New York Sales Tax 2025: Rules, Rates, and Compliance Guide

If you do business in New York, you need to understand how sales tax works. New York charges a state sales tax, and local areas can add their own. These rates vary by county and city. Whether you sell in person or online, you must charge the right amount, follow the rules, and send in the tax on time. This blog explains all about New York Sales Tax including – what to collect, when to file, and how to stay compliant in 2025.

What Is New York Sales Tax?

New York sales tax is added to the sale of most goods and some services. Sellers collect it from buyers at the time of sale. They send the money to the state later. It is a form of indirect tax paid by the final consumer.

New York State Sales Tax Rate

The base rate for New York State sales tax is 4 percent. This rate applies across the state. In many areas, local taxes are added to this base rate. These vary by city and county.

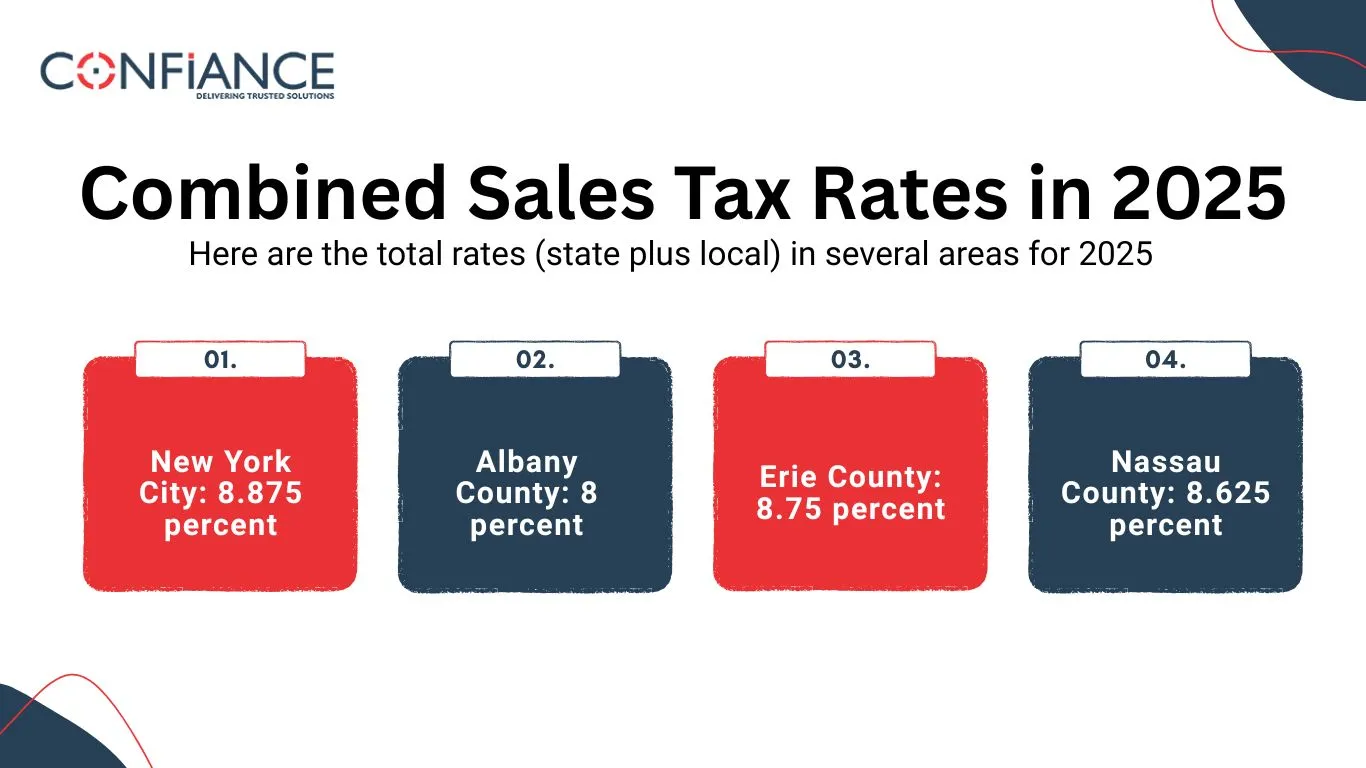

Combined Sales Tax Rates in 2025

Here are the total rates (state plus local) in several areas for 2025:

- New York City: 8.875 percent

- Albany County: 8 percent

- Erie County: 8.75 percent

- Nassau County: 8.625 percent

Each business must charge the correct rate for the location where the buyer takes possession or where the item is delivered.

Who Must Collect New York Sales Tax?

You must collect tax if your business has a physical site in New York. This includes stores, warehouses, or offices. Remote sellers must also collect tax if they meet the economic threshold. That means:

- More than $500,000 in sales to New York buyers

- Over 100 separate sales in one year

If your sales meet both conditions, you must collect tax. You must also register before you begin collecting.

Marketplace Facilitators

If you sell through a site like Amazon, that site is a marketplace facilitator. The site must collect and send in tax for your sales. You do not have to do it yourself unless you also sell through other methods.

What Items Are Taxed in New York?

Most goods are taxed. These include:

- Electronics

- Furniture

- Jewelry

- Clothing items over $110

- Household supplies

Some services are also taxed. These include:

- Hotel stays

- Car rentals

- Parking

- Repair and installation for some items

What Items Are Not Taxed?

Some goods and services are not taxed. These include:

- Most food bought at grocery stores

- Drugs with a prescription

- Clothing and shoes under $110

- Some medical tools and devices

Knowing what is taxed and what is not helps you collect the right amount. It also helps you avoid fines or extra payments.

Filing New York State Sales Tax Returns

Once registered, your business must file returns. These returns show how much tax you collected. The state tells you how often to file. Most businesses file monthly or quarterly. Very small sellers may file yearly.

Due dates for 2025 are:

- Monthly filers: 20th of the next month

- Quarterly filers: Due by the 20th of the month after the quarter ends

- Annual filers: Due by March 20 the next year

Returns are filed online through the New York Tax Department site. You must also pay the tax you collected.

Late Filing and Payment Penalties

If you file late or pay late, you will be fined. Penalties include:

- 10 percent of the unpaid tax

- Interest based on the current monthly rate

These add up quickly. File and pay on time to avoid extra costs.

Certificate of Authority

You must apply for a Certificate of Authority before collecting sales tax. This is your permit to collect tax in New York. Apply online. There is no cost.

Once approved, display your certificate at your business. You must show it to customers or inspectors when asked.

Sales Tax Exemptions

Some buyers do not have to pay sales tax. These include:

- Government groups

- Nonprofit organizations with a valid form

- Retailers buying items to sell again

To skip the tax, the buyer must give you a filled-in exemption form. Keep the form in your records.

Keeping Records

You must keep full records for at least three years. Records must show:

- What you sold

- When and where you sold it

- How much tax you collected

- Any exemption forms

Good records help you during an audit. They also help if you make a mistake and need to fix it later.

Use Tax

Use tax applies if you buy something from out of state and do not pay New York sales tax. You must report and pay the tax yourself.

This happens with online shopping or business purchases. If the seller does not collect New York tax, you owe use tax. Businesses report it on their return. People report it on their state income tax form.

Remote Sellers and Economic Nexus

A remote seller is a business outside New York that sells to New York buyers. If you pass these limits:

- $500,000 in yearly sales

- Over 100 separate sales

Then you must register and collect tax. It does not matter where your business is located.

Marketplace Rules

If you sell through a marketplace, the marketplace must collect and send the tax. This applies to:

- Amazon

- Etsy

- Walmart Marketplace

- eBay

The marketplace tracks sales and tax for you. But you still must report these sales if asked.

Audits and Common Triggers

New York audits businesses that do not follow tax rules. You may be audited if:

- Your sales drop a lot without reason

- You do not file returns

- You collect tax but do not send it in

- Your business grows fast

Keep your filings up to date and keep clear records to avoid issues.

Special Industry Rules

Some industries have special tax rules. Here are some examples:

Restaurants:

- Sales tax applies to prepared food and drink

- Tips given freely are not taxed

- Service fees added to bills are taxed

Construction:

- Materials are taxed

- Labor is not taxed for capital improvement jobs

- Repair work may be taxed if no capital improvement

Telecom Services:

- Phone service is taxed

- Internet access is not taxed

- Cable and satellite TV are taxed

New York State Sales Tax for Online Sellers

Online sellers with customers in New York must follow the same rules. If you pass the economic threshold, you must register and collect tax.

Use tax software to track rules for each city and county. Tax rates can vary by delivery address. The New York Tax Department offers rate lookup tools on its site.

How to Register

You register through the New York Business Express site. You need:

- Business name

- Federal EIN

- Names of owners

- Description of goods or services

You will get a Certificate of Authority. You must not collect tax before receiving the certificate.

Tips to Stay Compliant

- Register early and file on time.

- Charge the correct rate for each location.

- Keep records of all sales, tax collected, and exemption forms.

- Use tax software if you sell in many areas.

- Train staff to apply tax rules correctly.

Sales Tax Holidays

New York does not have a sales tax holiday. But clothing and shoes under $110 per item are tax free year round. Local areas may add their own taxes, so check local rules.

New York City Sales Tax Rules

The rate in New York City is 8.875 percent. This includes:

- 4 percent state tax

- 4.5 percent city tax

- 0.375 percent Metropolitan Commuter Transportation District tax

If you sell in the city, you must charge this rate. This applies to:

- Retail stores

- Online sales to NYC addresses

- Service providers with NYC customers

Returns for Multiple Locations

If your business has more than one site, you must track sales by location. You may need to file extra forms showing how much tax you collected in each area.

Collecting Tax from Tourists

Tourists must pay the same tax as local buyers. There are no refunds for tourists unless they return the item. Keep this in mind if your store is in a popular travel spot.

Correcting Mistakes

If you find a mistake in a past return, you must file an amended return. You can fix errors online. Pay any tax owed as soon as possible to avoid added interest.

New York State sales tax rules are detailed and strict. Rates vary by city and county. You must collect, file, and pay the right amount. Keep records and follow deadlines. The state can audit your business if anything looks wrong. By following the steps above, you can stay compliant and avoid problems.

Check the New York Department of Taxation and Finance website for updates and tools to help you. At Confiance, we offer all-round sales tax support for New York and other US states.

FAQs

- Do I need to collect sales tax if I only sell at craft fairs in New York?

Yes. If you sell taxable items at craft fairs or events in New York, you must collect sales tax. You also need a valid Certificate of Authority before making any sales. - How do I charge the correct rate if I ship across New York?

You must charge tax based on where the buyer receives the item. Use the state’s tax rate lookup tool to find the exact rate by address. - Are digital products taxed in New York?

Some are. Downloads like music, eBooks, or video may be taxed if they count as tangible property. Always check if the digital product falls under taxable goods. - What happens if I stop doing business in New York?

You must file a final sales tax return and close your sales tax account. This tells the state you no longer collect tax. - Can I get an extension to file my sales tax return?

No. New York does not give extensions for sales tax returns. You must file and pay by the due date to avoid penalties. - Do I charge sales tax on shipping charges?

If the item you ship is taxable, then the shipping fee is also taxed. If the item is not taxed, the shipping is not taxed either.