What is Cash Flow Management? How it Can Benefit Your Business

Every business depends on money moving in and out. This flow of money is what keeps a business alive. Cash flow management is the process of tracking this movement. It helps you see if your business can meet its expenses, invest when needed, and grow without falling short on payments. This blog explains how managing cash flow works and how it helps your business stay strong.

Understanding Cash Flow

Cash flow is the net amount of money going in and out of your business. If more money comes in than goes out, you have positive cash flow. If the opposite happens, you have negative cash flow. Both situations need attention.

Cash coming in usually includes payments from customers, asset sales, loans, or investments. Cash going out covers rent, payroll, bills, inventory, loan payments, and taxes.

This movement can be daily, weekly, or monthly. Good records help you see trends and act early.

What is Cash Flow Management?

Cash flow management is the process of tracking, analyzing, and controlling cash movement. It is not just bookkeeping. It is about keeping enough cash on hand to pay for regular expenses while planning ahead for larger ones.

You manage cash flow by looking at how much cash is available at any time and how much will be needed in the near future. It helps you avoid cash shortages and plan better use of extra funds.

Why Cash Flow Management Matters

Many businesses close because they run out of cash, not because they lack profit. Profit is what you earn after all expenses. Cash is what you need to pay bills now.

Here’s how managing cash flow helps you stay ahead:

- Keeps you from missing payments

- Helps you make better spending choices

- Shows when to cut costs or hold off on purchases

- Prepares you for slow periods

- Supports long-term planning

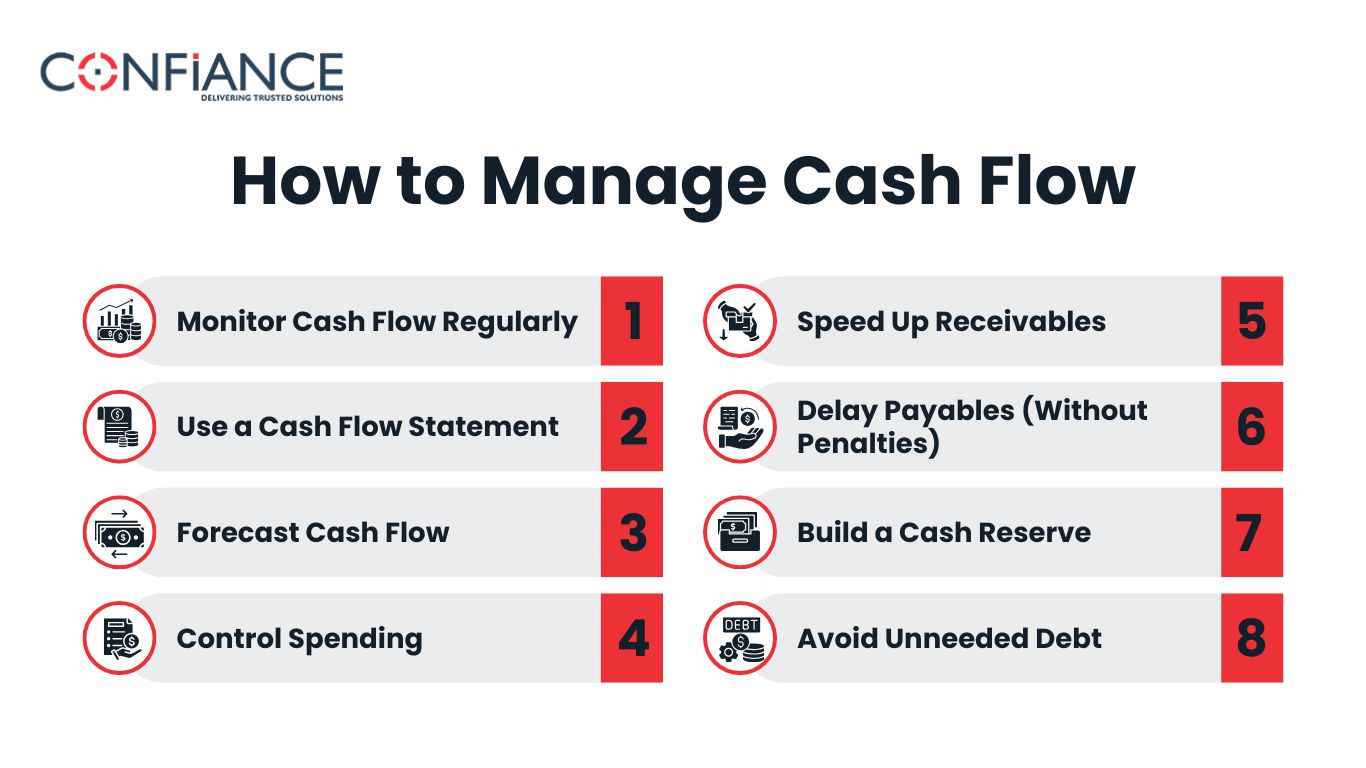

How to Manage Cash Flow

Cash flow management is not a one-time task. It needs regular attention. Follow these steps to keep your cash flow healthy.

1. Monitor Cash Flow Regularly

Check your cash flow often. Weekly tracking works best for most businesses. Use simple reports to list incoming and outgoing cash. This helps you catch changes early.

2. Use a Cash Flow Statement

A cash flow statement shows where money is coming from and where it is going. It has three parts:

- Operating activities

- Investing activities

- Financing activities

Each part shows how cash is being used. It tells you if the business is self-sustaining or needs outside help.

3. Forecast Cash Flow

A forecast helps you predict future cash levels. Look at past income and spending. Add in expected changes. This helps you plan for busy and slow periods.

- Forecasting helps you:

- Prepare for shortfalls

- Delay non-urgent purchases

- Time your payments better

- See if you can invest or need funding

4. Control Spending

Keep fixed costs low. Review regular expenses like rent, utilities, and software. Ask if you can get better rates or cut items you don’t use. Spend only when it adds value.

5. Speed Up Receivables

Encourage customers to pay sooner. You can:

- Send invoices right away

- Offer small discounts for early payment

- Use payment reminders

- Accept online payments

Faster payments improve your cash position without needing loans.

6. Delay Payables (Without Penalties)

Stretch payment dates when possible. Talk with vendors and ask for longer terms. This helps keep more cash in your business without hurting relationships.

But do not delay bills with late fees. These cost more in the long run.

7. Build a Cash Reserve

Set aside extra cash when times are good. A reserve acts like a cushion for slow months, unexpected repairs, or late payments. It gives peace of mind and time to adjust.

8. Avoid Unneeded Debt

Borrow only what you need. Loans add interest costs. Check if future income can cover loan payments before you borrow. Use debt when it supports growth, not to fix ongoing shortfalls.

Tools That Help with Managing Cash Flow

You do not have to manage cash flow by hand. Several tools and software make it easier.

- Accounting software: Helps you track income and expenses

- Cash flow calculators: Offer simple projections

- Spreadsheets: Good for custom plans

- Bank feeds: Show live cash balance and transactions

Choose tools that fit your business size and needs. The goal is to stay organized and updated.

Common Cash Flow Problems and Fixes

Even well-run businesses face issues. Here are common problems and how to fix them:

Late Payments from Clients

Late payments are a big cause of cash flow problems. Send invoices quickly, follow up, and enforce payment terms. Offer incentives for early payment.

Overspending

Spending without planning drains cash fast. Use a monthly budget. Review it before making big purchases.

Poor Inventory Control

Too much inventory ties up cash. Too little hurts sales. Use data to track sales patterns. Restock only what sells.

No Forecasting

Without forecasting, shortfalls come as a shock. Make it a habit to plan at least three months ahead.

How Cash Flow Management Benefits Your Business

Managing cash flow brings many direct and long-term benefits:

1. Better Decision Making

Knowing your cash position helps you make clear choices. You can decide when to buy, hire, or expand based on real numbers.

2. Avoids Panic

When cash is tight, panic leads to bad calls. A plan keeps you calm and ready with options.

3. Builds Business Strength

A business with stable cash is more flexible. It can handle market changes, slow sales, or new costs without rushing for loans.

4. Supports Growth

Positive cash flow lets you invest in marketing, equipment, or staff. Growth needs money. Cash flow gives you the power to grow without stress.

5. Improves Credit Access

Banks and investors check your cash flow. Strong cash management shows you run your business with care. It makes it easier to get funding when needed.

6. Keeps Staff and Vendors Happy

Paying on time builds trust. Employees stay loyal. Vendors offer better deals. It strengthens your network.

Signs You Need Better Cash Flow Management

If you face any of these often, it is time to review your cash flow practices:

- Constant overdrafts

- Delayed payroll or bills

- Scrambling to cover monthly costs

- Turning down good deals due to low funds

- No clear view of future cash

Small fixes can make a big difference. Do not wait for a crisis to improve your cash flow habits.

Best Practices for Long-Term Cash Flow Health

- Stay alert. Review reports weekly.

- Involve your team. Share key numbers with managers.

- Stick to payment terms. Be firm with clients.

- Automate what you can. Use reminders and online payments.

- Keep learning. Read, attend webinars, or talk to experts.

- Match income and expense timing. Avoid gaps.

- Track customer habits. Late payers can cause long-term problems.

- Reinvest wisely. Use extra funds to make the business stronger.

Cash flow management is not a task you can ignore. It is part of running a business every day. When done well, it gives you control, confidence, and freedom to grow. You do not need advanced skills to manage cash flow. You need consistency, planning, and the right tools.

No matter the size of your business, managing cash flow helps you stay on track and avoid surprises. Start small, stay steady, and your business will thank you for it. Do you want cash flow management handled by experts? Contact Confiance now and transform your business with our cash flow management services.

FAQs

1. What is the main goal of cash flow management?

The main goal is to ensure the business has enough cash to meet its short-term needs and to plan for future expenses without running into shortages.

2. How often should I check my cash flow?

Check your cash flow at least weekly. It helps catch problems early and keeps you prepared.

3. Can a business be profitable but still have cash flow issues?

Yes. Profit is on paper, while cash flow is real money. A profitable business can still run out of cash if payments are delayed or costs are too high.

4. What tools can help manage cash flow?

You can use accounting software, spreadsheets, or dedicated cash flow tools. Choose based on your business size and budget.

5. How does cash flow forecasting help a business?

Forecasting helps plan for future cash needs. It shows when you may run short or when you can spend more freely.

6. What should I do if my cash flow is always negative?

First, cut extra costs. Speed up collections. Delay unneeded spending. If the problem continues, review pricing, customer terms, and seek expert advice.