eCommerce Bookkeeping Guide for Online Store Owners

Running an online store comes with many moving parts. You need to handle orders, keep customers happy, and make sure your numbers add up. That’s where eCommerce bookkeeping comes in. It helps store owners stay in control of their finances, track profits, and avoid trouble during tax season.

This blog explains what bookkeeping for eCommerce businesses involves, why it matters, and how you can manage it without feeling lost in the process.

What Is eCommerce Bookkeeping?

eCommerce bookkeeping means recording, organizing, and tracking every financial activity in your online business. This includes:

- Sales from your website or platforms like Amazon and Shopify

- Payment processor fees

- Returns and refunds

- Supplier bills and shipping costs

- Marketing expenses

- Taxes and more

It’s not just about listing numbers. Bookkeeping gives you a full view of your business health. It helps you know what you earn, what you spend, and what you owe.

Why Bookkeeping for eCommerce Businesses Matters

Many store owners focus on sales and skip proper recordkeeping. But without bookkeeping, you run into blind spots. Here’s why it matters:

- Keep your finances organized: You see where the money comes from and where it goes.

- Supports tax filing: You’ll avoid last-minute stress and reduce your chances of errors or fines.

- Tracks growth clearly: You can compare results month over month and spot patterns.

- Helps with inventory decisions: Knowing what sells and what doesn’t saves time and money.

- Builds trust with investors or lenders: Clean books make your business look reliable.

If you ignore bookkeeping, you may end up making decisions without facts. That leads to poor planning, missed opportunities, and money problems.

Key Components of eCommerce Bookkeeping

Here are the main parts of eCommerce bookkeeping and what each one involves:

1. Sales Tracking

You must track every sale, including:

- Total amount paid

- Platform fees

- Discounts applied

- Taxes collected

Use tools that sync your sales channels to your bookkeeping system. That saves time and avoids errors.

2. Expense Recording

List every cost tied to your business. Common expenses include:

- Inventory purchases

- Shipping charges

- Software subscriptions

- Payment processor fees

- Advertising costs

- Web hosting and tools

Recording these helps track profits and prepare for tax deductions.

3. Accounts Reconciliation

This means checking your bank and payment processor records to confirm they match your books. Do this monthly to catch mistakes early.

4. Inventory Management

Your inventory ties into both sales and expenses. You need to record:

- Items bought

- Items sold

- Items returned

- Unsold stock

This helps avoid stockouts or excess inventory, both of which hurt profits.

5. Sales Tax Tracking

You may need to collect and file sales tax depending on where you sell. Laws vary by state and country. Track how much tax you collect and where it needs to be paid.

6. Profit and Loss Reporting

This report shows income versus expenses for a set period. It’s key to understanding whether your store makes money or not. Many bookkeeping tools generate this automatically.

Common Challenges in eCommerce Bookkeeping

Bookkeeping for eCommerce businesses has unique challenges. Here’s what to watch for:

Multichannel Sales

If you sell on Amazon, Etsy, Shopify, and your own site, data can spread across platforms. Make sure you gather all your sales into one system.

Currency Conversions

If you sell internationally, keep track of exchange rates and how they affect your profits.

High Volume Transactions

Many small orders mean many records. Automation helps cut down manual work and reduce errors.

Returns and Refunds

Returns affect both revenue and inventory. You need to track them properly to avoid distorted numbers.

Payment Processor Fees

Each processor charges fees, and they vary. These must be recorded so you know the real income from each sale.

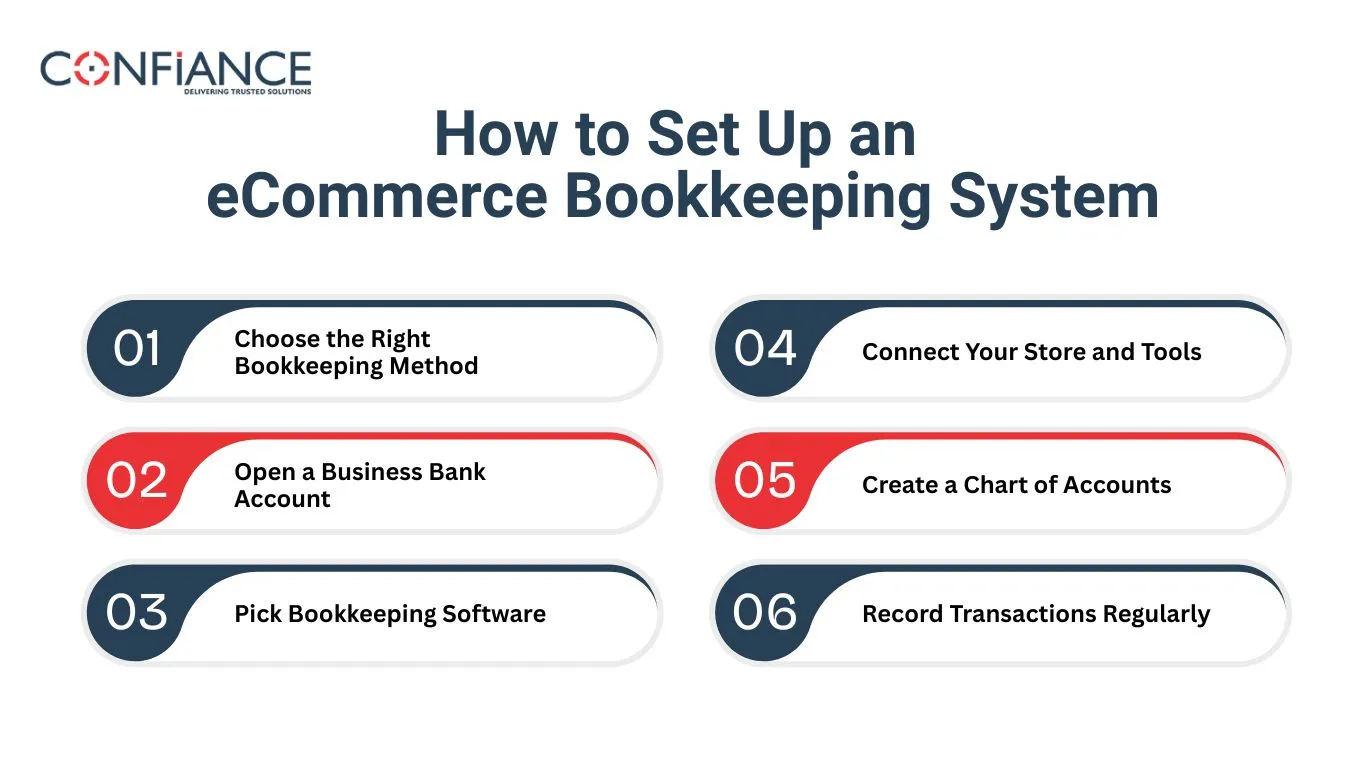

How to Set Up an eCommerce Bookkeeping System

You don’t need to start with complex software. Start small, stay consistent, and grow from there.

Step 1: Choose the Right Bookkeeping Method

Pick one of two methods:

- Cash basis: You record income when you receive it and expenses when you pay.

- Accrual basis: You record income when you earn it and expenses when you owe, not when cash moves.

Most small stores start with the cash method. As your business grows, the accrual method may make more sense.

Step 2: Open a Business Bank Account

Never mix personal and business finances. A separate account makes tracking easier and avoids confusion.

Step 3: Pick Bookkeeping Software

Options include:

- QuickBooks Online

- Xero

- Wave

- Zoho Books

- FreshBooks

Look for features like bank syncing, invoicing, sales tax tracking, and platform integrations.

Step 4: Connect Your Store and Tools

Link your website, marketplaces, payment processors, and bank accounts. This brings all your transactions into one place.

Step 5: Create a Chart of Accounts

This is a list of categories where money flows in and out. Examples include:

- Sales income

- Advertising expense

- Inventory purchases

- Shipping fees

Set it up right from the start for clear reporting later.

Step 6: Record Transactions Regularly

Don’t wait months to update your books. Set a weekly or monthly schedule to review and record all entries.

Tips to Keep eCommerce Bookkeeping Simple

Use Automation

Automated tools save hours each week. Use them to:

- Pull in sales data

- Match payments

- Track inventory

- Generate reports

Set Reminders

Put bookkeeping on your calendar. A regular routine keeps books up to date and avoids stress.

Stay Tax Ready

Set aside money for taxes as you go. Work with an accountant if your tax situation gets complex.

Keep Receipts

Use cloud storage or apps to save all receipts. You may need them later for audits or claims.

Review Reports Often

Check reports each month. This shows you if profits are rising, if costs are too high, or if cash flow is tight.

Should You Hire a Bookkeeper?

Many store owners handle bookkeeping on their own in the beginning. But over time, it can become a burden.

Consider hiring a bookkeeper when:

- You spend more time tracking numbers than growing your store

- You have sales across many platforms

- Tax time becomes overwhelming

- You want to make smarter decisions with clean data

You can hire a freelance bookkeeper, a firm, or use an online service that specializes in bookkeeping for eCommerce businesses.

Bookkeeping and Taxes for Online Stores

Tax rules depend on your location and where you sell. Here are some basics:

- Sales Tax: You may owe tax in states or countries where you have sales or inventory

- Income Tax: You must report profits and pay based on business type (sole proprietor, LLC, etc.)

- Deductions: You can deduct expenses like supplies, software, and shipping

Work with a tax professional who understands eCommerce. They can help file returns, claim deductions, and avoid penalties.

Best Tools for eCommerce Bookkeeping

Some popular tools that help online store owners manage their books:

| Tool | Best For |

| QuickBooks Online | All-in-one bookkeeping with strong integrations |

| Xero | Simple, clean design and solid reports |

| A2X | Great for Amazon and Shopify data imports |

| Wave | Free basic bookkeeping for small sellers |

| Zoho Books | Budget-friendly option with automation |

Pick what suits your budget and store size. Try demos and read reviews before committing.

eCommerce bookkeeping isn’t just about following rules. It helps you understand your store’s financial health. When done right, it supports better choices, lower stress, and smoother growth.

Start small, stay consistent, and invest in the right tools or help as your store grows. Whether you manage your books yourself or hire support, keeping your records clean will always pay off. At Confiance, we help eCommerce businesses scale globally with our eCommerce bookkeeping services. Contact us now to transform your eCommerce business and reach the global stage.

FAQs

- What is the best way to manage bookkeeping for eCommerce businesses?

Use accounting software that connects to your sales channels, tracks expenses, and handles reports. Automate tasks where possible. - Do I need a bookkeeper for my online store?

If bookkeeping takes too much time or feels confusing, hiring a bookkeeper can help. It ensures accuracy and frees up your schedule. - How do I track inventory in my eCommerce bookkeeping system?

Record purchases, sales, returns, and current stock levels. Use tools that sync with your platform to avoid manual tracking. - What expenses can I deduct as an eCommerce store owner?

You can deduct costs like inventory, packaging, shipping, advertising, software subscriptions, and transaction fees. - How often should I update my eCommerce bookkeeping records?

Update your records at least once a month. Weekly updates are even better for growing stores with steady sales. - Which software is best for small eCommerce businesses?

QuickBooks Online, Xero, Wave, and Zoho Books are good options. Choose one that fits your needs and works with your store platform.