Top Franchise Payroll Challenges and How to Overcome Them

Managing a franchise under a franchise agreement comes with a lot to handle, and payroll processing is often one of the hardest parts. It is common to make mistakes while dealing with changing labor laws, tracking hours, and paying workers on time. Even small errors can lead to fines or unhappy employees. Hence, managing franchise payroll challenges becomes very crucial for them.

In this blog, we’ll look at the most common franchise payroll challenges and learn how to fix them. Whether it’s dealing with different pay rates, handling overtime, or using the right payroll tools, we’ll break it down in simple terms. Overcoming these common franchise payroll challenges will help you save time, and keep your team paid and happy.

How Is Franchise Payroll Done?

Ffranchise owners can simplify payroll processing, ensuring that franchise employees are paid correctly and tax requirements are met. Payroll in a franchise setting usually works like this:

Collect Details: The franchise owner collects hours worked and pay data from each employee.

Set a Pay Schedule: Payroll is set on a fixed schedule, either weekly, every two weeks, or once a month.

Manage Taxation: Taxes are based on paychecks and sent to local, state, and federal offices.

File Year-End Forms: Tax forms like W-2s or 1099s are sent to workers and filed with the IRS every year.

Some franchisors offer payroll help. Others leave it up to the franchisee. Either way, keeping things accurate and on time is critical to avoid fines and lawsuits.

Managing Payroll for Franchises

Here are the main tasks involved in managing payroll for franchises:

- Track employee hours

- Calculate pay, extra time, bonuses, and handle paying employees across various locations

- Handle tips (common in food service)

- File payroll taxes

- Keep records

- Check worker classification

- Protect employee data

You now know the key parts of payroll for franchises. Next, let’s look at common problems many face with franchise payroll.

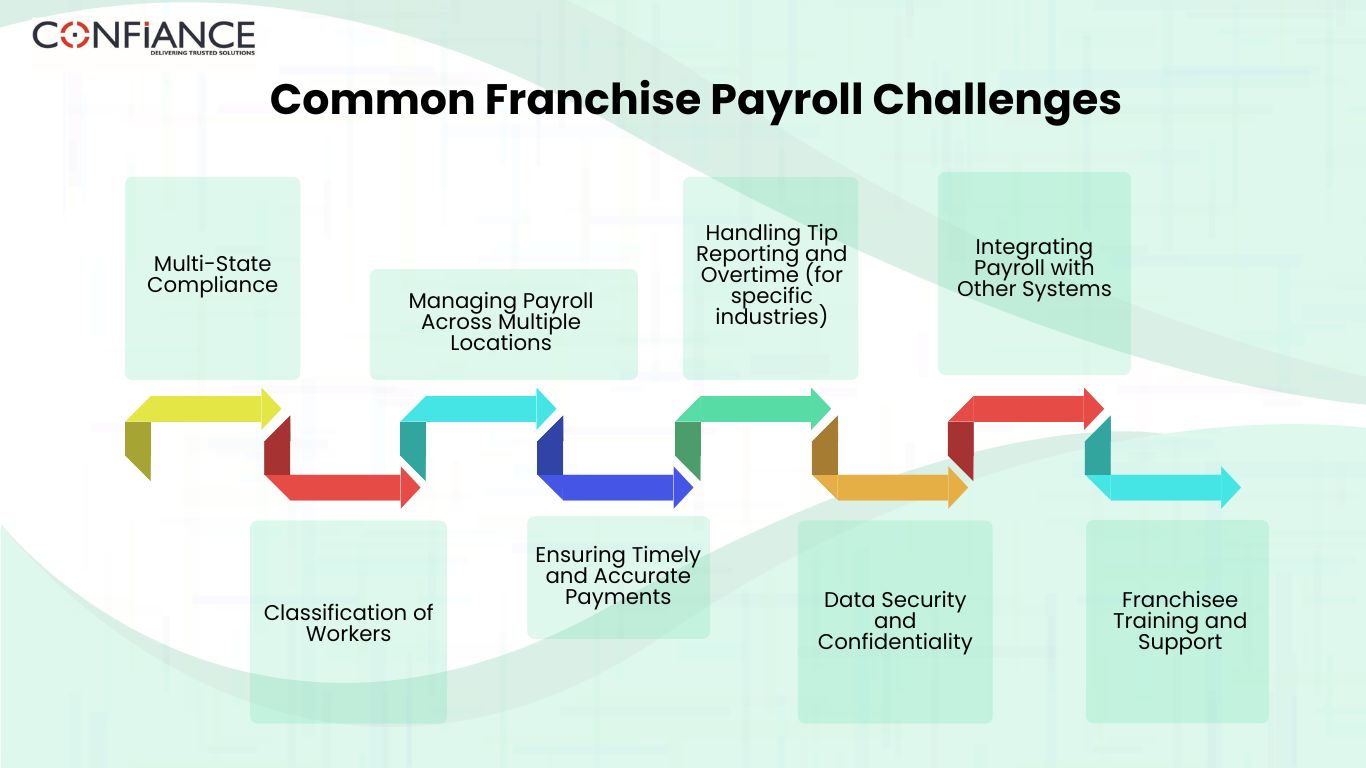

Common Franchise Payroll Challenges with Solutions

Challenge 1: Multi-State Compliance

Understanding Varying State and Local Payroll Laws

Some franchises have stores in more than one state. Each state has its own rules for pay, sick time, and extra hours. Some cities and counties have rules too. It’s hard to track all of them. Mistakes can lead to fines.

Solutions: Staying Compliant with Local Regulations

- Use trusted payroll services or tools that update tax and wage rules on their own to ensure compliance with local and state laws

- Check state and city rules before opening a new store

- Assign someone to track changes or sign up for state alerts

Challenge 2: Classification of Workers

Employees vs. Independent Contractors

It’s important to know who counts as an employee and who is a contractor, as the franchise agreement may also define expectations for these roles. Employees get benefits and have payroll taxes taken out. Contractors don’t. Getting this wrong can lead to audits and fines.

Solutions: Proper Worker Classification Practices

- Follow IRS guidelines. If you control what work is done and how it’s done, they’re likely an employee.

- Document the terms of every working relationship.

- Ask for help from an accountant or payroll expert when in doubt.

Challenge 3: Managing Payroll Across Multiple Locations

- Consolidating Payroll for Multi-Unit Franchises

Running payroll for many stores is tough. Each may have different hours, pay rates, and rules. This can lead to delays and errors. - Solutions: Centralized Payroll Systems

Use one payroll tool for all stores.

Pick one that tracks each store but shows all data together.

Have one team handle payroll for all sites.

Challenge 4: Ensuring Timely and Accurate Payments

- Payroll Errors and Late Payments

Late or wrong pay upsets franchise employees and may cause fines. These mistakes often come from manual steps, wrong tax rates, or bad time logs. - Solutions: Automation and Double-Check Systems

Use tools to track time and run payroll.

Set alerts for paydays and tax due dates.

Check reports before sending pay.

Challenge 5: Handling Tip Reporting and Overtime

- Tip Credits, Reporting, and Overtime Compliance

Restaurants and salons handle tips, which brings rules for tip pooling, tip credits, and tracking. These jobs also often face overtime issues. - Solutions: Specialized Payroll Tools for the Industry

Use payroll solutions designed for restaurants and service jobs.

Set up auto tip tracking and overtime logs.

Train managers on tip credit and report rules.

Challenge 6: Data Security and Confidentiality

- Risks of Payroll Data Breaches

Payroll holds sensitive data, like Social Security numbers and bank details. If this leaks, it can lead to lawsuits, fines, and lost trust. - Solutions: Secure Payroll Platforms and Policies

Use encrypted payroll software.

Limit access to payroll systems.

Lock printed records.

Train staff to protect data.

Challenge 7: Integrating Payroll with Other Systems

Linking Payroll with HR, Accounting, and Scheduling Software

If your systems don’t talk to each other, you're stuck entering the same data multiple times. That means more errors and wasted time.

Solutions: Using Integrated Platforms or APIs

- Choose payroll software that connects with your HR and accounting tools.

- Use APIs to link systems if they don’t connect out of the box.

- Pick tools that update records in real-time across platforms.

Challenge 8: Franchisee Training and Support

Knowledge Gaps Among Franchise Owners

Not every franchisee is a payroll expert. Mistakes can happen due to a lack of training or understanding of laws and systems.

Solutions: Ongoing Payroll Training & Support Programs

- Offer new franchisees basic payroll training.

- Provide access to payroll specialists or help desks.

- Create a payroll manual tailored to your franchise.

Managing Franchise payroll isn't easy. But, with the right tools, processes, and training, you can handle payroll smoothly. It may not be easy, but it’s one of the most important parts of running a franchise. Employees always expect to be paid on time and correctly. Tax regulators expect you to follow the rules. With an organized way, you can meet both expectations and build a strong, reliable franchise business.

Don’t have time to manage payroll for your franchise business? Confiance offers complete payroll services and franchise bookkeeping to ensure compliance with tax rules and support efficient payroll processing. Get in touch now and simplify payroll for your franchise business.