one form you cannot ignore. That’s IRS Tax Form 720. It may not be as well-known as other forms, but if you fall in its category, it’s a must. This blog will explain to you what Form 720 is, why it’s important, and how to file Form 720 the right way.

What Is IRS Tax Form 720?

IRS Tax Form 720 is used to report and pay federal excise taxes. These taxes apply to goods or services that fall under special tax rules. You don’t see these taxes often in your daily bills, but they are built into prices in certain industries.

Excise tax is not like income tax. It’s not based on your profit. It applies to the product or service you sell or use. If your business deals with fuel, air travel, or even indoor tanning, you may need to file this form.

The IRS uses Form 720 to keep track of these taxes. It collects information about how much tax you owe and which parts apply to your business.

Who Should File Form 720?

Not every business will need to file this form. But if your business falls into any of the categories that carry excise tax, you are required to use it.

Some common businesses that need to file Form 720:

- Fuel sellers or transport companies

- Airlines or travel services

- Communication providers

- Businesses that offer indoor tanning

- Companies that manufacture or sell heavy trucks or trailers

- Insurance businesses working with foreign policies

Even if you only deal with one taxable item, the form still applies. And it must be submitted on time, every quarter.

What Does Form 720 Cover?

There are different sections on the form. Each part deals with a certain type of tax. Here are some of the main areas:

1. Environmental taxes

If your business deals with products that affect the environment, like chemicals or ozone-depleting substances, this section applies.

2. Communication and air transport

This includes telephone service, satellite use, and tickets for air travel.

3. Fuel taxes

From gasoline to diesel, taxes apply if you sell or use fuel in your business.

4. Manufacturer’s taxes

If you sell tires, trucks, trailers, or heavy vehicles, this section is for you.

5. Retail taxes

This can include items like indoor tanning services.

Each item on the form has a unique tax number. You must know which ones apply to you and fill them in correctly.

When Do You Need to File It?

IRS Tax Form 720 is a quarterly form. That means you need to file it four times a year. Each quarter has a set due date.

Here is how the schedule works:

- 1st quarter (Jan to March) → Due by April 30

- 2nd quarter (April to June) → Due by July 31

- 3rd quarter (July to September) → Due by October 31

- 4th quarter (October to December) → Due by January 31

If you miss a deadline, the IRS may add late fees and interest. Filing on time helps avoid those penalties.

Do You Need to File Every Quarter?

Not always. If you only owe excise tax in one quarter, you can file once and stop. But if the IRS expects regular filing from you, they want to see that form every time.

If you are done with taxable activities, mark the box on the form that says “Final Return.” That tells the IRS you are closing your filing duties for Form 720.

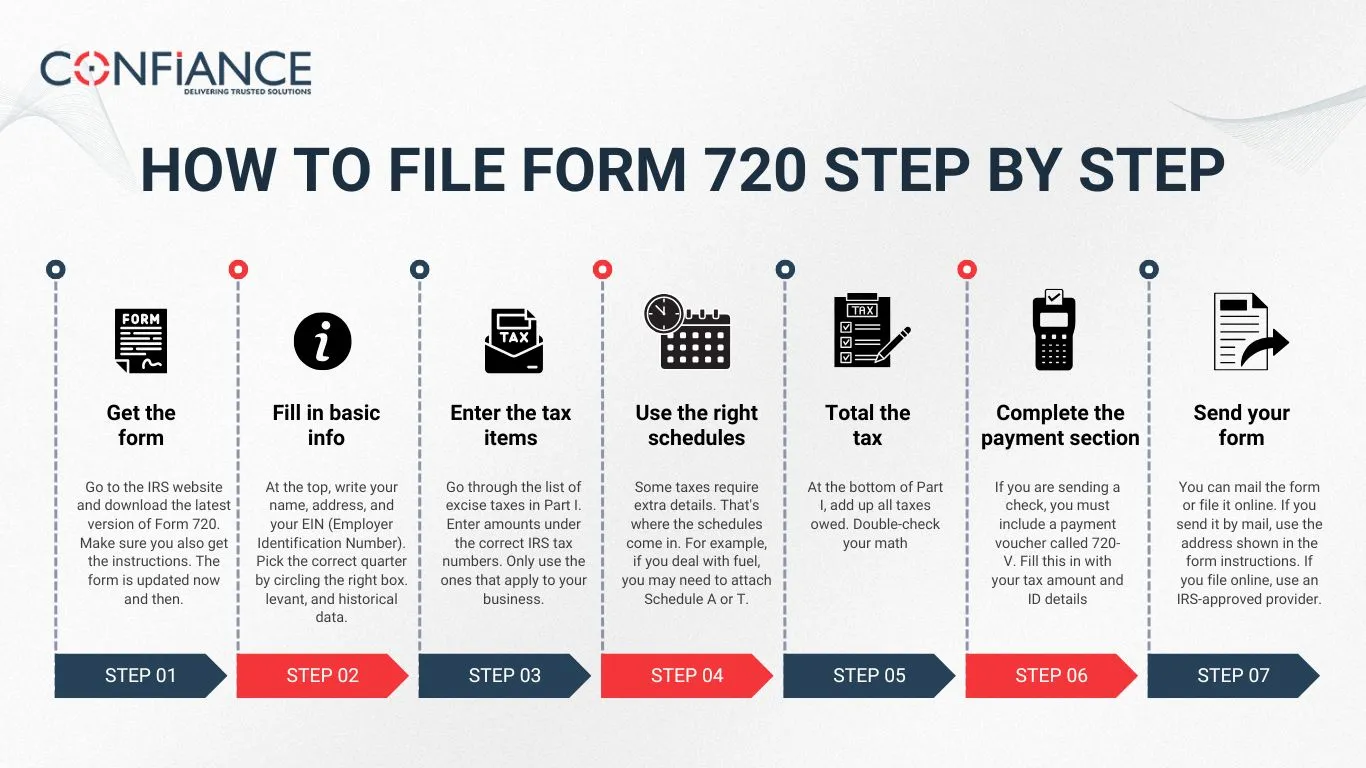

How to File Form 720 Step by Step

Now let’s walk through the process. Here’s a clear step-by-step guide to filing Form 720:

Step 1: Get the form

Go to the IRS website and download the latest version of Form 720. Make sure you also get the instructions. The form is updated now and then.

Step 2: Fill in basic info

At the top, write your name, address, and your EIN (Employer Identification Number). Pick the correct quarter by circling the right box.

Step 3: Enter the tax items

Go through the list of excise taxes in Part I. Enter amounts under the correct IRS tax numbers. Only use the ones that apply to your business.

Step 4: Use the right schedules

Some taxes require extra details. That’s where the schedules come in. For example, if you deal with fuel, you may need to attach Schedule A or T.

Step 5: Total the tax

At the bottom of Part I, add up all taxes owed. Double-check your math.

Step 6: Complete the payment section

If you are sending a check, you must include a payment voucher called 720-V. Fill this in with your tax amount and ID details.

Step 7: Send your form

You can mail the form or file it online. If you send it by mail, use the address shown in the form instructions. If you file online, use an IRS-approved provider.

Should You File Online?

Yes. Electronic filing is easy, fast, and safe. The IRS accepts e-filing for Form 720 through approved software companies.

Online filing helps reduce mistakes. It also gives you a quick proof of submission.

Some business owners prefer paper. That’s fine too, as long as the form is sent on time and filled in correctly.

What Happens If You Don’t File?

If you skip a filing or file late, the IRS can add fees. The penalty is often a percentage of the tax you owe. If you don’t pay at all, interest adds up over time.

You may also receive notices or reminders from the IRS. Repeated failure to file can cause bigger problems.

Filing Form 720 correctly is part of running your business the right way. Even if you owe small amounts, it is better to file and stay current.

Tips for Filing Form 720 Correctly

Here are a few simple tips to avoid errors:

- Double-check all tax numbers and rates

- Review your math before sending

- Don’t miss the due date

- Mark “Final Return” if you no longer owe excise taxes

- Keep a copy of everything for your records

- Make sure your name and EIN match your other tax records

- File even if you owe zero, if the IRS still expects it

What If You Made a Mistake?

If you discover an error after filing, don’t worry. You can file a corrected return. Just use another Form 720 and mark it as an amended return.

Fix the parts that were wrong and send the full form again. If you overpaid, you can request a refund or credit toward future taxes.

How Long Should You Keep Records?

The IRS expects you to keep your records for at least three years. This includes copies of the form, your tax calculations, receipts, and proof of payment.

If you are ever audited or asked for details, these records will help you respond.

Common Mistakes to Avoid

Some errors happen more than others. Watch for these:

- Filing the wrong quarter

- Using outdated tax rates

- Entering the wrong IRS tax number

- Skipping required schedules

- Forgetting the payment voucher

- Not filing at all

Planning ahead helps avoid those mistakes.

Why IRS Tax Form 720 Matters

You might think this form only affects big companies. That’s not true. Many small businesses are affected too.

Filing Form 720 shows that your business is in good standing. It proves you are meeting tax rules. If you plan to grow or apply for loans, being current on tax filings can help.

IRS Tax Form 720 is not as complex as it seems. Once you know what it’s for and how to fill it out, the process becomes routine.

Keep good records. Know which taxes apply to your business. File Form 720 every quarter when you owe excise tax. Choose online filing if it makes things easier.

Missing or ignoring this form can cost you later. But getting it right protects your business and keeps things clean with the IRS.

Still not sure if this form applies to you? Contact Confiance any day and we will help you check your business activity. If anything you sell or use falls under special taxes, we will help you file it.

FAQs

1. Is IRS Tax Form 720 only for large companies?

No. Small firms must file it if they sell items or services with excise tax. Size does not decide the rule. Tax type does.

2. What should I do if I stop offering taxable services?

Mark the final return box on Form 720. File it once more to close your tax duties.

3. Can I skip filing if I owe no tax this time?

If the IRS expects a return, you must still send it. Zero tax does not always mean zero filing.

4. What is the role of IRS tax numbers on the form?

Each tax type has a code. You must list the right one with its amount.

5. Is mailing Form 720 better than efiling it?

No. Both are valid. But efiling is faster and lowers risk of error.

6. Does Form 720 apply to indoor tanning services?

Yes. If you charge for it, you must report the tax using this form.

7. What if I use the wrong tax code on the form?

You must file a new form. Mark it as amended and fix the mistake.

8. Do I need to keep records after I file?

Yes. Keep copies and notes for at least three years. They help in case of audit.