QuickBooks Tutorial for Beginners in 2025

QuickBooks remains one of the most widely used accounting tools for small businesses. It helps users track income, handle expenses, manage payroll, and prepare for taxes. This QuickBooks tutorial for beginners in 2025 walks you through the key steps of getting started with QuickBooks. It includes a clear QuickBooks overview, setup process, essential features, and tips for beginners.

What Is QuickBooks?

QuickBooks is accounting software designed by Intuit. It comes in both online and desktop versions. The online version is popular because it works on any device and updates automatically. It is suited for businesses that need access from anywhere.

The desktop version is also strong and preferred by those who want local control. Both offer features such as invoicing, payments, reporting, and tax tracking.

QuickBooks Overview for New Users

For new users, QuickBooks can seem like a lot at first. The dashboard has many tabs and tools. But once you learn where things are, it becomes easier to use. This QuickBooks overview helps you understand the main sections:

- Dashboard: This is the first screen you see after logging in. It shows sales, expenses, profit and loss, and bank activity.

- Banking: Here you connect your bank and credit card accounts. QuickBooks pulls in your transactions so you can sort them.

- Sales: This tab helps you track invoices, customers, and sales receipts.

- Expenses: You can manage vendors and bills here. It is useful for tracking due dates and payment history.

- Payroll: If you have employees, you can run payroll and file tax forms.

- Reports: QuickBooks creates financial reports such as balance sheets, income statements, and cash flow summaries.

- Taxes: It helps you keep track of sales tax, GST, or VAT, depending on your location.

- Apps: You can add other tools to your account for extra features like inventory or project tracking.

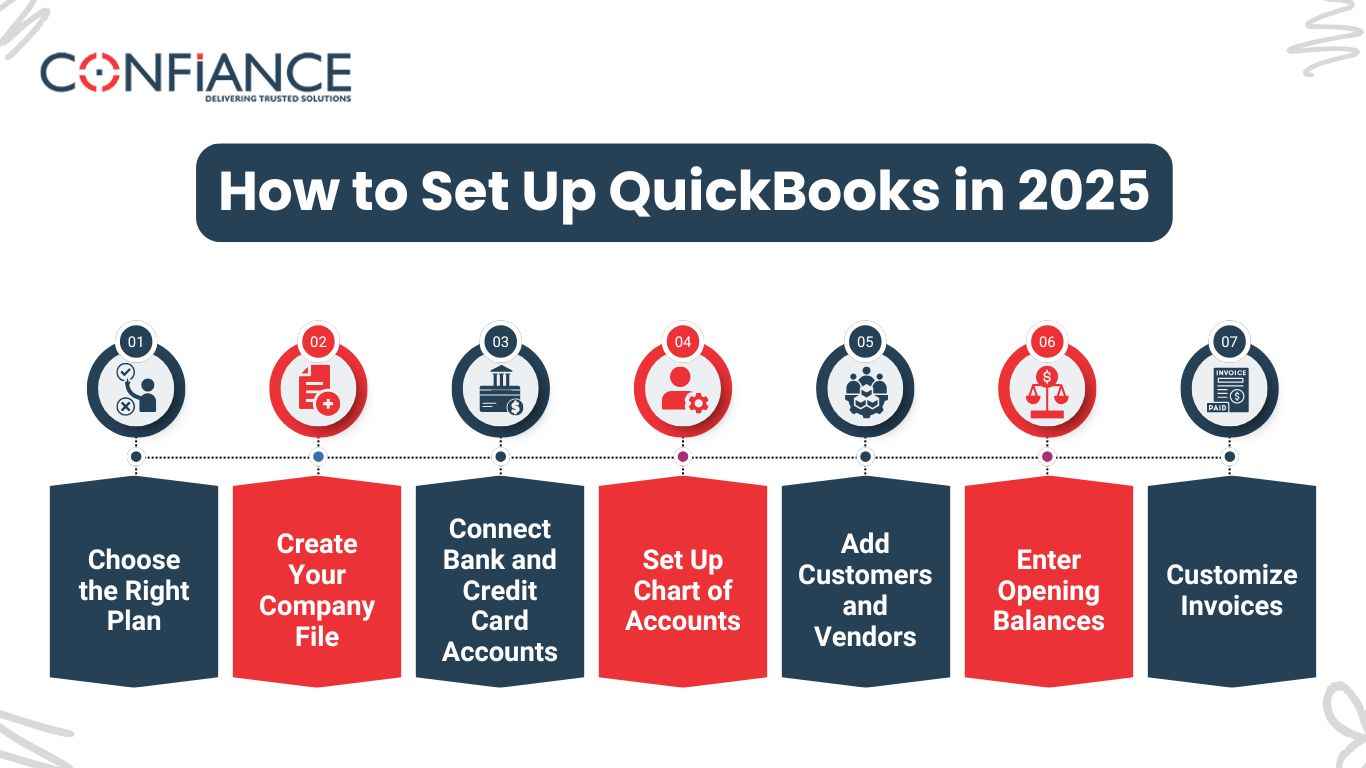

How to Set Up QuickBooks in 2025

Getting started is simple. The setup process takes less than an hour. Follow these steps in this QuickBooks tutorial to start using the software:

Step 1: Choose the Right Plan

Visit the QuickBooks website. Pick a plan based on your needs. Options may include:

- Simple Start: For solo users who want basic income and expense tracking

- Essentials: Includes bills, payments, and time tracking for more than one user

- Plus: Adds inventory and project tracking

- Advanced: Designed for bigger teams with custom reporting

Each plan supports cloud access, mobile apps, and customer support.

Step 2: Create Your Company File

Once you pick a plan, you enter your business info:

- Business name

- Type of company

- Tax details

- Fiscal year

QuickBooks will create a file to hold your company’s records. You can edit this info anytime.

Step 3: Connect Bank and Credit Card Accounts

The software allows you to link bank and card accounts. QuickBooks pulls in transactions so you do not have to enter them one by one. You can sort them by expense type, customer, or vendor.

This feature saves time and reduces errors.

Step 4: Set Up Chart of Accounts

A chart of accounts is a list of all the categories your business uses to track money. These include income, expenses, assets, and liabilities.

QuickBooks gives you a basic list based on your industry. You can add, edit, or delete accounts based on your needs.

Step 5: Add Customers and Vendors

Go to the sales and expenses tabs to add your customers and vendors. For each one, you can store contact info, tax settings, payment terms, and notes.

Once they are saved, it is easy to make invoices and bills.

Step 6: Enter Opening Balances

If you are switching from another system, enter your current balances. These include your:

- Bank balance

- Unpaid invoices

- Unpaid bills

- Assets

Doing this lets you continue tracking from the correct point.

Step 7: Customize Invoices

You can make your own invoice layout. Choose a template, add your logo, pick colors, and adjust the details. You can save this style as default.

Once it is ready, you can email invoices straight from QuickBooks.

Using QuickBooks Day to Day

Now that setup is done, it is time to use QuickBooks to handle daily work. Here is how to perform common tasks.

Create and Send Invoices

From the dashboard, go to the sales tab. Click on “Create Invoice.” Fill in the customer’s name, product or service, rate, and due date. Then save and send it.

QuickBooks tracks if it was viewed and paid.

Record Expenses

In the expense tab, you can log bills or one-time expenses. Pick the vendor, expense type, and payment method.

If you link a bank account, QuickBooks may find these automatically.

Reconcile Bank Accounts

Each month, check that QuickBooks matches your bank statements. Go to “Reconcile” and follow the steps. You compare the statement with what QuickBooks shows.

Fix any differences before moving on.

Run Payroll

If you added payroll, go to the payroll tab. Add employee details and pay rate. Then pick a schedule.

QuickBooks calculates tax, makes pay slips, and files reports.

File Sales Tax

In the taxes tab, QuickBooks tracks your sales tax or GST. It shows what you owe and when to pay.

You can create a return and record the payment in the same place.

Generate Reports

Reports help you see how your business is doing. Click “Reports” to find tools like:

- Profit and loss

- Balance sheet

- Accounts receivable aging

- Expense by vendor

- Sales by product

Each report is customizable. You can choose the date range and export to Excel or PDF.

Helpful Tips for Beginners

This QuickBooks tutorial includes tips to help you avoid common errors:

- Use bank feeds daily: The more often you sort expenses, the less cleanup you need.

- Name items clearly: Use easy labels for products, services, and accounts.

- Set reminders: Schedule time to check bills, invoices, and reports.

- Avoid backlogs: Enter data every week so it stays fresh.

- Keep backups: Even if you use the online version, download reports often.

- Use two users: Have one account for your bookkeeper and one for you.

- Check app store: You may find tools for time tracking, receipts, and more.

QuickBooks Online vs Desktop in 2025

While both are still in use, most beginners choose QuickBooks Online. Here is a quick comparison:

| Feature | QuickBooks Online | QuickBooks Desktop |

| Access | Web and mobile | Installed on one computer |

| Updates | Auto updates | Manual updates |

| Backups | Cloud-based | Needs setup |

| Cost | Monthly | One-time or annual |

| Users | Multiple access | Limited to license |

Pick the one that fits how and where you work. Many small businesses prefer the online version for flexibility.

Common Issues and How to Fix Them

Even with good setup, problems may happen. Here are fixes to common issues:

- Duplicates in bank feed: If you import and connect the same account, delete one version.

- Invoice not saving: Clear browser cache or switch to another browser.

- Mismatch in balances: Recheck reconciliations and past entries.

- Slow loading: Check your internet speed or update your browser.

- Payroll errors: Make sure employee info and tax settings are correct.

If problems stay, use QuickBooks support or community forums.

How QuickBooks Helps in 2025

This QuickBooks overview shows that the software is more helpful than ever. It saves time, cuts errors, and helps make better choices.

Here are some key benefits:

- Real time tracking: You see your cash flow live

- Smart reports: You spot trends faster

- Remote access: You can work from anywhere

- Automation: You do less data entry

- Tax ready: You are prepared when tax season comes

The design in 2025 is also cleaner, faster, and easier to learn.

Who Should Use QuickBooks

QuickBooks is made for business owners, freelancers, and bookkeepers. If you need to track money and send invoices, it works for you.

It is also useful if you:

- Run a service-based company

- Sell products and need inventory

- Pay staff or contractors

- Want help with taxes

- Need reports for a loan or investor

Even if you have no finance background, this QuickBooks tutorial shows it is easy to learn.

Learn More with Tutorials and Videos

This guide covers the basics, but you can learn more from:

- QuickBooks official training site

- YouTube tutorials

- Free online classes

- Help articles inside the app

Use these to explore deeper topics like project tracking, advanced reports, and third party apps.

This QuickBooks tutorial for beginners in 2025 gives you a clear path to start. From setup to daily use, it shows how to make the most of QuickBooks. With its features, you can run your business with less stress and more control.

If you want to explore QuickBooks further, try the demo or reach out to us for help. You will gain more confidence as you keep using it. Whether you are managing a small shop, freelance job, or full company, Confiance can customize it and its tools that fit your needs.

FAQs

1. What is the best way to learn QuickBooks as a beginner in 2025?

The best way to learn QuickBooks in 2025 is by combining hands-on use with beginner-focused video tutorials and guided setup tools within the software. Start with simple tasks like entering sales and tracking expenses.

2. Does QuickBooks offer a free trial for new users in 2025?

Yes, QuickBooks offers a free trial for new users in 2025. The trial typically lasts 30 days and includes access to all core features, allowing you to test the software before subscribing.

3. Can I switch to QuickBooks in the middle of a financial year?

Yes, you can start using QuickBooks mid-year. You will need to enter opening balances and current transactions to continue accurate tracking from your start date.

4. Is QuickBooks suitable for freelancers and one-person businesses?

QuickBooks is ideal for freelancers and small businesses. It includes tools to send invoices, track expenses, and prepare basic reports without needing advanced accounting knowledge.

5. What devices can I use to access QuickBooks in 2025?

In 2025, QuickBooks can be accessed on desktops, laptops, tablets, and smartphones. The web-based version supports most modern browsers, and the mobile app works on both Android and iOS.

6. Do I need accounting experience to use QuickBooks effectively?

You do not need prior accounting experience to use QuickBooks. The software is designed with built-in help, tooltips, and easy navigation to guide beginners through each step.