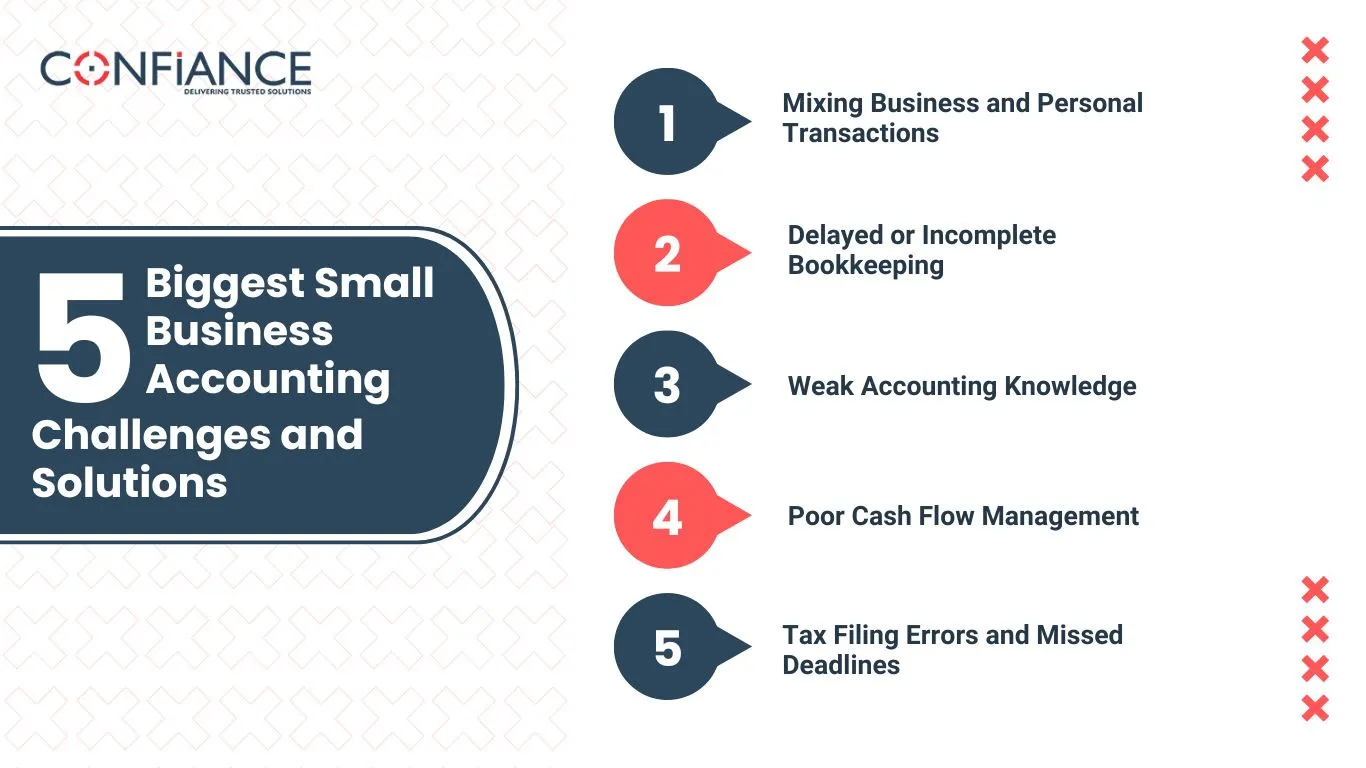

5 Biggest Small Business Accounting Challenges and Solutions

Accounting often becomes a roadblock for small business owners. It starts as a small task and soon turns into a daily stress. With sales to manage and customers to serve, recordkeeping often falls behind. Errors build up. Reports no longer show the full picture. Mistakes cost money. In many cases, poor accounting habits can hurt the health of the business. This blog outlines the five biggest small business accounting challenges and shows how to solve each one clearly. Every fix here is practical, realistic, and easy to apply.

1. Mixing Business and Personal Transactions

The Problem

Many small business owners use one bank account for both business and personal expenses. It may feel easier, especially in the early days. One card, one login, one balance. But this creates confusion over time. When you check your bank statement, it becomes hard to tell which purchase is for business and which one is not. That makes it tough to track costs and understand business performance.

During tax time, this becomes worse. You may miss valid business deductions. You may also report the wrong income. If you get audited, the lack of clear separation can raise flags. It also becomes harder to review cash flow and spending when your books are full of mixed entries.

The Solution

Open a business account before you make your first sale. Keep personal and business money separate at all times. Get a card that is only used for business purchases. Use it to pay for tools, rent, supplies, or any expense linked to work. Avoid using your business account to pay for groceries or travel that is not related to your business.

Use a simple accounting tool to tag transactions. Each payment or deposit should be labeled as either business income or business expense. Set time once a week to go over your transactions and fix any errors. Clean separation from the start prevents confusion later. It also helps during tax season and makes your business records clear and complete.

2. Delayed or Incomplete Bookkeeping

The Problem

Recordkeeping often feels like a chore. Some owners delay it for weeks. Others skip it altogether until the end of the month or quarter. That leads to missed receipts, wrong totals, and gaps in your financial history. You forget why a payment was made or what a deposit was for. The result is a record that looks complete but is full of errors.

This creates bigger problems. You may not notice when bills are unpaid. You may miss late payments from clients. Your profit reports could be wrong. Without clean records, it is hard to make smart choices. You could be spending more than you earn without even knowing.

The Solution

Build a habit that fits your daily work. Record sales and costs on the same day. Use tools that let you scan and save receipts. Most accounting apps let you take a photo and upload it from your phone. Tag each expense right away. Choose simple categories like travel, rent, wages, or supplies.

Set a day each week to check your books. Fifteen minutes is enough. This helps catch small errors early. If your schedule is packed, hire a part-time bookkeeper. Even two hours a month can keep your records clean. Staying consistent is better than rushing to catch up at the last minute.

3. Weak Accounting Knowledge

The Problem

Many small business owners never study accounting. They know how to sell or build or manage people. But they don’t know how to read a balance sheet. They confuse cash with profit. They don’t understand how unpaid invoices affect their business. As a result, they make choices with no insight into their numbers.

This can lead to overspending or missed opportunities. You might hire new staff without knowing if you can afford it. You may not see when a product loses money. You may also delay taxes or make wrong filings simply because you don’t know what the numbers mean.

The Solution

Start with the basics. Learn what terms like asset, liability, expense, and equity mean. Read your income statement and balance sheet every month. Watch how your cash moves through the business. Don’t wait until tax season to check your numbers.

Use software that explains reports in simple words. Choose tools that show totals in graphs or lists you can understand. Join a workshop or take a short course. Look for free resources made for business owners. Learn enough to ask better questions and check your books with confidence. This improves your decisions and helps avoid bigger mistakes.

4. Poor Cash Flow Management

The Problem

Many businesses struggle with cash even when sales look strong. You might have large bills to pay while waiting for clients to send money. If payments are late, you may not have enough cash to cover rent or staff. This leads to delays, fines, or cancelled orders. You end up borrowing or dipping into savings to stay afloat.

This issue becomes worse if you don’t track your cash daily. You may run short without seeing it coming. A business that earns good revenue can still fail because it runs out of cash.

The Solution

Build a cash flow tracker that shows your incoming and outgoing amounts. Use past data to plan what will come in next month and what you must pay. Track when customers usually pay their invoices. Follow up before they are late. Use reminders and clear due dates to keep payments on time.

List all fixed costs such as rent, salaries, and loan payments. List variable costs such as supplies or travel. If cash is tight, delay purchases that can wait. Build a reserve fund for slow months. Review your cash status every week. Use software that shows your balance and expected cash flow. The more often you check it, the fewer surprises you’ll face.

5. Tax Filing Errors and Missed Deadlines

The Problem

Taxes are one of the top small business accounting challenges. Many owners file late or forget forms. Some miss tax payments or underpay by mistake. Others don’t track deductible expenses and pay more tax than needed. Each error leads to penalties, stress, or audits. The tax process becomes something you fear rather than a routine task.

Filing taxes without good records adds risk. Guessing on numbers or leaving out entries causes long-term damage. You may also miss changes in tax rules or rates.

The Solution

Set tax reminders in your calendar. Include due dates for income tax, sales tax, and payroll tax if it applies. Use software that shows taxes owed and helps you prepare reports. Keep a folder where all receipts and tax forms are saved.

Review your totals monthly, not just yearly. That makes tax filing faster. Hire a tax expert if your return includes complex entries. They can help you claim legal deductions and avoid overpaying. Review past tax filings once a year to check for patterns or errors. This builds better habits and keeps your business safe.

How to Prevent Accounting Problems From the Start

The best way to handle small business accounting challenges is to avoid them before they grow. You do this with steady habits and simple systems.

Here’s what helps:

- Use a business account for all income and spending

- Save every receipt in a digital format

- Update your records each week, not once a year

- Learn how to read your reports and what they mean

- Set calendar alerts for every tax date

- Track client payments and follow up early

- Review your cash position at least once a week

- Ask for help when a problem is too complex to solve alone

These steps don’t take much time. But they protect your business from costly errors and confusion. Clear records help you stay calm and make better plans.

Tools That Help Fix Common Accounting Problems

Many tools today are made for small business needs. They are easy to use and save hours each month. Most let you connect your bank account, tag payments, create reports, and file tax forms without expert help.

QuickBooks

Tracks income, expenses, and invoices. Connects to your bank. Prepares reports. Works for most small firms.

Xero

Great for tracking cash flow. Handles payroll and sales tax. Syncs with mobile devices and allows access from anywhere.

FreshBooks

Best for freelancers and service providers. Offers time tracking, payment collection, and simple reporting.

Zoho Books

Affordable and packed with features. Tracks tax, sends bills, and reminds clients of due payments.

Choose one based on your needs. Most offer free trials, so you can test them before you commit.

When to Bring in a Professional

There is a point when you need expert help. Doing everything yourself saves money short term. But it often leads to stress and expensive mistakes later.

Hire an accountant if:

- Your books are not updated

- You missed past tax filings

- You plan to grow and want financial advice

- You want to apply for loans

- You feel unsure about the numbers

- You need help setting up a clean system

A skilled accountant saves more than they cost. They help clean your books, prepare taxes, and plan for next steps. You still make the decisions, but you make them with better data.

Every small business faces challenges with money. But most problems can be solved with simple fixes. Start by cleaning your books. Use separate accounts. Keep daily records. Watch your cash flow closely. File taxes on time. Learn enough to check reports and spot problems early. These habits take time to build but will keep your business safe and steady.

Solving small business accounting challenges is not about being perfect. It is about being consistent. Each smart step builds a stronger business. With clear numbers, you can grow with confidence and avoid surprises. Do you need more help with your small business bookkeeping? Confiance has been helping businesses across the globe deal with financial and accounting challenges. Contact us now to better understand how we can benefit your business with our bookkeeping services.

FAQs

- What are the main small business accounting challenges today?

Most small businesses face problems with cash tracking, late entries, tax filing, and poor spending control. These issues grow fast when not handled early.

- How can a small business keep its accounts clear each month?

Use a separate account for business money. Record payments and deposits the same day. Check totals weekly. Review reports before each month ends.

- What causes cash flow trouble in small businesses?

Late client payments, poor spending plans, and missed expense checks are the usual causes. These problems reduce the cash you need to keep work steady.

- Why is it risky to skip regular bookkeeping in a small business?

When records fall behind, totals become wrong. You lose track of bills, miss payments, and risk filing wrong tax amounts. Small gaps lead to big issues.

- What steps can reduce small business accounting errors?

Save receipts, update records weekly, use basic software, and keep all business spending in one account. These small steps stop errors before they grow.

- How often should small businesses review financial data?

Check your reports each month. Review unpaid bills and cash totals every week. This helps you catch gaps, missed payments, or slow sales early.

- When should a small business get help from an accountant?

If your reports feel unclear, taxes bring stress, or past errors remain unchecked, it is time to ask an expert. Small changes bring lasting results.

- Can software fix most small business accounting challenges?

Software helps track payments, plan spending, and prepare reports. It saves time, lowers mistakes, and keeps your data ready for taxes and growth.