1099-NEC vs 1099-MISC: Real-World Scenarios to Help You Decide

Tax time can be stressful for business owners and freelancers. A common question is: should you use 1099-NEC or 1099-MISC? Both forms report income paid to others. But they are used for different types of payments. Choosing the right form saves time. It also reduces stress and helps you avoid fines. This blog explains each form with simple examples. It will help you file your taxes with confidence.

Using the right form also keeps your records clear. Clear records make it easier to track payments and prepare for audits. Collect W-9 forms from everyone you pay. Keep all payment information organized. This habit saves time and makes your business finances simpler.

What Is Form 1099-NEC?

Form 1099-NEC is for paying people who are not your employees. Use it when:

- You pay $600 or more in a year

- The payment is for work or a service

- You hire a freelancer or contractor

- The person or company gives you a W-9 form

This form covers many jobs like writing, design, consulting, or on-site help.

What Is Form 1099-MISC?

Form 1099-MISC is for other types of income not tied to services. Use it when:

- You pay rent for an office or building

- You give prize money, awards, or bonuses

- You pay royalties for creative work

- You make other payments not linked to labor

This form has been used for years for payments for outside services.

Main Difference Between the Two Forms

| Form | Use Case |

| 1099-NEC | Service payments to contractors |

| 1099-MISC | Rent, royalties, awards, settlements |

Filing the correct form keeps your business in good standing with the IRS.

Why Choosing the Right Form Matters

Using the right form helps you:

- Avoid IRS fines or warnings

- Keep your books clear and neat

- Build trust with workers and vendors

- Complete tax reports faster and with less stress

Real-World Scenarios

Scenario 1: Freelance Designer

You hire a designer to make a logo for $800. This is a service. Use 1099-NEC.

Scenario 2: Office Rent

You pay monthly rent for an office. This is not a service. Use 1099-MISC.

Scenario 3: Cash Prize

You run a contest and give $2,000 to the winner. This is not for work. Use 1099-MISC.

Who Must File These Forms?

- 1099-NEC: if you pay $600 or more for services to a contractor

- 1099-MISC: if you pay rent, royalties, or award money

Send a copy to both the payee and the IRS.

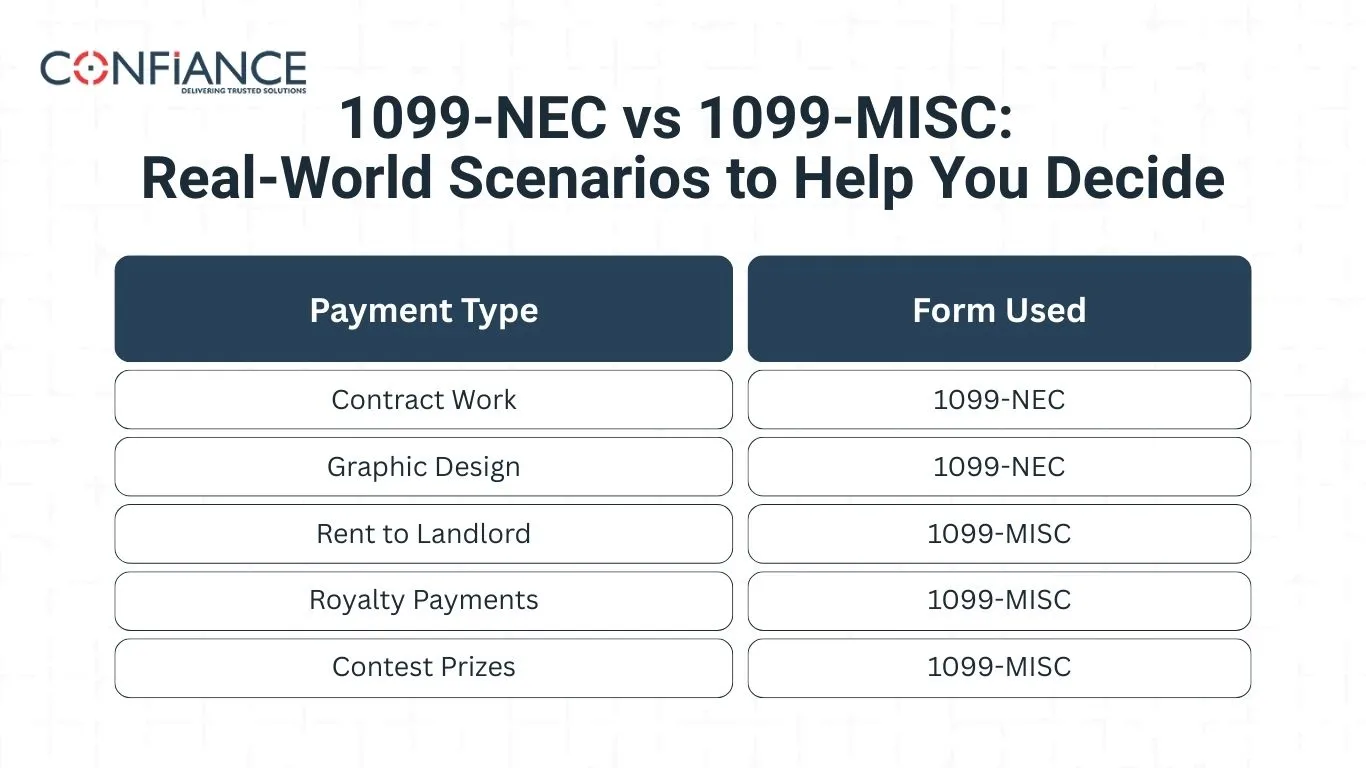

Quick Comparison Table

| Payment Type | Form Used |

| Contract Work | 1099-NEC |

| Graphic Design | 1099-NEC |

| Rent to Landlord | 1099-MISC |

| Royalty Payments | 1099-MISC |

| Contest Prizes | 1099-MISC |

Deadlines

- 1099-NEC: January 31 to IRS and contractor

- 1099-MISC: January 31 to payee, usually by Feb 28 to IRS (if mailed)

Why the IRS Created 1099-NEC

Before, people used 1099-MISC for nearly all payments. This caused confusion. The IRS made 1099-NEC to separate service payments from other income. This makes reporting easier and reduces errors.

How to Decide Fast

Ask:

- Was the money for a service by a non-employee? → 1099-NEC

- Was the money for rent, royalties, or prizes? → 1099-MISC

Tips to Keep Good Records

- Save all contractor invoices in one place

- List rent payments separately

- Collect W-9 forms before paying anyone

- Check payments monthly to know which form to file

More Real-World Scenarios

Consultant Work

You pay a business consultant $2,000 for advice. This is a service. Use 1099-NEC.

Royalty Income

You pay royalties for a song, artwork, or book. Use 1099-MISC.

Cleaning Company

A cleaning crew cleans your office for $700 and is not a corporation. This is a service. Use 1099-NEC.

Importance of the W-9 Form

The W-9 form collects:

- Contractor’s name and address

- Tax ID or Social Security Number

It makes it easier to choose between 1099-NEC or 1099-MISC and reduces mistakes.

Tips to Avoid Mistakes

1. Keep Clear Records

Keep simple records of all payments. Include the date, amount, and reason. Good records cut errors and make filing easy.

2. Separate Payment Types

Split payments for work and non-work items, like rent, prizes, or royalties. This helps pick the right 1099 form.

3. Use Accounting Software

Track payments with software. It finds mistakes, keeps books neat, and makes reports fast.

4. Verify Payee Information

Check names, addresses, and tax IDs. Wrong info can lead to fines from the IRS.

5. Track Filing Deadlines

Mark 1099 deadlines on your calendar. Late filing can mean fines or interest.

6. Review Payment Limits

Report payments over $600 for services or rents. Payments below this do not need a 1099.

Common Mistakes to Avoid

1. Using the Wrong Form

Do not use 1099-MISC for contractors. They need 1099-NEC forms.

2. Forgetting Required Forms

Not sending a 1099 for payments over $600 can cause fines. Check thresholds.

3. Late Filing

Reporting payments late can result in penalties. Set reminders for all deadlines.

4. Misclassifying Employees

Calling employees contractors by mistake can lead to audits and back taxes.

5. Ignoring Payment Limits

Not knowing the minimum limit may cause missed filings or extra work.

6. Incorrect Payee Information

Wrong names or tax IDs can trigger IRS notices and fines.

Choose Form 1099-NEC when a contractor or freelancer performs a service and receives payment of six hundred dollars or more in a year. Use Form 1099-MISC when a payment relates to rent, royalties, prize money, or any type of income that is not tied to a service. The choice depends only on the nature of the payment. Knowing the purpose of each form helps your records stay compliant with IRS rules. Also, it protects your business from fines/penalties.

You need to keep W-9 form in an organized file so each payment connects to the proper taxpayer information. Confiance helps you keep a clean record of each payment. We let you file with confidence and accuracy. This lets you show each vendor or contractor that you keep clear records and respect tax rules. Use the real cases above as a checklist each time you issue a payment, and you will select the correct form without pause and keep your records accurate and complete. Contact us now to get more help regarding 1099-NEC or 1099-MISC.

FAQs

Q1. When do I use 1099-NEC vs 1099-MISC?

Use 1099-NEC for non-employee service payments. Use 1099-MISC for rent, prizes, royalties, and other non-service payments.

Q2. Is rent reported on 1099-NEC?

No. Rent goes on 1099-MISC.

Q3. Do I need to send both forms?

No. Send only the form that fits the payment.

Q4. What if I pay a lawyer?

Legal fees for services usually go on 1099-NEC.

Q5. Are contest prizes the same as services?

No. Prizes are miscellaneous income. Use 1099-MISC.

Q6. What if I make a mistake?

File a corrected form with the IRS.

Q7. Do individuals need to file these?

Most individuals do not. Only businesses or self-employed people usually file these forms.