Top Benefits of Accounting Outsourcing Services for Growing Businesses

Running a growing business means facing more complex financial tasks every month. As your company expands, so does the need for organized bookkeeping, payroll support, tax compliance, and real-time financial insights. Trying to manage all of these tasks in-house often becomes costly, time-consuming, and error-prone. That is why more companies today are turning to accounting outsourcing services.

Outsourcing provides skilled support, improves accuracy, and saves money without hiring a full internal team. It helps your staff focus on growth instead of chasing receipts and tracking spreadsheets.

This article explores the top benefits of outsourcing accounting and bookkeeping services, especially for businesses that are scaling. Each section covers real value that financial outsourcing brings to your operations, planning, and profitability.

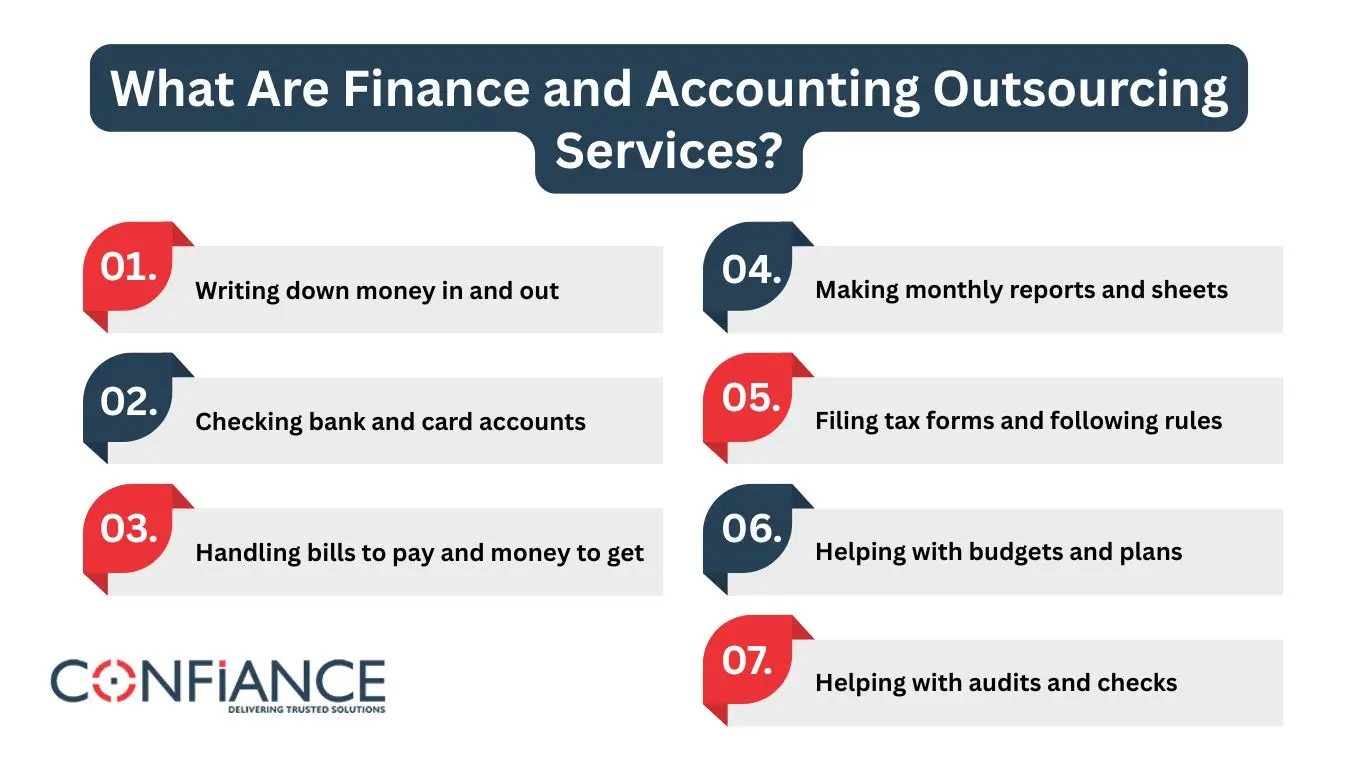

What Are Finance and Accounting Outsourcing Services?

Finance and accounting outsourcing means a business hires another company to do its money work. These firms do bookkeeping, reports, payroll, taxes, and other money jobs.

Common tasks are:

- Writing down money in and out

- Checking bank and card accounts

- Handling bills to pay and money to get

Making monthly reports and sheets - Filing tax forms and following rules

- Helping with budgets and plans

- Helping with audits and checks

Instead of doing this work inside your business, you pay a team outside to do it all behind the scenes.

Lower Costs Without Cutting Quality

In-house accounting requires full-time salaries, benefits, office equipment, and software licenses. If you build a team of two or three people, the cost climbs fast. Outsourcing removes that overhead.

You only pay for what you need. There are no recruiting fees, no staff training, and no lost time during sick leaves or vacations. You also save on payroll taxes, insurance, and office space.

Outsourced accounting firms use trained professionals and proven processes. You get reliable service at a lower cost than building a team from scratch.

Professional Expertise From Day One

With accounting outsourcing, you get skilled money experts right away. These teams know the latest tax laws, money report rules, and rules for your business type.

You don’t need to train new staff or worry about workers leaving. Your outside team brings skill and order from the start. They handle hard reports and act fast when tax rules, software, or laws change.

This help from skilled pros makes your reports better and cuts the risk of costly mistakes.

Save Time and Keep Your Team Focused

Managing finances in-house can slow down your internal team. Instead of spending time on sales, operations, or client support, your staff ends up working on data entry, receipt tracking, and basic reports.

Outsourcing accounting and bookkeeping services shifts that load. Your team stays focused on your business goals. Tasks like invoice processing, bill payments, bank reconciliations, and payroll run in the background.

You no longer waste hours managing spreadsheets or correcting small mistakes. Reports come on time, with less effort from your internal staff.

Improved Accuracy and Fewer Mistakes

Doing accounting by hand can cause small mistakes. These can turn into big problems like missed payments, repeated entries, wrong tax forms, or lost receipts.

Outsourced teams use tools and clear steps to cut errors. They make sure each entry is right and follows rules.

They also do regular checks and audits to find and fix problems early. This lowers risk, keeps you in line with rules, and makes your books ready for review anytime.

Scalability Without Disruption

As your business grows, your accounting needs change. New products, services, or workers bring more money activity. Handling this growth inside may need new staff, better systems, or changed processes.

Finance and accounting outsourcing makes it easy to grow. You can ask for more help in busy times or less when things slow. You can add services like payroll or tax filing when needed.

This flex saves time and money while keeping your business running well at every stage.

On-Demand Financial Reports

Good and timely money reports help you make smart choices. With outsourced accounting, you get reports when you need them. These include:

- Profit and loss reports

- Cash flow summaries

- Balance sheets

- Reports on bills not paid

- Budget vs actual tracking

- Plans for the future

Outsourced teams send reports weekly, monthly, or every few months. They can also make summaries for banks, investors, or your board. Clear reports help you see growth and spot problems fast.

Strong Internal Controls and Fraud Prevention

When just one or two people handle your money, mistakes or fraud can go unnoticed. Without checks, big problems can happen.

Outsourced accounting firms use clear steps and split duties to build safer systems. They set up approval steps, double checks, and records ready for audits to track every transaction.

This keeps your money data safer and lowers the chance of fraud inside. Even small businesses gain from these controls.

Use of Advanced Technology

Top accounting firms use cloud software like:

- QuickBooks Online

- Xero

- Zoho Books

- NetSuite

- Sage Intacct

These tools automate tasks like logging sales, matching payments, and making reports. This cuts down on hand work and speeds up your accounts.

With safe cloud access, you can check your books anytime, from any place. This lets you control your money fast and easy.

New tech helps cut errors and gives quick updates. You get the best tools without running them yourself.

This keeps your money data safe, correct, and up to date while you grow your business.

Real-Time Cash Flow Tracking

Cash flow problems cause many business failures. Outsourced accounting teams watch your money coming in and going out every day. This helps you:

- Track unpaid bills

- Manage supplier payments

- Plan payroll

- Spot cash shortfalls

With clear cash flow tracking, you avoid overdraft fees, late payments, and emergency loans. You get better control of your business money.

Avoid Tax Penalties and Stay Compliant

Missing tax deadlines or filing incorrect forms can lead to penalties. Tax rules change often and vary by state and industry.

Outsourced accounting firms keep up with these changes. They help with:

- Quarterly estimated tax payments

- Year-end filings

- Sales tax calculations

- 1099 forms and payroll reporting

With their help, you stay compliant and avoid costly mistakes. You also save time preparing for tax season because your records are already in order.

Better Support for Remote Teams

If your business has many locations or remote workers, cloud-based outsourced accounting helps a lot. Everyone can use the same system, see real-time data, and share files safely.

Work does not rely on office visits or paper forms. Whether your team is in one place or many, your finances run smoothly.

This makes it easy for today’s businesses to work without delays or mix-ups.

Preparation for Audits or Funding Rounds

If your business needs outside funding, clean books are key. Investors want clear reports and steady records.

Outsourced accounting teams keep records ready for audits all year. They sort receipts, reports, and logs to speed up checks. They also make custom summaries for banks, lenders, or investors.

This prep boosts your trust and speeds up getting funds.

Custom Services for Different Industries

Not all businesses need the same reports or accounting steps. A retail shop tracks stock, while a law firm tracks billable hours. A contractor manages job costs, while a consultant tracks time-based income.

Outsourced accounting teams offer help made for your industry. They adjust services to fit your work, rules, and goals.

This focused help makes your records more accurate and your reports more useful.

Global Support for Growing Businesses

If your business sells to customers in other countries or hires workers from abroad, you need support that works worldwide.

Outsourced firms handle tasks like:

- Accounting in different currencies

- Paying staff in many countries

- Filing taxes across borders

- Following rules for each region

They know the financial laws in each place. They help you stay legal and avoid fines as your business grows and reaches new markets.

This support makes it easier to expand without extra stress or risk.

Simplified Payroll Processing

Payroll can be hard for growing businesses. Taxes, deductions, overtime, and benefits add to the work.

Outsourced firms use tools to:

- Track hours and attendance

- Calculate pay and deductions

- File tax forms and make payments

- Create pay stubs and reports

This saves time, cuts errors, and helps you pay your staff right and on time.

Regular Check-Ins and Personalized Support

Good outsourcing firms assign a dedicated account manager or team. They meet with you regularly, explain reports, and answer questions.

You can set the schedule for weekly calls, monthly reviews, or quarterly planning. This communication builds trust and ensures your needs are met.

You are never left in the dark. Your financial partner stays in touch and supports your long-term goals.

Build a Strong Financial Base

Every business needs clear and correct money records. If you want to grow, sell, join with another firm, or just run well, clean books matter.

Outsourced accounting gives you a strong base. It helps you make smart choices, worry less, and focus on growing your business.

Why Finance and Accounting Outsourcing Works

Finance and accounting outsourcing helps growing firms in clear ways. It cuts costs, reduces mistakes, and gives you access to trained experts. You also get better reports, stay on track with rules, and can grow with ease.

Outsourcing is not just for big firms. Small and mid-sized businesses in many fields can use it too. Pick a provider who knows your trade, offers clear prices, and stays in touch. At Confiance, we provide expert accounting outsourcing services for businesses around the world. With the right team, your money tasks get easier, faster, and more accurate.

FAQs

1. How do finance and accounting outsourcing services integrate with existing business systems?

They connect with your existing software using APIs and secure data sync tools. This keeps your records updated without manual transfers.

2. Is it possible to outsource only specific accounting functions instead of the entire process?

Yes, you can choose to outsource tasks like payroll or tax prep. This lets you keep control over other areas.

3. What industries benefit most from accounting outsourcing services?

Industries like healthcare, legal, real estate, and eCommerce benefit due to their complex reporting needs. These services adapt to specific rules and processes.

4. Can outsourced accounting teams support different accounting standards, such as GAAP or IFRS?

Yes, they work with both GAAP and IFRS depending on your needs. They adjust reports to match your compliance rules.

5. What level of customization is available in outsourced financial reporting?

You can request reports by department, product line, or investor format. Dashboards and forecasts are tailored to your goals.