Delaware LLC Formation Fees and Requirements

Starting a business in Delaware is common for owners across the United States. Among structures, forming a Limited Liability Company offers flexibility, liability protection, and a simple process. Delaware provides clear rules and a helpful legal system. This guide explains the full steps, focusing on Delaware LLC formation fees and legal requirements.

Why Choose Delaware for Your LLC

Delaware is known for clear business laws and legal safety. Its Court of Chancery deals only with business issues. This makes legal steps quicker. Many owners choose Delaware for fast action and a reliable system.

Delaware LLCs give privacy, broad ownership rights, and do not require owners to live in the state. You can manage your Delaware LLC from any place. These facts make Delaware a top option for U.S. and foreign owners.

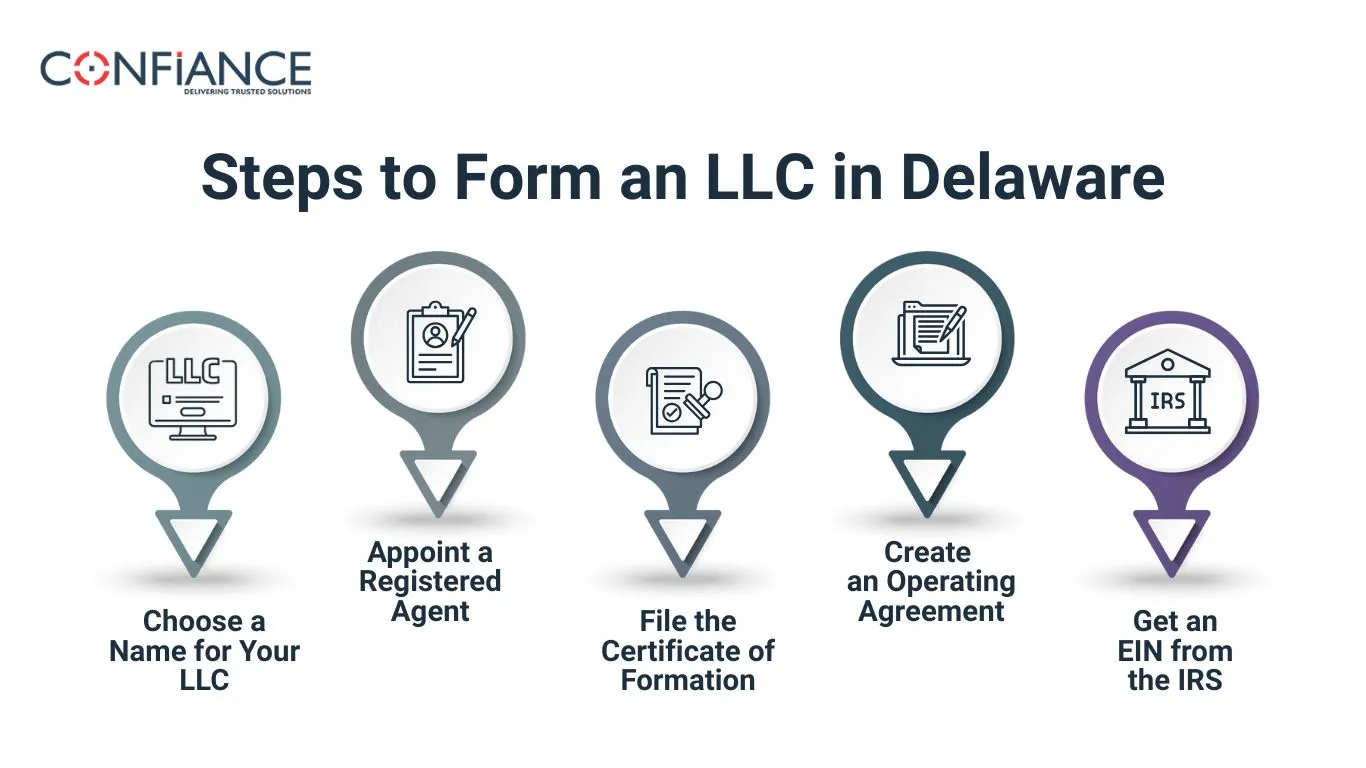

Steps to Form an LLC in Delaware

To form a Delaware LLC, follow a clear process. Each step includes a fee or rule. Following each step avoids delays.

Choose a Name for Your LLC

Pick a name not already in use. It must include “Limited Liability Company” or “LLC.” You can check if the name is available on the Delaware Division of Corporations website.

You may reserve your name for 120 days by paying $75. This is optional but useful if you're not ready to file.

Appoint a Registered Agent

All LLCs must have a Delaware registered agent. This person or service receives legal papers. The agent must be located in Delaware and be present during business hours.

You can act as your own agent if you live in Delaware. Most owners pay a service, which costs $50 to $300 per year.

File the Certificate of Formation

To create the LLC, file the Certificate of Formation with the Delaware Division of Corporations. This form includes the LLC name, the agent's details, and your signature.

Delaware LLC formation fees for this filing are $90. A certified copy costs $50 extra. You can file by mail, online, or in person.

Create an Operating Agreement

Though not required by law, this document is important. It lists owner rights, roles, and management rules. It also protects your personal assets.

An operating agreement keeps the business structure clear. It helps prevent future problems.

Get an EIN from the IRS

An Employer Identification Number is needed if your LLC hires workers or opens a business bank account. Even if it is not required, many banks will ask for it.

You can get an EIN free from the IRS website. The form is short and easy to complete.

Delaware LLC Formation Fees Breakdown

Know the full Delaware LLC formation fees before you start. Some fees are fixed. Others depend on what services you use.

| Item | Fee |

| Certificate of Formation | $90 |

| Name Reservation | $75 |

| Certified Copy | $50 |

| Registered Agent | $50–$300/year |

| Franchise Tax | $300/year |

| EIN | Free |

These Delaware LLC formation fees cover the cost to form and keep your company active. Services may offer package deals.

Franchise Tax Requirement

Each year, Delaware LLCs must pay a $300 franchise tax. This is due by June 1. All LLCs pay the same, no matter their income.

Late payments cause a $200 penalty and 1.5 percent interest each month. You can pay online. No report is needed unless asked.

Business Licenses and Permits

Delaware does not issue a general license at the state level. Still, your local city or county may require one. Check based on your work and address.

Even if you run the business online, local rules may apply. Follow all local laws to avoid problems.

Doing Business in Other States

If your Delaware LLC operates in other states, you must register there as a foreign LLC. Each state has different rules and costs.

Not registering leads to fines and limits your right to sue in that state. Make sure you register wherever you do business.

Foreign LLCs Registering in Delaware

If your company is formed elsewhere but plans to operate in Delaware, you must file as a foreign LLC. The form is the Certificate of Registration of Foreign Limited Liability Company.

This costs $200. You must also list a Delaware agent. The rule is the same for all outside companies.

Optional Services and Extra Costs

Besides Delaware LLC formation fees, you may use extra services:

- Same-day filing: $100

- Next-day filing: $50

- Extra copies: $20 and up

- Certified documents: around $50

- Name change: $200

- Reinstatement: pay all past taxes, penalties, and a filing fee

Choose services based on how fast you need results or what changes you plan.

Comparison with Other States’ LLC Fees

Compared to Delaware, other states may charge more or less. For example, California charges an $800 annual tax. Texas has no franchise tax for most LLCs but does require a public report. New York requires a publication process that costs several hundred dollars.

Delaware LLC formation fees are moderate and predictable. The flat $300 franchise tax is easier to plan for than income-based fees in other states. For privacy and ease, Delaware remains a strong choice.

What Happens If You Don’t Maintain Compliance

If you do not pay your franchise tax or maintain a valid agent, your LLC will fall out of good standing. This can block you from entering contracts or filing lawsuits in Delaware courts.

Reinstating a lapsed LLC requires payment of all back taxes, penalties, and a reinstatement filing. You must act quickly to avoid further costs.

How to Close a Delaware LLC

To close your Delaware LLC, you must file a Certificate of Cancellation. The fee for this filing is $200. You must also pay any due franchise tax before submitting the form.

Once filed, your LLC will be closed in the state system. Be sure to notify banks, clients, and tax authorities.

Who Should Consider a Delaware LLC

Delaware is ideal for startups, online businesses, holding companies, and multi-owner ventures. If you want strong privacy, fair courts, and a simple tax process, a Delaware LLC fits well.

Even small businesses choose Delaware for its easy filings and fixed annual fees. You don’t need to be a large firm to gain from Delaware’s structure.

Why Form a Delaware LLC

You get strong benefits for the Delaware LLC formation fees you pay:

- No rule on where owners live or their citizenship

- No public list of owner names

- No Delaware tax if you don’t operate there

- No capital needed to start

- A court that only hears business matters

- Online services to manage filings fast

These points support smooth business setup and fewer problems.

Non-Resident Owners and Taxes

You do not need to live in the U.S. to own a Delaware LLC. Still, foreign owners must follow U.S. tax laws.

You may need to file tax forms with the IRS even if your company does not pay taxes in Delaware. Ask a tax expert if unsure.

Your LLC must always keep a Delaware agent with a street address.

How Long the Process Takes

Normal processing takes 10 to 15 business days. Faster service costs more but can give same-day or next-day results.

Paying for speed is useful if you need to start soon or apply for licenses or a bank account.

After You Form the LLC

Once your Delaware LLC is active, take these steps:

- Open a bank account in your business name.

- Apply for local licenses if needed.

- Keep clear records from day one.

- Pay the franchise tax each year.

- Update your operating agreement when things change.

These tasks help keep your business legal and ready to grow.

Use a Service or File It Yourself

You do not need a lawyer to form a Delaware LLC. You can do it yourself or use a service.

Many services charge between $100 and $500. They help with forms, act as agents, and provide other support.

Using a service saves time. But if your structure is simple, you can file alone without problems.

Mistakes to Avoid

People make errors that cost time and money. Watch out for these common mistakes:

- Not paying the $300 franchise tax on time

- Picking a name already taken

- Forgetting to appoint a Delaware agent

- Ignoring other states where you do business

- Skipping the operating agreement

Avoid these issues by following each rule closely.

Summary of Delaware LLC Formation Fees

Here’s a final look at Delaware LLC formation fees:

- Filing fee: $90

- Franchise tax: $300

- Agent: $50–$300 yearly

- Name reservation: $75

- Certified copy: $50

- Foreign registration: $200

- Fast service: $50 to $100

- Cancellation filing: $200

Plan ahead and know the total cost to avoid surprises.

Forming a Delaware LLC is clear and easy to follow. The steps are short, and the fees are not high. Knowing the Delaware LLC formation fees helps you plan and stay compliant.

Delaware gives you privacy, fairness, and strong legal tools. Keep records clean. File on time. Follow all required steps. Your LLC will stay safe and active.

FAQs

- Is there a fixed cost to keep a Delaware LLC active each year?

Yes. You must pay $300 every year, no matter how much your LLC earns or spends. - Can I use a family member as my registered agent in Delaware?

Yes. They can act as your agent if they live in Delaware and are available during working hours. - Do I need to list my name on public records when forming a Delaware LLC?

No. Delaware does not require you to share owner names in public state records. - Will my Delaware LLC need a new EIN if I move to another state?

No. The EIN stays the same unless you change the business structure or ownership. - Can I form more than one Delaware LLC at the same time?

Yes. There is no limit. Each LLC needs its own filing and registered agent. - What happens if I forget to renew my agent’s service?

Your LLC may lose good standing. This can lead to late fees or legal limits until you fix it.