Cash Basis Accounting vs. Accrual Accounting – Detailed Analysis

Choosing the right accounting method affects how a business tracks income and expenses. Two common methods are Cash Basis Accounting and Accrual Accounting. Each one handles transactions differently. This decision shapes how you report profits, file taxes, and understand business performance. In this blog, we will have a look at both methods and understand how they work, their benefits and limitations. We will also help you to choose one from the two depending on the situation.

What is Cash Basis Accounting?

Cash Basis Accounting records income when money is received. It records expenses when they are paid. This method tracks only cash that moves in or out of the business. If you send an invoice in January and receive payment in March, you record the income in March.

It is simple to use and fits many small businesses. It shows how much cash is on hand. It does not track income that is owed or bills that are unpaid.

Key Features

- Income is recorded when cash is received

- Expenses are recorded when paid

- Does not track unpaid bills or invoices

- Matches accounting records to bank balance

Pros

- Easy to understand and apply

- Lower bookkeeping costs

- Good for tracking actual cash flow

- Fits many small business needs

Cons

- Can show incorrect profit levels

- Does not track future income or bills

- Not ideal for companies with inventory

- Limits financial planning

What is Accrual Accounting?

Accrual Accounting records income when earned, even if not yet received. This includes accrued revenue, which refers to income earned but not yet billed or collected. It records expenses when they happen, including accrued expenses that are not yet paid. If you send an invoice in January, you report that income in January. This method gives a full picture of how a business performs during a period.

It tracks money that is owed to you and money you owe to others. It helps match revenue to the costs that created it. That gives an accurate picture of business performance.

Key Features

- Income is recorded when earned

- Expenses are recorded when used or incurred

- Tracks accounts receivable and accounts payable

- Accounts for prepaid expenses that are paid upfront but used over time

- Gives a full picture of financial activity

Pros

- Reports accurate profit and loss

- Matches income with related costs

- Supports financial planning and reports

- It also helps build a complete balance sheet, showing assets, debts, and equity.

- Required for many large businesses

Cons

- More complex than cash method

- Often needs accounting software

- May not reflect available cash

- Requires knowledge of bookkeeping rules

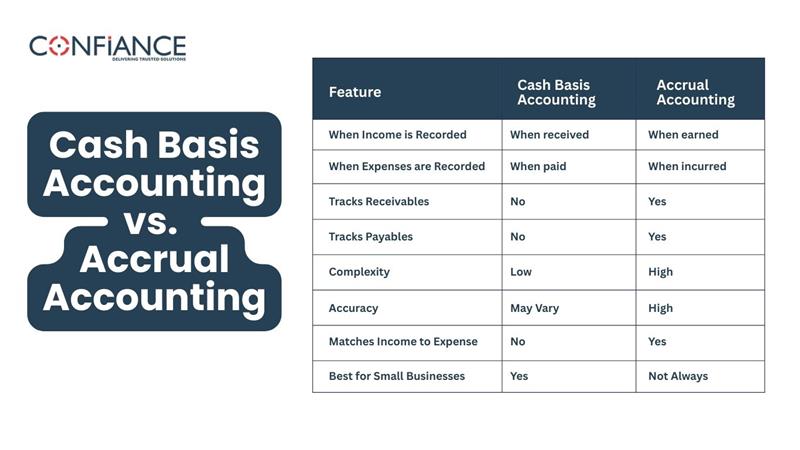

Key Differences Between the Two Methods

Feature |

Cash Basis Accounting |

Accrual Accounting |

| When Income is Recorded | When received | When earned |

| When Expenses are Recorded | When paid | When incurred |

| Tracks Receivables | No | Yes |

| Tracks Payables | No | Yes |

| Complexity | Low | High |

| Accuracy | May vary | High |

| Matches Income to Expense | No | Yes |

| Best for Small Businesses | Yes | Not always |

Cash Basis Accounting gives a snapshot of current cash. Accrual Accounting shows the full story behind business operations. The method you use affects how you see profits and make decisions.

Real-Life Examples

Example for Cash Basis Accounting

You run a small consulting firm. You send a $4,000 invoice to a client on June 25 but receive payment on July 10. You record the income on July 10 because that’s when the cash arrives.

Example for Accrual Accounting

In the same case, using accrual accounting, you record the $4,000 income on June 25 when the service was delivered, even if the payment comes later. This helps match the income to the period it was earned.

Example for Expenses – Cash Basis

You buy office supplies on credit in April but pay the bill in May. Under cash basis, the expense is recorded in May.

Example for Expenses – Accrual Basis

With accrual accounting, you record the expense in April when the supplies were used, even if you pay in May.

Tax Implications

Tax rules matter when picking an accounting method. The IRS allows both methods for small businesses. However, if your annual revenue is more than $25 million, you must use Accrual Accounting. Also, if your business holds inventory, you may have to use the accrual method even if your income is lower.

The cash method can offer tax benefits in some cases. For example, you can delay billing or pay early to manage your taxable income. The accrual method follows fixed rules. Income and expenses are reported in the correct tax years, regardless of when the cash is received or paid.

Talk to a tax advisor before choosing a method. The IRS also expects consistency once a method is selected. Changing methods requires approval.

Choosing between Cash Accounting and Accrual Accounting

The right method depends on how your business operates. These factors can help you make a choice:

1. Size of Your Business

Very small businesses often use the cash method. It is easier and works well if you do not carry inventory or use credit. Larger businesses, or those with many customers or vendors, benefit from accrual reporting.

2. Industry Type

Service providers and contractors often use the cash method. Retailers, wholesalers, and companies with inventory use Accrual Accounting. In those industries, it is important to match costs with the goods or services sold.

3. Cash Flow Management

If you need to watch cash closely, Cash Basis Accounting helps. It shows how much money you have at any time. If your focus is long-term planning, accrual is better. It shows income and expenses in the period they happen.

4. Business Growth

If your business is growing, accrual may be the better choice. It helps when applying for loans or bringing on investors. These parties usually expect formal financial statements based on the accrual method.

Decision Checklist

Use this quick list to decide which method fits your business:

- Do you sell products or carry inventory? → Use Accrual

- Are your sales mostly cash or card payments? → Cash Basis may work

- Do you offer credit to customers or buy on credit? → Accrual gives a better picture

- Is your main focus on real-time cash tracking? → Go with Cash Basis

- Do you need full financial reports for investors or banks? → Choose Accrual

- Are you planning to scale or take on outside funding? → Start with Accrual

- Want something simple and easy to maintain? → Stick to Cash Basis

Cash Basis Accounting and Accrual Accounting both work, but they serve different needs. The cash method is simple and tracks money on hand. The accrual method gives a full picture of business performance, even if the cash has not moved yet.

The best method depends on your size, goals, and industry. A small business may start with the cash method and move to accrual later. It is not just about ease or habit. It is about what helps you understand your business better.

Check IRS rules before making a change. Talk to a tax professional or accountant if needed. Once you choose a method, stick with it unless you have a strong reason to switch.

Review your method each year. As your business grows, your needs change. Your accounting method should keep up. Connect with Confiance if you need professional help with your cash or accrual accounting. We house accounting and tax professionals that can help you choose the right method for your business.

FAQs

Which is better for small businesses: cash basis or accrual accounting?

Cash basis works well for small businesses with simple transactions. Accrual accounting is better for businesses that need detailed reports and track inventory.

Can I switch from cash basis method to accrual accounting method?

Yes, you can switch. You must file IRS Form 3115 and adjust your previous records.

Why do many businesses prefer accrual accounting?

Accrual accounting provides a full view of income and expenses. It matches income with expenses for more accurate reports.

Is cash basis accounting allowed for tax filing?

Yes, cash basis is allowed for small businesses with under $25 million in revenue and no inventory.

Does cash basis accounting track unpaid invoices?

No, the cash basis method does not track unpaid invoices. It only records transactions when cash is received or paid.

What happens if I report income late with cash basis accounting?

If income is delayed, it is recorded when cash is received. This can affect your tax filings.

Can I use both cash basis and accrual accounting?

No, you must choose one method. Some businesses use cash basis for taxes and accrual for internal records.