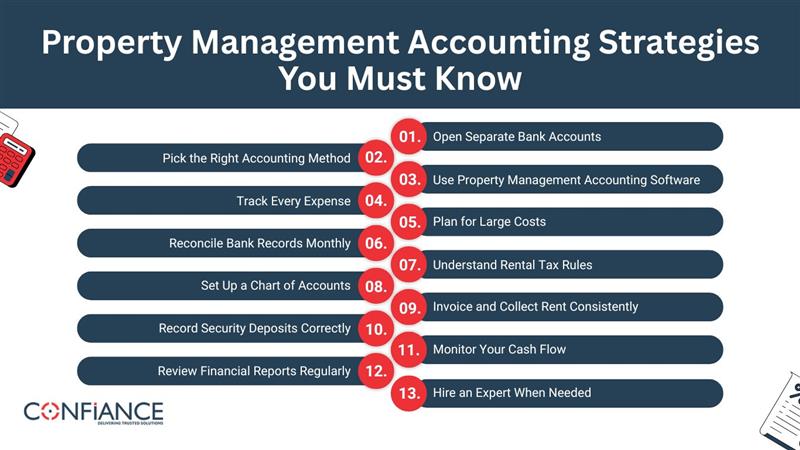

Property Management Accounting Strategies You Must Know

Handling rental properties is more than collecting rent and dealing with repairs. Strong accounting keeps your business stable and helps you grow over time. Without it, even well-managed properties can lose money. In this blog, we have mentioned 13 property management accounting strategies to help you stay organized, reduce risk, and improve your accounting process.

Why do Property Management Accounting Strategies Matter?

With property management accounting strategies, you can know where your money goes and what returns you’re getting. A reliable strategy helps you stay compliant, file accurate taxes, and avoid legal issues. More than that, it gives you a clear view of how each property is performing.

When records are clean and updated, it becomes easier to track unpaid rent, cut down on late fees, and plan for repairs. You also avoid surprises that can throw off your cash flow or cause stress during tax season. Here are some key strategies you must follow for your property management business.

1. Open Separate Bank Accounts

Start with a simple but essential step. Keep your rental finances separate from your personal funds. Use a dedicated bank account for your property income and expenses. This adds a layer of clarity and helps during audits or tax reviews.

If you manage more than one property, it’s better to separate funds further. Either set up sub-accounts or track each property separately using your accounting software. This way, you can spot which properties are profitable and which ones are falling behind.

2. Pick the Right Accounting Method

You’ll need to choose between two main accounting methods: cash basis and accrual basis.

- Cash basis is when you record income when you receive it and expenses when you pay them. It’s easier to use and works well for landlords with a few properties.

- Accrual basis records income when it’s earned and expenses when they’re billed through your managed properties. It gives a more accurate view of your business but takes more time to manage.

Most small landlords prefer the cash method. Larger operations or those with loans, property managers, or outside investors may benefit from the accrual method. Pick one method and stay consistent. Switching methods later may require IRS approval and extra paperwork.

3. Use Property Management Accounting Software

Use accounting software for property management instead of manual methods. Manual bookkeeping works for one or two units, but it becomes messy as you grow. Use software built for property management. These tools allow you to track rent, expenses, maintenance, and deposits in one place. Many of them also help with tenant screening and lease management. Software can also help with rent collection and maintenance request tracking.

Most property management software offers helpful features such as:

- Bank integration

- Expense tracking by property

- Rent reminders and late fee automation

- Tax reporting

- Mobile access

Some of the popular tools include Buildium, AppFolio, and TenantCloud. Choose a tool that matches the size of your portfolio and your budget. Avoid overpaying for software with features you don’t use.

4. Track Every Expense

Every dollar spent on your property should be recorded. This includes maintenance, cleaning, utilities, supplies, insurance, permits, and professional services. Even small expenses add up over time and affect your bottom line.

Use your software’s expense tracking feature to tag each expense to the correct property. This makes it easier to file taxes and monitor where your money goes. Always save receipts and organize them by date or vendor. Most software tools allow you to scan or upload receipts for easy storage.

5. Plan for Large Costs

Unexpected repairs are part of the rental business. Appliances break. Roofs leak. Laws change. You need to be ready.

Set money aside every month for big repairs. This includes things like broken appliances, roof leaks, or major updates. A safe amount is 10 to 15 percent of the rent you collect each month. You can adjust that based on the size and age of each property.

Do not wait until something fails. Make regular checks and fix small issues early. It costs less to repair problems before they turn into bigger ones.

6. Reconcile Bank Records Monthly

Reconciliation means matching your internal records with your bank statements. This step helps you catch errors, missed payments, or possible fraud. Do this once a month without fail.

Look at rent payments, deposits, bank fees, and outgoing bills. If something doesn’t match, investigate right away. Don’t rely on memory or guesses. Regular reconciliation keeps your records clean and your finances in check.

7. Understand Rental Tax Rules

Knowing the tax side of property management is just as important as rent collection. Each state has its own rules, but some basics apply across the board.

Common deductions include:

- Mortgage interest

- Property taxes

- Repairs and maintenance

- Depreciation

- Insurance premiums

- Management fees

- Utilities and supplies

Some expenses like upgrades or remodeling may need to be depreciated over time instead of claimed all at once. Talk to a tax professional to make sure your deductions are valid and complete. Using the right property management accounting strategies reduces your tax bill and keeps you compliant. Good tax planning is key to sound financial management.

8. Set Up a Chart of Accounts

A chart of accounts is a list of categories you use to track money. Think of it as a map for your finances. It includes income types like rent and late fees, and expenses like cleaning, repairs, and insurance.

Use the same chart across all your properties. This lets you compare performance and run clear reports. Software tools often come with built-in charts of accounts, but you can edit them to match your needs.

9. Invoice and Collect Rent Consistently

Send rent invoices on time and use reminders to reduce late payments. Set clear payment terms in your lease. Include details like rent amount, due date, and payment method. Accepting online payments speeds up rent collection.

Most property management software can send rent invoices, process online payments, and track late fees automatically. These software also automate rent collection and track rent payments to avoid delays. This saves time and reduces confusion. Always follow up on missed payments and document all communication. Following this saves time and avoids manual follow-ups.

10. Record Security Deposits Correctly

Security deposits are not income. They are liabilities because they must be returned to the tenant unless there’s damage or unpaid rent. State laws control how much you can collect, how you store it, and when you must return it.

Keep security deposits in a separate account. Track them in your records, and update the balance when any amount is used or refunded. Never mix deposits with your regular income. Doing so can lead to legal issues.

11. Monitor Your Cash Flow

Cash flow is the money coming in minus the money going out. Positive cash flow means your properties are profitable. Negative cash flow means you’re losing money or running too close to zero.

Create a monthly cash flow report. Include rent income, utilities, repair costs, insurance, and mortgage payments. Watch for changes over time. If your cash flow drops, review your expenses, and consider raising rent or reducing vacancies. You must review your expenses regularly to manage costs better and manage expenses effectively.

12. Review Financial Reports Regularly

Reports can show the financial health of your properties over time. Your accounting software should support strong financial reporting. It should provide key reports such as:

- Income statements

- Balance sheets

- Cash flow statements

- Expense breakdowns

- Rent rolls

Review these reports each month. They show how your business is doing and help with planning. You can use them to compare properties, spot late payments, or check if costs are rising faster than income.

Good reports also make it easier to apply for loans or show your financials to investors or partners.

13. Hire an Expert When Needed

If you manage multiple units or feel overwhelmed, hire a professional. A bookkeeper or accountant with property experience can help clean up your records, organize your taxes, and save you time.

Don’t wait until you’re behind. Outsourcing your accounting can prevent mistakes that cost more in the long run. Just make sure they understand rental property rules and use tools that fit your system. At Confiance, we offer property management accounting services using the latest tools and industry standards.

By going through these property management accounting strategies and following them carefully, you can organize and manage your property business efficiently. Also, these strategies can help you stay in control and make informed decisions.

FAQs

1. What accounting method is best for rental property owners?

- The cash method works best for most small landlords. It records income when received and expenses when paid.

2. Can landlords deduct property management expenses on taxes?

- Yes. You can deduct fees paid to property managers, accountants, and legal services used for rental activity.

3. How do I track rental income and expenses by property?

- Use accounting software that lets you assign every transaction to a specific property. This helps with reports and taxes.

4. What should be included in a chart of accounts for rental property?

- Include rent income, repairs, cleaning, insurance, property taxes, utilities, and professional fees. Use the same format for all properties.

5. How much should I save each month for rental property repairs?

- Save 10 to 15 percent of your monthly rent income. Keep it in a separate account for large or surprise costs.

6. Are security deposits considered income?

- No. Security deposits are not income. They are held in trust and must be returned unless used for damages or unpaid rent.

7. How often should I reconcile my rental property bank account?

- Do this once a month. It helps catch errors, missed payments, or unauthorized charges.